NOAH18 London Investor Book

Table of Contents Program 7 Venture Capital 10 Growth 126 Buyout 150 Debt 165 2

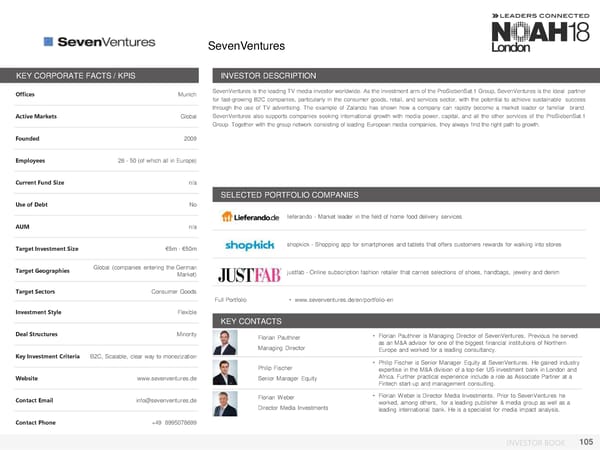

Table of Contents Venture Capital Growth 3TS Capital Partners 11 ECONA 50 Project A 92 Accel Partners 128 83North 12 Eight Roads 51 PropTech1 Ventures 93 Activant Capital 129 ACT Ventures 13 Endeit Capital 52 ProSiebenSat.1 Accelerator 94 BlackFin Capital Partners 130 Acton Capital Partners 14 FJ Labs 53 QD Ventures 95 Burda Principal Astutia Ventures 15 Fluxunit - OSRAM Ventures 54 Redalpine 96 Investments 131 Atlantic Labs 16 Frog Capital 55 Redline Capital 97 CapitalD 132 Aventures 17 General Catalyst 56 Red-stars.com data AG 98 Egmont 133 Axa Venture Partners 18 German Media Pool 57 Redstone 99 EMK Capital 134 b10 19 German Startups Group 58 RTA Ventures 100 General Atlantic 135 BackBone Ventures 20 Global Founders Capital 59 RTP Global 101 GPI Capital 136 Balderton Capital 21 Global Ventures 60 Samos Investments 102 Great Hill Partners 137 BCG Digital Ventures 22 GPS Ventures 61 Schibsted Growth 103 Horizon Capital 138 Beringea 23 GR Capital 62 Seventure Partners 104 HPE Growth Capital 139 Berlin Technologie Holding 24 Griffon Capital 63 SevenVentures 105 Insight Venture Partners 140 Bessemer Venture Partners 25 Hammer Team 64 SmartFin 106 LetterOne 141 BFB Brandenburg Kapital 26 Hearst Ventures 65 SpeedInvest 107 NGP Capital 142 BMW iVentures 27 High-Tech Gruenderfonds 66 SpeedUp Venture Capital NuCom Group 143 Boerse Stuttgart Digital Holtzbrinck Ventures 67 Group 108 Scottish Equity Partners 144 Ventures 28 i5invest 68 STIHL Digital 109 Stripes Group 145 btov Partners 29 IBB Beteiligungsgesellschaft 69 STS Ventures 110 Summit Partners 146 Buildit Invest 30 Idinvest Partners 70 Swisscom Ventures 111 Target Global 147 Caixa Capital Risc 31 InMotion Ventures 71 TA Ventures 112 Top Tier Capital Partners 148 Caphorn Invest 32 Innogy Ventures 72 Talis Capital 113 Verdane 149 Capital300 33 Innovo.vc 73 Target Partners 114 Vitruvian 150 Capnamic Ventures 34 Intel Capital 74 Tengelmann Ventures 115 Check24 Ventures 35 Iris Capital 75 Tiburon 116 Cherry Ventures 36 ISAI 76 Unternehmertum Venture Citi Ventures 37 Kizoo 77 Capital Partners 117 CommerzVentures 38 Lakestar 78 Vealerian Capital Partners 118 Concentric 39 LeadX Capital Partners 79 Ventech 119 Constantia New Business 40 Levensohn Venture Partners 80 Via ID 120 Coparion 41 Maersk Growth 81 Vito Ventures 121 Creandum 42 Mangrove Capital Partners 82 Vorwerk Ventures 122 Creathor Ventures 43 Mountain Alliance 83 W Ventures 123 Curious Capital 44 Munich Venture Partners 84 Wecken & Cie. 124 DB1 Ventures 45 Next Media Accerlerator 85 WestTech Ventures 125 Deutsche Telekom Capital Northzone 86 Xange 126 Partners 46 NWZ Digital 87 DN Capital 47 OneRagtime 88 Draper Esprit 48 P101 89 Earlybird 49 Partech Ventures 90 Piton Capital 91 3

Table of Contents Buyout Debt AnaCapFinancial Partners 152 Bootstrap Europe 167 Apax 153 Columbia Lake Partners 168 Ardian 154 Davidson Technology Growth Bain Capital 155 Debt 169 Capvis Equity Partners 156 Global Growth Capital 170 EQT Partners 157 Harbert European Growth FSN Capital Partners 158 Capital 171 GENUI 159 Kreos Capital 172 KKR 160 Silicon Valley Bank 173 Macquarie Capital 161 Maryland 162 Oakley Capital 163 Permira 164 TPG 165 4

EUROPE’S LEADING INTERNET Selected Completed NOAH Transactions CORPORATE FINANCE BOUTIQUE August 2017 December 2016 ® Acquisition of a Majority Stake in Investment in Unique Industry Know-How Strong Investment Banking Competence by by Focus on Leading European Internet companies Over 40 years of combined relevant M&A Covering over 400 companies across 25 online experience at a valuation of $200m verticals, a broad range of over 500 investors Routine execution of M&A and financing as well as 100+ online-focused corporates transactions with sizes of several billion euros Financial Advisor to EMK Capital Financial Advisor to Silver Lake Deep understanding of industry dynamics 30 successfully completed NOAH Advisors transactions underline successful transfer of October 2016 September 2016 Ability to add value beyond banking advice M&A competencies to the Internet sector Investment in Acquisition of a Majority Stake in Facilitates overall process and minimizes management distraction by by Unmatched Network and Relationships Full Commitment - We Are Entrepreneurs! from NOAH Advisors is globally well connected Entrepreneurial mind-set, focused on growing the 84% Ownership at a valuation of €300m and has direct access to virtually all key business and establishing a reputation for excellence Exclusive Financial Advisor to KäuferPortal players in the industry and its Shareholders Financial Advisor to Oakley Capital Knowledge of and strong relationships with Ability to deliver top results in short time frames potential buyers’ key decision makers December 2014 October 2014 Highly success-based compensation structures Sale of 100% of Proactively finds and unlocks attractive align interests of clients and NOAH Advisors, and Sale of 100% of investment opportunities for leading investors demonstrate conviction to deliver top results Annual NOAH Conference in its 8th year Creative deal solutions for $800m to for €80m to The NOAH Advisors Core Banking Team Marco Rodzynek Jan Brandes Exclusive Financial Advisor to Exclusive Financial Advisor to Fotolia and the Selling Shareholders Trovit and its Shareholders Managing Director & Founder Managing Director September 2014 May 2014 [email protected] [email protected] Sale of controlling stake in +41 799 581 512 +49 174 2010 984 sold 100% of Nikhil Parmar Aleksander Skwarczek to Director Analyst for $228m to a joint venture between [email protected] [email protected] +44 7521 835 241 +48 692 270 613 Exclusive Financial Advisor to Exclusive Financial Advisor to Yad2 Facile.it and its Shareholders and its Shareholders 4

The NOAH Bible, an up-to-date valuation and industry KPI publication. This is the most comprehensive set of valuation comps you'll find in the industry. Reach out to us if you spot any companies or deals we've missed! September2018 Edition (PDF) Sign up Here 66

Program 7

MAIN STAGE - Day 1 30 October SESSION TITLE COMPANY TIME COMPANY SPEAKER POSITION Breakfast 8:00 - 10:00 K 9:10 - 9:15 Welcome Note ® NOAH Advisors Marco Rodzynek Founder & CEO CP 9:15 - 9:30 Lakestar Klaus Hommels Founder & CEO 9:30 - 9:40 Lesara Roman Kirsch Founder & CEO CP 9:40 - 9:50 limango Sven van den Bergh Founder & Managing Director 9:50 - 10:00 Picnic Michiel Muller Co-Founder 10:00 - 10:10 Fessura Andrea Vecchiola CEO 10:10 - 10:20 PromoFarma David Masó MR Co-Founder & CEO ertical Zur Rose Group Olaf Heinrich Board Member & CEO of DocMorris 10:20 - 10:30 Dr. Martens Kenny Wilson CEO V EcommerceFC Permira Tara Alhadeff Principal 10:30 - 10:40 Scandit Samuel Mueller Co-Founder & CEO NGP Capital Bo Ilsoe Partner CP 10:40 - 10:50 ABOUT YOU Tarek Müller Co-Founder & MD CP 10:50 - 11:00 Porsche Deniz Keskin Director, Brand Management 11:00 - 11:10 Calm Michael Acton Smith Co-Founder & Co-CEO CP 11:10 - 11:20 DOC+ Ruslan Zaydullin Co-Founder & CEO 11:20 - 11:30 Lumen Dror Ceder Founder & CPMO 11:30 - 11:40 Zava David Meinertz CEO ellness 11:40 - 11:50 Babylon Health Ali Parsa Founder & CEO FC Kinnevik Chris Bischoff Senior Investment Director 11:50 - 12:00 KRY Johannes Schildt Co-Founder & CEO Accel Sonali de Rycker Partner CP 12:00 - 12:10 Telepaxx Rainer Kasan Co-Founder & CTO 12:10 - 12:40 Zava David Meinertz CEO KRY Johannes Schildt Co-Founder & CEO Digital Health & WP Babylon Health Ali Parsa MR Founder & CEO Telepaxx Rainer Kasan Co-Founder & CTO Medopad Dan Vahdat Founder & CEO 12:40 - 12:55 The Positive Impacts of Diversity in Business P enable2grow Stefanie Peters CEO Silicon Valley Bank Phil Cox Head of EMEA CP 12:55 - 13:05 SAP Deepak Krishnamurthy EVP & Chief Strategy Officer 13:05 - 13:15 Immobiliare.it Silvio Pagliani Co-Founder CP 13:15 - 13:25 Smartfrog Charles Fraenkl CEO 13:25 - 13:35 McMakler Felix Jahn Founder & CEO ech 13:35 - 13:45 Nested Matt Robinson CEO FC Christoffer Norman Investment Manager Northzone PropT CP 13:45 - 13:55 Holaluz Carlota Pi Co-Founder & CEO 13:55 - 14:05 Bulb Hayden Wood Founder & CEO FC DST Global Tom Stafford Partner CP 14:05 - 14:15 OurCrowd Andrew Kaye President & CIO 14:15 - 14:25 LendInvest Christian Faes Co-Founder & CEO 14:25 - 14:35 Billie.io Dr. Matthias Knecht Co-Founder CP 14:35 - 14:45 Oakam Frederic Nze Founder & CEO LendingPlatforms 14:45 - 14:55 Prodigy Finance Cameron Stevens Co-Founder & CEO FC 14:55 - 15:05 Klarna Michael Rouse MR CCO Permira Andrew Young Principal 15:05 - 15:15 SafeCharge Yuval Ziv MR CCO PaymentsCP 15:15 - 15:25 Credorax Igal Rotem CEO FC 15:25 - 15:35 simplesurance Robin von Hein MR Founder & CEO ech Rakuten Mark Haviland EVP Global Development T 15:35 - 15:45 GoCompare Faisal Galaria Chief Strategy Officer InsuranceCP FC 15:45 - 15:55 N26 Francisco Sierra MR Head of European Markets 15:55 - 16:05 solarisBank Dr. Roland Folz CEO CP 16:05 - 16:15 Revolut Nikolay Storonsky Founder & CEO 16:15 - 16:25 Tandem Ricky Knox CEO 16:25 - 16:35 Moonfare Alexander Argyros Founder Moonfare Hans Haderer Former Senior Partner, BC Partners 16:35 - 16:45 Deposit Solutions Dr. Tim Sievers MR Founder & CEO FC Vitruvian Partners Torsten Winkler Partner Banking of the Future 16:45 - 16:55 Stocard Björn Goß Founder & CEO Macquarie Capital Elmar Broscheit Managing Director 16:55 - 17:05 Zopa Jaidev Janardana CEO CP CP 17:05 - 17:15 Blockchain Nicolas C. Cary Co-Founder 17:15 - 17:25 Ledger Éric Larchevêque CEO Crypto FC Draper Esprit Ben Tompkins Managing Director 17:25 - 17:40 Intel Capital Karen Stafford Investment Director for Northern & CEE P innogy Innovation Hub Annemie Ress MR Managing Director InvestorPanel OneRagtime Stéphanie Hospital Founder & CEO K 17:40 - 17:45 Closing Note ® NOAH Advisors Marco Rodzynek Founder & CEO 17:45 - 20:00 Networking Drinks Lunch served between 12:00 - 13:30 CP Company K Keynote P Panel FC Fireside MR Interview / Panel with participation of Marco Presentation Chat Rodzynek Founder & CEO, NOAH Advisors

MAIN STAGE - Day 2 31 October SESSION TITLE COMPANY TIME COMPANY SPEAKER POSITION Breakfast 8:00 - 10:00 K 9:30 - 9:35 Day 1 Summary ® NOAH Advisors Marco Rodzynek Founder & CEO FC 9:35 - 9:45 Gett Dave Waiser MR Founder & CEO 9:45 - 10:05 AUTO1 Group Hakan Koç MR Co-Founder & Co-CEO CP 10:05 - 10:15 Cars24 Vikram Chopra Founder & CEO 10:15 - 10:25 Frontier Car Group Sujay Tyle Co-Founder & CEO FC 10:25 - 10:35 Carwow James Hind Founder & CEO Balderton Capital Rob Moffat Partner 10:35 - 10:45 Via Daniel Ramot Co-Founder & CEO 10:45 - 10:55 Glovo Oscar Pierre Co-Founder & CEO ravel & Mobility 10:55 - 11:05 Lastminute.com Group Fabio Cannavale CEO T CP 11:05 - 11:15 Wanderu Polina Raygorodskaya CEO 11:15 - 11:25 eDreams ODIGEO Dana Dunne CEO 11:25 - 11:35 Viselio Niklas Zeller Co-Founder & CEO FC 11:35 - 11:45 Travelperk Avi Meir MR Co-Founder & CEO FC 11:45 - 11:55 Monzo Tom Blomfield CEO FC 11:55 - 12:05 RTP Global Leonid Boguslavsky MR Founder & Chairman 12:05 - 12:15 NUCOM GROUP Claas van Delden Co-CEO FC EY-Parthenon Andreas von Buchwaldt Partner 12:15 - 12:30 Allegro Francois Nuyts CEO Permira David Erlong MR Principal FC 12:30 - 12:40 Catawiki Ravi Vora CEO Northzone Michiel Kotting Partner 12:40 - 12:50 CHRONEXT Philipp Man Founder & CEO CP 12:50 - 13:00 Brayola Orit Hashay Founder & CEO 13:00 - 13:10 Depop Marie Petrovicka Chief of Staff HV Holtzbrinck Ventures Jan Miczaika Partner FC 13:10 - 13:20 Gousto Timo Boldt Founder & CEO MMC Ventures David Kelnar Partner and Head of Research Classifieds & Marketplaces 13:20 - 13:30 iMENA Group Khaldoon Tabaza Founder & MD CP iMENA Group Saygin Yalcin Founder & CEO of SellAnyCar.com 13:30 - 13:40 Student.com Luke Nolan Founder & CEO NOAH Berlin 2018 Startups 13:40 - 13:45 KIDSORTED Julia Brucher Co-Founder & CEO CP KIDSORTED Lindsay Trombley Co-Founder & COO NOAHStartups 13:45 - 13:50 Zana Julia Hoxha Co-Founder & CEO 13:50 - 13:55 FinCompare Stephan Heller Founder & CEO FC 13:55 - 14:05 SOSV Benjamin Joffe MR Partner CP 14:05 - 14:15 TeamViewer Oliver Steil CEO 14:15 - 14:25 Personio Hanno Renner Co-Founder & CEO 14:25 - 14:35 Native Instruments Daniel Haver MR CEO FC 14:35 - 14:45 Avenso Daniel Raab CEO 14:45 - 14:55 Vilynx Juan Carlos Riveiro Co-Founder & CEO CP Vilynx Elisenda Bou Co-Founder & CTO Caixa Capital Xavier Álvarez Director 14:55 - 15:05 Kaltura Jenny Kalenderidis VP & General Manager, EMEA FC 15:05 - 15:15 BehavioSec Neil Costigan CEO Cisco Investments Jon Koplin Senior Director 15:15 - 15:25 engineer.ai Sachin Dev Duggal Co-Founder B2B & SaaSCP Lakestar Manu Gupta Partner 15:25 - 15:35 Darktrace Emily Orton CMO FC Talis Capital Vasile Foca Co-Founder & Managing Partner 15:35 - 15:45 DocuSign Olivier Pin VP Product Management EMEA 15:45 - 15:55 Eyeo Tim Schumacher Chairman 15:55 - 16:05 AU10TIX Ron Atzmon Managing Director CP 16:05 - 16:15 PlaySight Chen Shachar Co-Founder & CEO 16:15 - 16:25 Streetbees Tugce Bulut Founder & CEO FC PepsiCo Paul Kelly Head of Strategy and Business Development EMEA CP 16:25 - 16:35 Job Today Polina Frolova-Montano COO ech 16:35 - 16:45 Coople Viktor Calabrò Founder & Executive Chairman FC 16:45 - 16:55 Jobandtalent Juan Urdiales Co-Founder & Co-CEO HR T DN Capital Thomas Rubens Partner CP CP 16:55 - 17:05 Ashoka Matthias Scheffelmeier Partner, Germany CP 17:05 - 17:15 PTScientists Robert Böhme Founder & CEO K 17:15 - 17:20 Closing Note ® NOAH Advisors Marco Rodzynek Founder & CEO Lunch served between 12:00 - 13:30 CP Company K Keynote P Panel FC Fireside MR Interview / Panel with participation of Marco Presentation Chat Rodzynek Founder & CEO, NOAH Advisors

Venture Capital 10

3TS Capital Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Budapest, Bucharest, Istanbul, Praque, 3TSCapital Partners is one of the leading European technology focused private equity and venture capital firms. 3TS provides expansion capital and Vienna, Warsaw buyout funding for small and medium-sized businesses in growth sectors including Technology & Internet, Media & Communications and Technology- Enabled Services. Investors in the current and past 3TS funds totaling over €300 million include EIF, EBRD, Cisco, OTP, Sitra, 3i and KfW among Active Markets Central and Eastern Europe others. Founded 1998 Employees 11 - 25 (of which 14 in Europe) Current Fund Size > €100m SELECTED PORTFOLIO COMPANIES Use of Debt No AUM > €300m Target Investment Size €300k - €15m Target Geographies Central and Eastern Europe Target Sectors Technology & Internet, Communications & Media, Technology-enabled Services Full Portfolio • www.3tscapital.com Investment Style Active KEY CONTACTS Deal Structures Significant Minority, Majority Key Investment Criteria High growth Global Challengers, or Local Leaders Website www.3tscapital.com Contact Email [email protected] Pekka Maki Zbigniew Lapinski Svetoslav Stefanov Elbruz Yılmaz Managing Partner Senior Partner Investment Director Investment Director [email protected] [email protected] [email protected] [email protected] m Contact Phone +43 1 4023679 INVESTOR BOOK 11

83North KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, Herzliya 83North (formerly Greylock IL) is a global venture capital firm with more than $550 million under management. They invest in European and Israeli entrepreneurs creating global businesses, across all stages of consumer and enterprise companies. 83North is the sum of the latitudes of London and Tel Aviv.83North is committed to help build global leading companies, with more than half of its portfolio companies having opera- tions in the Active Markets UK, Israel US. Founded 2006 Employees 9 Current Fund Size n/a SELECTED PORTFOLIO COMPANIES Use of Debt n/a Actifio delivers Enterprise Data-as-a-Service to hundreds of global enterprise customers and service provider part- AUM $550m ners iZettle, a mobile payments company, offers small businesses with portable point-of-sale solutions and free sales Target Investment Size $10m - $30m overview tools Target Geographies Europe, Israel BlueVine allows small businesses to get paid immediately on their outstanding invoices Target Sectors Curated Web, Enterprise Software, SaaS Full Portfolio • www.83north.com/companies Investment Style n/a KEY CONTACTS Deal Structures n/a Gil Goren David Buttress Key Investment Criteria Teams of consumer and enterprise Partner Partner companies across all stages Website www.83north.com Gil Goren Contact Email n/a Partner Contact Phone n/a INVESTOR BOOK 12

ACT Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Dublin, Ireland ACT’sfunds are sourced from leading domestic and international financial institutions. Investments are made in companies at early and expansion stages, with a particular interest in backing ambitious entrepreneurs who wish to build scaleable businesses. With its extensive contacts and experienced team, ACT plays an active supportive role in helping companies to expand into international Active Markets Ireland/UK/Europe markets. Founded 1944 Employees 10 (of which 10 in Europe) Current Fund Size €100m SELECTED PORTFOLIO COMPANIES Use of Debt n/a AUM n/a Target Investment Size n/a Target Geographies Ireland/UK/Europe Target Sectors Disruptive Tech Investment Style Active KEY CONTACTS Deal Structures n/a Debbie Rennick • Debbie has over 25 years experience in corp finance & tech venture capital investing. She works closely with several portfolio teams & Key Investment Criteria Disruptive products, ambitious teams and Director was responsible for investments in Soundwave (acq by Spotify) large and growing markets Email: [email protected] Heartsine (acq by Physio Control/Stryker) FeedHenry (acq by Redhat) Qumas (acq by Acceleris) Website www.actventure.com Contact Email [email protected] Contact Phone +35312600966 INVESTOR BOOK 13

Acton Capital Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Munich Acton Capital Partners is a growth-stage venture capital firm, based in Munich. With investments in more than 70 companies since 1999, the Acton team brings a wealth of expertise and experience to the companies in which it invests, delivering superior capital returns. The ideal investment candidates are Internet companies in the consumer or B2B-SaaS space with proven and scalable business models, striving to take their growth Active Markets Europe, Canada, US East Coast opportunities to the next level. Founded 1999 Acton’s current fund was initiated in 2014 with a volume of 170m€ and has so far invested amongst others in HomeToGo, Tictail, iwoca, GetSafe, Mambu, Mobify, Eloquii, Comatch, Finanzcheck.de, Chefs Plate, Zenjob, Freska, Cluno and Koio. With its previous fund (vintage 2008), Acton had invested in companies such as Linas Matkasse, Windeln.de, MyOptique Group, mytheresa.com, Etsy, Audibene, Momox, KupiVIP and Clio. Before Employees 15, of which 14 in Europe 2008, the Acton team had invested through the Burda Digital Ventures fund I and II in companies like Ciao, HolidayCheck, Zooplus, OnVista, Cyberport, AbeBooks and Alando. Current Fund Size €170m SELECTED PORTFOLIO COMPANIES Use of Debt No HomeToGo is the world’s largest meta search engine for vacation rentals combining the models of enquiry and AUM €400m immediate booking. Based in Berlin. Mambu offers an agile, flexible and affordable cloud banking platform that enables innovative banking providers to Target Investment Size €3m - €15m rapidly create, launch and service loan and deposit products. Based in Berlin. Target Geographies Germany, Europe, Canada, US East Founded in 2017, Cluno is the leading full-stack car subscription provider in Germany and the EU, offering Coast customers a wholly new way of car ownership. Cluno is based in Munich. Target Sectors Internet (E-Commerce, Marketplaces, SaaS, Fintech, Online Services, Media, ...) Full Portfolio • www.actoncapital.com/#Portfolio Investment Style Active KEY CONTACTS Deal Structures Minority, preferrably lead or co-lead • Managing Partner and co-founder of Acton since 1999, before that treasury at investor Dr. Christoph Braun Hubert Burda Media and at McKinsey. Key Investment Criteria Functioning business model, Series A to C Managing Partner • Companies: Momox, Tolingo, Clio, sofatutor, Mobify, Chefs Plate, Cluno and Email: [email protected] windeln.de. Past investments include e.g. Alando, AbeBooks, Ciao, Finanzcheck, Lumas, Etsy, audibene. Website www.actoncapital.com • Managing Partner of Acton since 2013. CEO of large electronics e-commerce Fritz Oidtmann companies and supervisory board member of XING before. Co-founder & Contact Email [email protected] Managing Partner CEO of OnVista, partner at McKinsey before. Email: [email protected] • Companies: Momox, Home24, iwoca, Mambu. Notable past involvements include e.g. OnVista, Cyberport, computeruniverse, Chip, XING. Contact Phone +49 89 2421887-0 INVESTOR BOOK 14

Astutia Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Munich, Berlin ASTUTIA is an independent investment company focusing on innovative founders and companies with outstanding growth potential. Our investments focus the areas of E-Commerce, Digital Media and Enterprise Solutions. We usually invest from early start-up to growth stages. Besides venture capital, we offer a truly international network and specialised know-how for entrepreneurs to support successful development Active Markets Seed, Early-Stage VC and sustainable growth. Our latest exits include Fashionette, InterNations and Joblift. Founded 2006 Employees 5 of which 5 in Europe Current Fund Size N/A SELECTED PORTFOLIO COMPANIES Use of Debt No With an integrated platform, an online shop for the community and the popular Asana Rebel app, Asanayoga has become a vital part of the Yoga movement. AUM N/A Horizn Studios develops smart suitcases, bags and accessories for today´s urban, digital nomads - to make our Target Investment Size 100k – 1m travel even more exciting and pleasant. Target Geographies Germany, Europe Withpersonalized search, integrated price comparison and shopping possibility, Stylelounge makes shopping your favorite pieces even more convenient Target Sectors E-Commerce, Digital Media, Enterprise Solutions Full Portfolio • www.astutia.de Investment Style Hands on KEY CONTACTS Deal Structures Minority stakes Benedict Rodenstock • Formerly at Hubert Burda Media, WEB.DE, Roland Berger Strategy Key Investment Criteria Team, market Managing Partner Consultants; MBA, studied in Bologna, St.Gallen and New York Email: [email protected] • Companies: Flaconi, Asanayoga, Stylelounge Website www.astutia.de Contact Email [email protected] Photo Manuel Sprödhuber • Since 2014 part of the team. Formerly Marketing & Sales manager at MedTech Investment Manager company nal von minden, studied Business Administration. Contact Phone +49 89 2302284 0 Email: [email protected] • Companies: Horizn Studios, Coureon, Joblift INVESTOR BOOK 15

Atlantic Labs KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Berlin Atlantic Labs supports and invests in mission-driven founders working on transformative technology ventures. We partner with founders early, providing the capital, tools and network necessary to growing their companies and accompanying them on their entrepreneurial journey. Our Active Markets Germany current areas of focus include Digital Health, Future of Work,Machine Learning, Blockchain, Mobility and Industrial Applications Founded 2007 Employees 4-10 (all in Europe) Current Fund Size undisclosed SELECTED PORTFOLIO COMPANIES Use of Debt No World’s leading music creator platform AUM n/a Target Investment Size €200k - €1m Full-stack car subscription provider Target Geographies Europe (with focus on Germany) Automated full-service staffing platform Target Sectors Digital Health, Future of work, Blockchain, Mobility, Industrial Tech Full Portfolio www.atlanticlabs.de Investment Style Active KEY CONTACTS Deal Structures Minority / Lead Christophe F. Maire Jens-Philipp Klein Key Investment Criteria Thesis driven investment approach, Founding Partner Partner Early stage, strong founder team Email: [email protected] Email: [email protected] Website www.atlanticlabs.de Dr. Marc-Olivier Lücke Daniel Niemi Contact Email [email protected] Partner Principal Email: [email protected] Email: [email protected] Contact Phone n/a INVESTOR BOOK 16

AVentures Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Kyiv, Ukraine AVentures Capital is the leading Ukrainian early-stage VC fund. We invest in global companies which utilize their R&D in Ukraine. The fund's investment focus spans across software tech, including such areas as machine learning, big data, AR, VR, SaaS, cloud, storage, enterprise, web, mobile, IoT and others. In addition, AVentures Capital advises IT businesses across all stages and other funds on strategy and execution. Active Markets Ukraine Currently, we are raising our second fund as well as helping our portfolio companies in IoT, ML, Cybersecurity, SaaS and Cleantech to raise follow-on Founded 2013 rounds. Employees 6 SELECTED PORTFOLIO COMPANIES Current Fund Size Current - $10m. Raising $30m Petcube - a global leader in Connected Pet market. Petcube manufactures interactive cameras that let its users communicate and play remotely with their pets as well as dispense treats using the Company`s mobile app. Moreover, recently the Company successfully launched subscription program and is going to launch e-commerce Use of Debt No platform in partnership with the leading pet food manufacturers. Spinbackup - a cloud cybersecurity and cloud-to-cloud backup solutions provider for G Suite and soon for Office AUM $10m 365. The Company`s solutions automatically protect organizations of all sizes against data leak and data loss in the cloud that mostly come from ransomware, insider threats, and human error. Spinbackup has over 400k users globally, more than 2000 organizations, and a partnership with Google. Target Investment Size $250k – $500k SolarGaps is the manufacturer of Smart Solar Blinds that generate electricity and pay for themselves. Installed on just a third of a home’s windows, SolarGaps can cover up to 70% of an average home’s electricity needs. Extra Target Geographies Ukraine, the USA energy can be easily sold to the city`s power grid. Apart from generating electricity, the Company`s smart blinds also automatically track the sun to provide active shading or can be set to follow a predefined schedule. Smart blinds can be controlled by a smartphone, Google Home and Alexa. Target Sectors Opportunistic Full Portfolio www.aventurescapital.com/#portfolio Investment Style Active KEY CONTACTS Deal Structures Minority Andrey Kolodyuk Andrey Kolodyuk, entrepreneur turned VC, started his entrepreneurial career in Photo New York in 1992 and eventually has founded and built over 10 companies in IT, Key Investment Criteria 1) Global focus . 2) R&D in Ukraine Managing Partner telecom, internet and media with $1 Billion total revenues. Andrey is the founder of Email: [email protected] Divan.TV, an OTT service provider with 300 million Ukrainian and Russian- speaking audience living worldwide. Website www.aventurescapital.com Yevgen Sysoyev, a former successful investment banker, co-founded AVentures Yevgen Sysoyev Capital. Over the years, he’s been a Board Director of such tech companies as Contact Email [email protected] Photo Managing Partner Petcube, Augmented Pixels, Spinbackup, CoreValue, Depositphotos, and others. Email: [email protected] He is recognized as one of the most influential people in Ukrainian tech Contact Phone +38 0664679714 community. INVESTOR BOOK 17

AXA Venture Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Paris, London, New York, San Francisco AVP is $275M venture capital firm investing in seed and early stage companies through AVP Early Stage, and in growth equity companies through AVP Capital. Our checks range from $300K for seed investments to $20M for growth equity transactions. Active Markets Global Founded 2016 Employees 14 (of which 11 in Europe) Current Fund Size $275m SELECTED PORTFOLIO COMPANIES Use of Debt No US marketplace for financial products AUM $425m Target Investment Size $0.3 - $20m Enterprise cyber-security rating platform Target Geographies Global Mobile, AI-powered sales assistant for field sales teams Target Sectors Technology Full Portfolio • www.axavp.com/companies/ Investment Style Active KEY CONTACTS Deal Structures Minority Imran Akram Early – traction Photo General Partner • Companies: Auto1, ForceManager, Sonovate Key Investment Criteria Growth – clear unit economics [email protected] Website www.axavp.com Francois Robinet Contact Email [email protected] Photo Managing Partner • Companies: Goji, Tanker [email protected] Contact Phone +44 2071930406 INVESTOR BOOK 18

b10 I Venture Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Berlin b10 is a Berlin-based venture capital firm investing in seed and pre-seed startups. Welook for "category killers" with a B2B focus. We invest and act as an operational investor, supporting the founders actively with a team of Active Markets Germany specialists in the areas of recruiting, UX/UI design, content, finance, fundraising, legal, etc. Founded 2014 In the last years b10 successfully exited for example Quandoo, the leading restaurant reservation system worldwide for 200.000.000 EUR to Recruit Holdings and Free2Move (fkaCarjump) to PSA(Peugeot) in 2016. Employees 10 Thecombination of hands on support and entrepreneurial experience makes b10 a perfect partner for Startups to grow. Current Fund Size €10m Use of Debt No SELECTED PORTFOLIO COMPANIES Free2Move allows people to find and compare vehicles from a wide variety of carsharing providers AUM €10m Target Investment Size €100k - €500k ENWAY is developing the technology platform for autonomous street sweepers and other specialty vehicles Target Geographies Germany Thryve powers the individualization of health care by providing the only health API needed for health services to access sensible health data from more than 100 smartphones, smartwatches and fitness trackers B2B, Marketplaces, Communications, Target Sectors Health Financial Technology, Digital Services, Retail Full Portfolio www.b10.vc/portfolio Investment Style Active KEY CONTACTS Deal Structures Minority Daniel Hoepfner • Daniel Hoepfner is founder and MD of b10 Early Stage Venture Capital Managing Director • Prior to that, Daniel was founder and CEO of PressMatrix, Founding Key Investment Criteria Category Killer Business Angel at Sensorberg GmbH [email protected] • Focus on Fundraising, Sales and Legal Website b10.vc Henri Kuehnert • Henri Kuehnert is founder and MD of b10 Early Stage Venture Capital • Prior to that, Henri was founder and CEO of SinnerSchrader Mobile, Contact Email [email protected] Managing Director Investor and Advisor at Quandoo, Founding Business Angel at Sensorberg GmbH [email protected] • Focus on Fundraising, Sales and Financial Planning Contact Phone n/a INVESTOR BOOK 19

BackBone Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Zurich BackBone Ventures stands for goal-oriented, value-adding and sustainable support for promising start-ups through network, capital and expertise. Our aim as a Swiss Venture Capital Firm based in Zurich is to find the most promising deals in the market and to bring in added value. Switzerland, Deutschland, Austria, Israel, BackBone's focus is on seed and start-up investments, primarily in the area of innovative ICT and disruptive technology projects. Active Markets Liechtenstein Founded 2018 Employees 5 (of which all in Europe) Current Fund Size n/a SELECTED PORTFOLIO COMPANIES Use of Debt No ImmunOs Therapeutics AG is leading the next generation of immunotherapies by fast-tracking new discoveries to enhance combination therapies with novel human immunomodulatory proteins that have a role in both the innate AUM €1m and adaptive immune system for cancer treatment By using stem cell research Supermeat produces synthetic poultry meat. Supermeat will revolutionize the poultry Target Investment Size €100k - €500k industry - clean, sustainable & pet friendly. Target Geographies primarily DACH Lawoon is an online platform for the placement of mini-jobs with automated payment processing. The Start-up allows bringing together clients and contractors in just a few clicks. Target Sectors ICT, Disruptive Technologies, Biotech Full Portfolio • www.backboneventures.ch/portfolio Investment Style Active KEY CONTACTS Deal Structures Minority Name Janic Frölicher Photo Title Investment Associate • B.B.A. Zurich University of Applied Science Key Investment Criteria Innovative & passionate • Rahn & Bodmer Co., VZ Vermögenszentrum, Credit Suisse AG Email: [email protected] Website www.backboneventures.ch Name Philippe Bernet Contact Email [email protected] Title Investment Manager • M.A. HSG Accounting & Finance • UBSAG, HA&W, Truventuro, Hermes Capital Email: [email protected] Contact Phone +41 44 500 23 81 INVESTOR BOOK 20

Balderton Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London At Balderton we invest in European entrepreneurs with global ambitions. Balderton is Europe’s largest early stage venture capital investor, focused on European technology companies at Series A, with funds totalling Active Markets Europe $2.6BN.Weinvest between $1Mto $20Minto companies with the potential to disrupt huge industries, and the ambition to scale globally. Wehaveatrack-record of backing breakthrough companies ranging from MySQL to Betfair, and The Hut Group to Yoox Net-a-Porter. Webring our Founded 2000 deep experience and unrivalled professional and personal network to bear to support our companies from start to exit. Our equal partnership includes two founders of $bn companies (Business Objects and Blinkx PLC) and senior execs from Goldman Sachs, Uber, Dropbox, Google and Yahoo. Employees 25 - 50 (of which all in Europe) Current Fund Size $375m SELECTED PORTFOLIO COMPANIES Use of Debt No API-first content infrastructure that replaces legacy content management systems. Founded in Berlin, expanded AUM $2.6bn successfully to US and have raised follow on funding from Benchmark and General Catalyst. Target Investment Size $1m - $20m Leading mobile casual games developer, based in Berlin Target Geographies Europe The future of music publishing, ensuring that songwriters artists (representing ~40% of the top 100) are paid rapidly and fairly across all offline & online platforms Target Sectors Technology Full Portfolio • www.balderton.com/portfolio Investment Style Active KEY CONTACTS Deal Structures Minority Suranga Chandratillake • Previously founder of Blinkx PLC and US CTO of Autonomy Partner • Partner at Balderton since 2013 Key Investment Criteria Team, disruptive • Companies: Contentful, Dalia research, Vivino, Banjo, Comply Advantage, Email: [email protected] Funnel, The Tab, Magic Pony, Mojiworks Website www.balderton.com Rob Moffat • At Balderton since 2009. Previously at Google and Bain Contact Email [email protected] Partner • Companies: Wooga, Carwow, Zego, Mojiworks, Dinghy, Prodigy Finance, Nutmeg, Patients Know Best Email: [email protected] Contact Phone +44 20 70166800 INVESTOR BOOK 21

BCG Digital Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Manhattan Beach, Berlin, Sydney, BCG Digital Ventures is a corporate investment and incubation firm. They invent, build and invest in startups with the world’s most influential Offices London, San Francisco, New York, Silicon companies. They share risk and invest alongside their corporate and startup partners via a range of collaborative options. Valley, Tokyo, Seattle Founded in 2014, they have major Innovation and Investment Centers in Manhattan Beach, Berlin, London, Sydney, San Francisco and New York, Active Markets Global as well as DV Hatches in Silicon Valley, Seattle and Mexico City, with more locations opening in the coming quarters. Their Centers and Hatches are home to a diverse range of entrepreneurs, operators and investors who are building businesses, creating and expanding markets and developing new technologies that benefit millions of people across the globe. Founded 2014 Employees 350 Current Fund Size n/a SELECTED PORTFOLIO COMPANIES Use of Debt n/a FarePilot helps taxi and ride hailing drivers find more jobs using a predictive supply/demand model AUM n/a Takt distills customer data into uniquely tailored experiences; we orchestrate physical and digital exchanges into Target Investment Size n/a one seamless journey Target Geographies Global Kaishi Pte - Connected device and app platform for pregnancy and early-stage parents Target Sectors Digital Full Portfolio • www.bcgdv.com/portfolio Investment Style Active KEY CONTACTS Deal Structures n/a Claudia Armbruester Juergen Eckel Experience Design Venture Architect Key Investment Criteria n/a Director Director Urs Rahne Arndt Roller Website htwww.bcgdv.com Managing Director Partner and Managing Director Contact Email [email protected] Katarina Ewert Learning and Development Coordinator Contact Phone n/a INVESTOR BOOK 22

Beringea KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London and Detroit Beringea is a transatlantic venture capital investor that seeks to create lasting success for entrepreneurial companies. With offices in London and Detroit and over $715 million under management in the U.K. and the U.S., we provide patient capital and a transatlantic Active Markets United Kingdom, USA, and Europe footprint to back founders throughout their journey, helping them overcome barriers to scale and build international success stories. Our track record of three decades of successful investing across every major industry has inspired our own entrepreneurial ethos; cultivated an Founded 1988 exceptional network throughout the technology and investment communities; and fostered the experience required to create meaningful businesses and deliver value for our shareholders. Employees 30 (of which 22 in Europe) The diversity of background, opinion, and expertise throughout our transatlantic team reflects the community of founders and companies we support and enables us to collaborate effectively with our portfolio to capitalize on opportunities enabled by technology. Current Fund Size Multiple funds SELECTED PORTFOLIO COMPANIES Use of Debt Yes Monica Vinader is one of the UK’s fastest growing jewellery brands and an international retail success story – its AUM $715m+ unique luxury, yet affordable, jewellery is sold in the USA, Europe and Asia, with revenues breaking £35m in 2017. SMARTASSISTANT is a pioneering digital assistant, creating an artificially-intelligent adviser used by retailers and Target Investment Size $1m - $10m corporates to enable consumers and users to seamlessly walk through complex purchases or decisions. Target Geographies UK, USA, and Europe Aistemos is an artificial intelligence company that has ordered and analysed the world’s 100m patents, working with the likes of BAE Systems and ARM to map and understand global innovation trends. Target Sectors Software and AI, Retail, Digital Media Full Portfolio • www.beringea.co.uk/portfolio Investment Style Active KEY CONTACTS Deal Structures Minority Eyal Malinger • Former director of Corporate Development at Countrywide PLC where he oversaw investments in property technology; MBA from Harvard Business Key Investment Criteria Revenues of £1m+ Investment Director School Email: [email protected] • Companies: Poq, TV Player, SMARTASSISTANT, MPB.com, Aistemos, Perfect Channel, Simplestream Website www.beringea.co.uk Rob Dagger • Prior to Beringea, Rob worked as a senior consultant in Deloitte’s strategy practice, focusing primarily on projects for technology and media Contact Email [email protected] Investment Manager organisations. Email: [email protected] • Companies: Thread, WhistleSports, SMARTASSISTANT, ContactEngine, ResponseTap, Honeycomb Contact Phone +44 (0)20 7845 7820 INVESTOR BOOK 23

Berlin Technologie Holding KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Berlin Berlin Technologie Holding (“BTH”) is a German based Holding and growth investment firm focused exclusively on investments in technology and technology-enabled businesses. BTH was founded by successful entrepreneurs and investors who invest in companies with significant growth potential. Active Markets Austria, Germany BTH provides growth capital, management know how and access to high caliber entrepreneurial partner network to companies facing strategic or Founded 2013 operational challenges. BTHstrongly believes that entrepreneurs with character deserve capital with character and thus invests own equity and also provide their experience Employees 4 - 10 (of which all in Europe) and network to those that distinguish themselves and their business model through clarity. Current Fund Size n/a Theycall it Augmented Capital. SELECTED PORTFOLIO COMPANIES Use of Debt Yes Sensorberg provides Beacon-software based on-the-fly IoT networks AUM n/a Target Investment Size €500k - €3m Digital front end platform that maximizes the quality, performance, and reach of customer interface Target Geographies Austria, Germany Germany’s largest private cash payment infrastructure Target Sectors Financial Services, Marketing, Analytics, Digital Services Full Portfolio • www.berlinholding.com/#portfolio-jump Investment Style Active KEY CONTACTS Deal Structures Flexible Joern-Carlos Kuntze • Seasoned Strategy, Company Builder and Corporate Finance expert. Serial Team with strong Execution Mindset, Managing Director Entrepreneur. Previously Partner at OC&C and Oliver Wyman Key Investment Criteria disruptive B2B Business Model, Financial • Companies: Sevenval, Minodes, Applause, PressMatrix Model with Recurring Revenues Email: [email protected] Website www.berlinholding.com Contact Email [email protected] Contact Phone +49 30707190203 INVESTOR BOOK 24

Bessemer Venture Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Boston, New York City, Westchester, San Bessemer backs passionate and thoughtful founders as they turn exciting ideas into market leading businesses. They admire those who aren’t afraid Francisco, Silivon Valley, India, Israel to break with convention and are driven to push the limits of what is possible with technology and product. They invest in all stages. From seed stage Active Markets US, India, Israel to growth, and across the technology and services stack, BVPinvests in enterprise, consumer and healthcare technology startups around the world. Founded 1911 Employees 40 Current Fund Size $1.6bn Use of Debt Yes SELECTED PORTFOLIO COMPANIES AUM n/a Intercom is a customer communication and support service for businesses Target Investment Size $1m - $5m Pinterest is a visual bookmarking tool that helps you discover and save creative ideas Target Geographies Global Cloud Computing, Consumer, CrowdFlower is the essential human-in-the-loop platform for data science teams Target Sectors Cybersecurity, Financial Services, Healthcare, Industry Software, Marketplaces, Mobile Full Portfolio • www.bvp.com/portfolio Investment Style n/a KEY CONTACTS Deal Structures Convertible Debt, Equity (Minority) • VC at Bessemer Venture Partners Passionate and thoughtful founders with Photo Jordan Windmueller • Previously: Private Equity Partners at BlackRock (2013 – 2013), Analyst at Key Investment Criteria exciting ideas into market leading VC Schooner Capital LLC (2011 – 2011), Office of Strategic Partnerships at U.S. businsses Department of Commerce (2011 – 2011) Website www.bvp.com Contact Email n/a Contact Phone n/a INVESTOR BOOK 25

BFB Brandenburg Kapital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Potsdam With a track record of over 20 years in venture capital and the experience from more than 200 investments in numerous companies, we are the most active equity investor in our region. We invest in fast-growing companies throughout the whole life-cycle while we want to be an active and reliable partner for our portfolio companies as well as our co-investors. Our current VC fund is financed by the European Regional Development Fund (ERDF) Active Markets n/a and Investitionsbank des Landes Brandneburg (ILB). Founded 1993 Employees 11 (of which 11 in Europe) Current Fund Size €70m Use of Debt No SELECTED PORTFOLIO COMPANIES Leading sharing platform for private caravans AUM €110m Target Investment Size €500k - €5m Leading medtech company in electromagnetic surgical navigations solutions Target Geographies Germany - State of Brandenburg Manufacture and distributor of eco-friendly tea capsules ICT/Digital Economy, Life Sciences / Target Sectors MedTech, Proptech, Industrial Applications Full Portfolio www.brandenburg-kapital.de Investment Style Active KEY CONTACTS Deal Structures Minority Olav Wilms • Olav has been heading ILB’s venture and mezzanine capital activities since November 2010 and acts as managing director for all of ILB’s investment Key Investment Criteria Open Participation or combination of CEO subsidiaries. He also steers the strategic investments of the bank and open and silent Email: [email protected] represents ILB on, among others, the investment committee of the Hasso Plattner Venture II Fund. Website www.brandenburg-kapital.de Thomas Krause • Thomas has been active in the venture capital business since 2001. During this period, he was responsible for the equity investments in companies Contact Email [email protected] Member of management board such as gate5, PC-Soft and Berlin Heart. He heads the venture capital Email: [email protected] activities of ILB based in Potsdam. Contact Phone +49 331 660-1698 • Companies (current board positions): asgoodasnew, SMACC, Pentracor INVESTOR BOOK 26

BMW iVentures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Silicon Valley, San Francisco, Munich BMWiVentures, BMW’sEUR500million venture capital fund, invests money and resources in startups in the fields of autonomous driving, digital car and automotive cloud, e-mobility, artificial Intelligence and data, industry 4.0, shared and on-demand mobility, customer digital life, and energy Active Markets Global services. Thefirm has already partnered with innovative companies such as Carbon3D, Chargepoint, DesktopMetal, JustPark, Life360, Moovit, Nauto, Scoop, Founded 2011 Stratim, Turo, Xometry and Zendrive. Employees 10 BMWiVentures invests in all stages from seed and incubation to growth companies. Current Fund Size $616m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM $716m Moovit is a transit data company that offers a transit app. Target Investment Size N/A May Mobility develops autonomous vehicles from the chassis up with a focus on system level safety design. Target Geographies Global Autonomous Driving, Digital Car & Full Portfolio • www.bmwiventures.com/portfolio-2/ Automotive Cloud, E-Mobility, AI / Data / Target Sectors Cyber Security, Industry 4.0, Shared & On-Demand Mobility, Customer Digital Life, Energy Services Investment Style Active KEY CONTACTS Deal Structures n/a Tobias Jahn Principle • With BMW iVentures since July 2015, previously Senior Manager New Key Investment Criteria n/a Ventures at 3M Email: [email protected] Website www.bmwiventures.com Contact Email n/a Contact Phone n/a INVESTOR BOOK 27

Boerse Stuttgart – Digital Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Stuttgart Boerse Stuttgart Digital Ventures develops innovative business models for exchange trading and over-the-counter (OTC) trading in fungible products. It also invests in promising startups and enters into partnerships with selected partners to implement its digitisation strategy. Boerse Stuttgart Digital Ventures GmbH is a wholly-owned subsidiary of Boerse Stuttgart. Active Markets Europe and Nordics Founded 2017 Employees 2 (of which all in Europe) Current Fund Size n/a SELECTED PORTFOLIO COMPANIES Use of Debt No Sowa Labs is a fintech startup specialized in predictive data analytics and disruptive applications in trading of AUM n/a financial assets and cryptocurrencies. Target Investment Size n/a BISON is the first app for trading cryptocurrencies – Made in Germany. Target Geographies n/a Full Portfolio • www.bsdv.vc/#portfolio Target Sectors FinTech Investment Style Active KEY CONTACTS Deal Structures n/a Photo Matthias Ick • Joined Boerse Stuttgart Digital Ventures in 2017, previously MD and Key Investment Criteria n/a Executive Committee Member at Maxmillan Digital Education and CEO and Venture Partner Founder of tutoria Website www.bsdv.vc Contact Email [email protected] Contact Phone n/a INVESTOR BOOK 28

btov Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices St. Gallen, Berlin, Luxembourg btov Partners is a European venture capital firm focused on early stage investments in digital and industrial technology companies. btov Partners operates own funds, managed partner funds and offer direct investment opportunities to private investors. Across the three divisions, Focused on Europe and invest outside of the team manages EUR 360m and looks at more than 3,000 companies each year. Active Markets Europe on a case-by-case basis btov teams in St.Gallen, Berlin and Luxemburg jointly with seasoned entrepreneurs back Start-ups with teams willing to make the difference. Founded 2000 Thedigital tech fund invests in B2C- and B2B-oriented businesses in the fields of commerce, marketplaces, mobile and software. The industrial tech fundplaces its focus on deep tech, e.g. in industry 4.0, resource efficiency, industrial AI, IoT, enterprise software, cyber security, as well as medtech. Employees 11-25 (of which all in Europe) SELECTED PORTFOLIO COMPANIES Current Fund Size €75m No. 1 marketplace for European term deposits Use of Debt No Leading financial comparision website AUM €360m Target Investment Size €250k - €3.5m The first manned, fully electric and safe VTOLs in the world Target Geographies Europe Blacklane is a Berlin-based global professional driver services company B2C- and B2B oriented business in the Target Sectors field of commerce, marketplace, mobile and software Full Portfolio • www.btov.vc/portfolio/ Investment Style Active KEY CONTACTS Deal Structures Minority Dr. Jochen Gutbrod • Dr. Jochen Gutbrod was CFO of Holtzbrinck Publishing Group and Deputy Chairman of the Executive Board. In addition, he was CEO of Holtzbrinck Potential to tranform large industries, General Partner Digital. Prior to joining Holtzbrinck, he held leadership positions at Schroder Key Investment Criteria unique market positioning, defedable Investment Management assets • Florian was one of the co-founders of btov in the year 2000. Since then he Florian Schweitzer has worked on btov’s private investor network and investment business. Website www.btov.vc General Partner Florian has graduated with a degree in management from the University of St. Gallen Contact Email [email protected] Luca Martinelli • Luca studied International Business in Maastricht, Milan & London and holds a Masters Degree in Technology and Management orientated Business General Partner Administration from TU Munich. He founded two start-ups in the education & Contact Phone +49 30 346 55 84 00 recruiting space. INVESTOR BOOK 29

Buildit Accelerator KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Estonia Buildit is the first accelerator in the Baltic States and Nordic countries with focus on physical devices, accepting hardware and creative industries startups worldwide. Active Markets Baltic States and Nordics During the 3 month mentoring program teams can use their prototyping facilities, see list of available tools here. Startups are offered free open office space at Tartu Science Park and can test their product with end-users in a Living Lab setting. Teams also get free and discounted services from partners – that includes development tools, design services, legal and accounting services + many more. Founded 2013 €25,000 investment is offered in exchange for 12% shares. Teams can also go for €15,000 investment in return for 9% or choose €10,000 for 6%. For self-sufficient companies that already have funding they offer to participate in program with no investment for 3% of company shares. Employees Approx. 35 Current Fund Size N/A SELECTED PORTFOLIO COMPANIES Use of Debt No The first window automation solution with a sleek design, affordable price and with just one-click installation on AUM N/A existing blinds. Target Investment Size €10k – €25k Velmenni is developing Jugnu - a future technology which can transfer high speed data using visible light. Target Geographies Baltic States and Nordics Huntloc is a solution for hunters to increase hunting efficiency and safety. Huntloc helps to collect, share and manage hunting related information and gives graphical view about hunt participants positioning in real time. Target Sectors Physical Devices, Hardware Full Portfolio • www.buildit.ee/companies Investment Style Active KEY CONTACTS Deal Structures Accelerating Sven Illing Managing Partner • Manging Partner at Buildit Accelerator since 2014 Key Investment Criteria N/A • Previously founder of GameFounders a global game studio accerlator Email: [email protected] Website www.buildit.ee Contact Email [email protected] Contact Phone +372 53 317 134 INVESTOR BOOK 30

Caixa Capital Risc KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Barcelona, Madrid Caixa Capital Risc, the venture capital arm of CriteriaCaixa, an investor that provides equity and convertible loans to innovative companies in their early stages. Active Markets Spain Through different specialized vehicles, we invest in the seed phase and offer support during the A and B Series rounds, if necessary. The team has an executive and financial experience in start ups and rapid-growth companies boasting sectorial specialization particularly in Founded 2006 early stages companies. We invest in B2B business in the fields of: Fintech, Digitalhealth, Energy, Enreprise Software, Traveltech, Telecommunications, Agrotech, Edtech and Logistics. Employees 24 Current Fund Size €75m Use of Debt No SELECTED PORTFOLIO COMPANIES KDPOF develops state of the art microelectronics for high speed communications over large core Plastic Optical AUM €235m Fiber (POF). By providing a flexible, robust and affordable Gigabit networking technology that efficiently approaches the theoretical limit of the channel, KDPOF makes Gigabit communication over POF a reality Target Investment Size €300k - €3m Vilynx has built an artificial intelligence brain that helps media companies to compete with Netflix and other digital Logo giants increasing engagement, efficiency and insight. Vilynx provides intelligent content metadata, video previews, recommendations and search engines to publishers so that they can better monetize their content libraries. Target Geographies Spain and Portugal PlayGiga is an independent Games-as-a-service (GaaS) company and a pioneer in cloud-based gaming. Logo PlayGiga's customers include Telcoms, ISPs and media companies that already offer video and music services to B2B business: Fintech, Digitalhealth, their subscribers. With PlayGiga, companies can offer users a console-quality experience, a curated catalogue of Target Sectors Enterprise software, Data Analytics AAA games and an easy to use mobile-enabled parental control, delivering a family-friendly service. Energy, Traveltech, Agrotech, Logistics Investment Style Active Full Portfolio • www.caixacapitalrisc.es/en/empresas KEY CONTACTS Deal Structures Minority Asset management expert, with 20 years of experience in banking and venture Xavier Álvarez capital. Previously: Head of International Banking at Criteria, angel investor and Strong team, disruptive prior to that, Managing Director of Corporate & Structured Risk department in Key Investment Criteria technology, scalable business models, Managing Director CaixaBank. Focus on Fintech and Insurtech Business. global market potential Email: [email protected] Companies: KDPOF, Vilynx, Playgiga, Immfly Website www.caixacapitlrisc.es Contact Email [email protected] Contact Phone +34 93 4094060 INVESTOR BOOK 31

CapHorn Invest KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Paris, Lille, New York City CapHorn Invest is an independent Venture Capital Firm launched in 2010. The company invests in B2B digital companies. CapHorn Invest currently manages 180million euros across two funds and has a portfolio of more than 20 companies. Active Markets Global Founded 2010 Employees 20-30 (of which 25 in Europe) Current Fund Size €180m SELECTED PORTFOLIO COMPANIES Use of Debt No Antvoice allows medias to better monetize their advertising space through a very efficient IA tool predicting AUM €180m customer behavior. Saagie (pronounced "sadgee") is the fastest way to deploy your big data projects into production and to embed AI Target Investment Size €1m - €20m into your business. As a ready-to-deploy and fully managed platform, Saagie is massively used in the Bank & Insurance industry. Target Geographies n/a Ledger allows individuals and corporates to safely stock their blockchain assets with a revolutionary cryptology process Target Sectors Digital B2B Full Portfolio • www.caphorninvest.com/portfolio Investment Style Active KEY CONTACTS Deal Structures Minority Laurent Dumas-Crouzillac • Joined CapHorn Invest in 2015, previously Partner at A Plus Finance and Key Investment Criteria n/a Partner Partner ad IDInvest. Email: [email protected] • Companies: Saagie, FINALCAD, AntVoice, Ledger Website www.caphorninvest.com Contact Email [email protected] Contact Phone n/a INVESTOR BOOK 32

Capital300 KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Vienna, Linz capital300 is backing disruptive European technology companies run by outstanding entrepreneurs who are willing to solve tough problems on a global scale. Founded in 2017 by Peter Lasinger, an experienced VC investor and Roman Scharf, a serial entrepreneur and founder of Jajah, the first European company backed by Sequoia Capital. Active Markets Europe Weinvest together with leading US and UK venture capital firms. Such partnerships provide portfolio companies with a substantial leverage for conquering international markets and building a significant global presence. We focus on Series A rounds (€ 2-10M), aiming to co-invest € 1+M in addition to our global fund partners. Founded 2017 Employees 3 Current Fund Size €31m SELECTED PORTFOLIO COMPANIES Use of Debt No A social, hyper-casual gaming platform AUM Target Investment Size €1m - €10m Previous Companies Jajah, Talenthouse, Hitbox, Crystalline Mirror Solutions,… Target Geographies Europe Full Portfolio www.capital300.com/#businesses Target Sectors Technology (focus ICT) Investment Style Active KEY CONTACTS Deal Structures Minority Photo Peter Lasinger Roman Scharf Key Investment Criteria Team, global ambitions, technology Partner Photo Partner Website www.capital300.com Photo Eva Arh Contact Email [email protected] Principal Contact Phone n/a INVESTOR BOOK 33

Capnamic Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Cologne, Berlin Capnamic Ventures (www.capnamic.com) is one of Europe’s leading early-stage Venture Capital firms, with offices in Berlin and Cologne. The VC invests most of its funds in tech startups in the German-speaking region. Beyond that, Capnamic joins forces with international co-investors. All portfolio companies are supported through Capnamic’s global network of established industry partners. Active Markets Austria, Germany, Switzerland Thevast expertise of the Capnamic team includes more than 70 investments, a high turnover of successful trade sales and IPOs, as well as a strong Founded 2013 entrepreneurial track record within the investment team. Thegeneral partners are Jörg Binnenbrücker (@bibrue), Olaf Jacobi (@olafjacobi) and Christian Siegele. Employees 4 - 10 (of which 10 in Europe) Current Fund Size n/a Use of Debt No SELECTED PORTFOLIO COMPANIES AUM n/a Mobile attribution provider of choice for thousands of app creators around the world Target Investment Size €500k - €3m SaaS for Enterprise Architecture trusted by leading brands Target Geographies Austria, Germany Switzerland Online platform for the sale and purchase of luxury watches Marketplaces, FinTech, Health, Marketing, Target Sectors Analytics, Digital Services, Digital Infrastructure, Digital Transformation, B2B Solutions Full Portfolio • www.capnamic.com/companies Investment Style Active KEY CONTACTS Deal Structures Minority Olaf Jacobi • Olaf carries over 20 years of experience as a manager, entrepreneur and Managing Partner inves- tor. Between 2007 and 2015, he was a partner and co-owner of Target Key Investment Criteria Team, Timing, Technology Partners. From 1999 to 2007, he founded and established multiple Email: [email protected] prosperous startups, which led to several successful exits Website www.capnamic.com Jörg Binnenbrücker • Jörg is an attorney at law, studied Economics and has been active in the VC Managing Partner scene for more than 13 years. Before setting up Capnamic, Jörg was the Contact Email [email protected] founding partner and managing director of DuMont Venture and built up the Email: [email protected] investment business of the DuMont media group. Contact Phone +49 221 67781930 INVESTOR BOOK 34

Check24 Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Frankfurt The CHECK24 Ventures team is made up of successful entrepreneurs and managers. Based on their experience and background CHECK24 Ventures can support ambitious entrepreneurs throughout their journey in growing their business. In the past CHECK24 Ventures has guided numerous companies to their success and know the challenges that lie ahead. They are focused on early stage financing of young companies and Active Markets Austria, Germany, Switzerland invest earlier than most other VCs. The goal is, together with the founders, to generate value from day one and as such do not only provide capital. CHECK24 Ventures is successful when the backed founders are successful. They offer and combine the best of two worlds: they provide early Founded 2016 venture capital financing and also offer access to the CHECK24 network, its employees and their know how in the fields of IT, product and online & offline marketing. Employees 1 - 3 (of which all in Europe) Current Fund Size €60m SELECTED PORTFOLIO COMPANIES Use of Debt No askCharlie is an online lead generation portal for local service providers AUM n/a Target Investment Size €500k - €2.5m Gini extracts, structures and processes content from documents through artificial intelligence Target Geographies Austria, Germany, Switzerland Medilove is a comparison portal for cosmetic surgery procedures, including breast implants and facelifts. Target Sectors Marketplace, Media, Financial Technology, Fianncial Services Full Portfolio • www.check24.vc/en/#portfolio Investment Style Active KEY CONTACTS Deal Structures Minority, Flexible Matthias Orlopp • Scout 24 (FinanceScout, Autoscout) MD & CFO Key Investment Criteria Team, product Managing Director • CHECK24 MD & CFO Email: [email protected] • CHECK24 Ventures MD Website www.check24.vc Contact Email [email protected] Contact Phone n/a INVESTOR BOOK 35

Cherry Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Berlin They are entrepreneurs, focusing on seed stage companies and investing across Europe. The goal is to add value from day one, not just capital. They are successful if their founders are successful. Cherry Ventures will do anything in their power to make that happen. They provide advice for key strategic issues as well as day-to-day management tasks. They offer support to build-up strong functional units across the complete company Active Markets Europe, Israel value chain and provide access to personal network for the recruitment of key positions. They also coach entrepreneurs, connect founders (with key external partners especially in marketing, operations and IT) and support founders in preparing, running investor pitches, structuring deals (cash-for- Founded 2012 equity, media-for-equity, etc.) and in negotiating future financing rounds. Employees 11 - 25 (of which 12 in Europe) Current Fund Size €150m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM n/a AUTO1 Group is a used car purchaser based in Berlin Target Investment Size €400k - €10m Caroobi is a vertical marketplace for instant booking of car repair and maintenance services Target Geographies Europe, Israel, Turkey Enmacc aims to become the world’s leading OTC marketplace for energy trading by connecting all market participants via a highly scalable tech-platform Target Sectors Technology, Technology-enabled services Investment Style Active Full Portfolio • www.cherry.vc/portfolio Deal Structures Flexible, Lead KEY CONTACTS Industry agnostic, early-stage, first Christian Meermann • After some years at The Boston Consulting Group, Christian joined Zalando institutional investor, disruptive as their first CMO. He then joined the Management Board of Peek&Clop and Key Investment Criteria technology, solve specific problem for Founding Partner was responsible for the company’s online business consumer • After several years with McKinsey Daniel co-founded CityDeal and led the Daniel Glasner company as CEO until the acquisition through Groupon in 2010. Daniel is Website www.cherry.vc Founding Partner founder of Quandoo, a SaaS company for restaurants that was sold to Recruit Holdings in March’15 Contact Email [email protected] Filip Dames • Filip founded his first company in 2008, an online auction house for antiques and collectibles. He then joined the founding team of Zalando and held Founding Partner several executive positions. Contact Phone n/a INVESTOR BOOK 36

Citi Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices 4: San Francisco, Palo Alto, NY and Tel Citi Ventures is the innovation engine of Citi, committed to conceiving, launching and scaling new initiatives with the potential to transform the future Aviv of financial services. We accelerate innovation at Citi by investing in startups, piloting new technologies, and testing new solutions and business Active Markets North America, Europe, Israel models through our Citi Innovation Labs and Citi businesses. Founded 2010 Basedin Silicon Valley, close to the disruptive forces that are reinventing industries and upending traditional business models, Citi Ventures analyzes market signals to bring the best from the outside into Citi, and fosters bold ideas that set the conditions for innovative action. Weseek to deliver next-generation experiences for Citi’s customers by systematically exploring leading-edge topics from machine learning and Employees 10 in Venture Investing team blockchain technology to new lending platforms and marketplaces. Current Fund Size Balance sheet-funded Citi Ventures’ investing model features three characteristics focused on helping maximize startups’ potential: (1) Timeliness and flexibility; (2) Value- add, leveraging Citi and its broader franchise for commercialization opportunities; and (3) Do-no-harm (e.g., no strings attached). Use of Debt No SELECTED PORTFOLIO COMPANIES AUM Not applicable Focus area: Financial Services & Technology • Digital transactions management provider that automates and digitizes documents & transactions Target Investment Size $1m - $10m • Publicly-traded. Target Geographies North America, Europe, Israel Focus area: Commerce & Payments • AI-powered Integrated Receivables SaaS platform. Optimizes cash flow through automation of receivables and 5 sectors: payments processes across credit, collections, cash application, deductions, and electronic invoicing and Fintech (Financial Services & payments. Target Sectors Technology); Commerce & Payments; Focus area: Data Analytics & Machine Learning Data Analytics & Machine Learning; • Data science company that uses machine learning to prevent fraud in omnichannel commerce Marketing Technology & Customer Experience; Security & Enterprise IT Full Portfolio • www.citi.com/ventures/portfolio.html Investment Style Passive KEY CONTACTS Deal Structures Standard VC terms • Joined Citi Ventures in 2015, previously Managing Director, Global Head of Luis Valdich Strategic Investments at J.P. Morgan and Consultant at McKinsey Fit within 5 focus areas (see above); Managing Director • Companies: ClarityMoney (acquired by Goldman Sachs); Contguard; Key Investment Criteria Strategic relevance (can bank be helpful); HighRadius; and two that have not been announced yet, a vertically-focused $2mm annualized product revenue; high Email: [email protected] POS lender and a provider of personal finance analytics growth Website www.citi.com/ventures/focus.html Contact Email [email protected] Contact Phone +1 9174566046 INVESTOR BOOK 37

CommerzVentures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Frankfurt CommerzVentures is the corporate VC arm of Commerzbank and invests in FinTech and InsurTech companies across Western Europe, Israel and the US. Thepartners aspire to work with the best entrepreneurs who can articulate why they can dominate a given market segment. The team has >30 years of experience in venture capital. CommerzVentures invests in A-C round with a focus on B rounds. Active Markets Europe, Israel, and the US Founded 2014 Employees 6 (of which all in Europe) Current Fund Size €100m SELECTED PORTFOLIO COMPANIES Use of Debt No Short-term loan provider to small businesses AUM €30m Target Investment Size €2m - €10m Open API issuer processor platform Target Geographies Europe, Israel, and the US Cloud banking technology platform provider Target Sectors FinTech & Insurance Full Portfolio • www.commerzventures.com/Portfolio.html Investment Style Passive KEY CONTACTS Deal Structures Minority Patrick Meisberger Stefan Tirtey Key Investment Criteria Team, market potential, execution, Managing Director Managing Director defedable USP Website www.commerzventures.com Heiko Schwender Paul Morgenthaler Contact Email [email protected] Senior Investment Manager Senior Investment Manager Contact Phone n/a INVESTOR BOOK 38

Concentric KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, UK & Copenhagen, Denmark Weareanopentechnology investment partnership, not astereotypical VC, and we do not see ourselves as just financial investors, more as business partners and builders ActiveMarkets Europe Adding value by active management and working with companies before and after investing Founded 2013 Focus on investment opportunities born out of changing customer behaviour / demands across a number of core sectors / verticals: fintech, proptech, marketplaces, B2Bautomation Employees 6 c.50 investments undertaken over past 15 years Current Fund Size €30m Supported by long-standing family office co-investors Use of Debt Yes SELECTED PORTFOLIO COMPANIES Launches and operates used-car marketplace in emerging markets, including Nigeria, Chile, Pakistan, and AUM c. €40m Indonesia Target Investment Size Up to €5m over life of an investment Workspace and office services provider building sector-focused, curated communities Target Geographies Key innovation hubs of Western Europe Platform for management of short term rentals that allows homeowners to maximize rental income Target Sectors Fintech, proptech, marketplaces, B2B automation Full Portfolio • www.concentricteam.com/investment-platforms/ Investment Style Active KEY CONTACTS Deal Structures Significant minority equity positions • Denis Shafranik • 9 years in investment banking Original, scalable and defendable • Partner • 8 years in VC technology investment Key Investment Criteria Category leaders • Email: [email protected] • Companies: PayasUgym, PSM, Neteven, Billetto, ChargeMaster, etc. Post achieving product-market fit Website www.concentricteam.com • Kjartan Rist • 18 years in technology (founder, advisor, investor, Board) Contact Email [email protected] • Partner • Companies: VOSS Solutions, Shazam, NetClean, Endeca, TopTable, etc. • Email: [email protected] Contact Phone +44 (0) 20 7839 8143 INVESTOR BOOK 39

Constantia New Business KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Vienna Constantia New Business (CNB) is an independent sister company of Constantia Industries, headquartered in Vienna, Austria. The group is privately owned and run, with a strong sense for diversification and international outlook. CNB is looking for outstanding and passionate teams working on high-tech products addressing B2B industries. CNB invests into companies from DACH and CEE region in Post-Seed rounds with a ticket starting at Active Markets DACH €500k. Founded 2012 Employees 5 (of which 5 in Europe) Current Fund Size Evergreen ltd co Use of Debt Exceptional SELECTED PORTFOLIO COMPANIES AUM n.a. High quality video streaming technology over the web as Software-as-a-Service. Target Investment Size €500k - €2m Pioneers the development of radio-frequency (RF) antenna, waveguide and filter products based on additive manufacturing. Target Geographies DACH, CEE Aircloak enables high-fidelity analytics of sensitive datasets while strongly protecting individuals’ privacy. Target Sectors Deep tech, SaaS, IoT, Robotics, Advanced Materials Investment Style Active Full Portfolio • www.ciag-cnb.at/#portfolio Deal Structures Various KEY CONTACTS Philipp Thurn und Taxis • Head of Constantia New Business & Member of the Board of Directors of B2B, Innovative technology with strong CIAG with international experience as consultant, manager and entrepreneur Key Investment Criteria USP and high scalability, After market Managing Director in software and telecommunications among others. Executive Board at Efkon entry, First revenues AG and VP Global Corporate Development at SAP AG. Email: [email protected] • Companies: bitmovin, swissto12 Website www.ciag-cnb.at Sabine Fleischmann • Many years of working experience in IT, with main emphasis on software (e.g. Contact Email [email protected] Microsoft, Sun, IBM), management tasks in consulting, sales and general Senior Investment Manager management. Coach and consultant. Experience with International Energy Management. Contact Phone +43 1 588 45-0 Email: [email protected] • Companies: BENEnergy, VirtualQ, Aircloak INVESTOR BOOK 40

Coparion KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Cologne, Berlin Coparion is a pragmatic investor with an eye for the essentials and persistence for the long-run. Coparion helps young technology companies achieve swift and sustained growth. With assets under management of EUR 225 million their team has Active Markets Germany the means to do so. Coparion supports entrepreneurial vision with the know-how, but without intervening in daily business operations. Thanks to 25+ years of team experience in venture capital and in building companies, they discern potentials and open up new perspectives. They have the Founded 2016 substance, tenacity and creativity required to mutually manage difficult situations successfully. They only invest with other co-investors. Thefocus is on the start-up and early growth phase. They appreciate initial successes, such as the sales and key accounts developed or successful Employees 13 (of which all in Europe) product launches. Per company they invest up to EUR 10 million, usually in several financing rounds of EUR 0.5-5 million each. Current Fund Size €225m SELECTED PORTFOLIO COMPANIES Use of Debt No AI for robot autonomy AUM €225m Target Investment Size €500k - €5m B2B marketplace for long-stay furnished appartements Target Geographies Germany Electronic Fleet Manager based on connected car Target Sectors IT, Internet, High-Tech, Life Science Full Portfolio • www.coparion.vc/en#tmpl-portfolio Investment Style Active KEY CONTACTS Deal Structures Minority, with co-investors Christian Stein Managing Director • Managing Director at Coparion since launch. Previously Partner at Creathor Key Investment Criteria „Traction“ – No seed funding Venture, CFO at Zadego , BCG, IBM Email: [email protected] Website www.coparion.vc David Zimmer Contact Email [email protected] Managing Director • Managing Director at Coparion since launch. Previously Director at Quadriga Capital and CEO at Altira AG Email: [email protected] Contact Phone +49 30 58584400 INVESTOR BOOK 41

Creandum KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Stockholm, Berlin, San Francisco Creandumis a leading early-stage venture capital firm investing in innovative and fast-growing technology companies. The Creandum Advisory team is based in Stockholm, Berlin and San Francisco. The Creandum funds have invested in over 70 companies including being early investor in companies such as Spotify, iZettle, Vivino, Kry, Neo4j, 8fit, Billie, Epidemic Sound, Xeneta, Klarna and many more. Active Markets Europe and North America Founded 2003 Employees 15 Current Fund Size €180m SELECTED PORTFOLIO COMPANIES Use of Debt No • World’s largest music streaming service. With Spotify, it’s easy to find the right music for every moment of your AUM €435m day and in your life Target Investment Size €500k - €10m per round • Number one solution for retail mobile payments and point-of-sale solutions in Europe and Latin America Target Geographies Europe and North America • Vivino is the world's largest online wine marketplace, powered by a community of 30 million who use Vivino to discover and buy wine Target Sectors B2Cand B2B, Software Full Portfolio • www.creandum.com/portfolio/ Investment Style Active KEY CONTACTS Deal Structures Minority Johan Brenner • Johan is one of Europe’s most experienced venture capital investors having worked across a broad set of industries globally, built a number of successful Key Investment Criteria Possibility to scale globally General Partner businesses as an entrepreneur, and as Partner in leading venture capital firms [email protected] • Companies: i.a. iZettle, Klarna, Pleo, Bokio, Syft, Neo4j, Vivino, Planday Website www.creandum.com Simon Schmincke • Simon is a developer by heart and a venture capitalist by mind. German born, Contact Email n/a Photo Partner Simon gained operational experience building three companies for Rocket Internet, as well as investment experience with Earlybird Venture Capital [email protected] • Companies: i.a. Bllie, Comtravo, RFRSH, Tide, Taxfix Contact Phone n/a INVESTOR BOOK 42