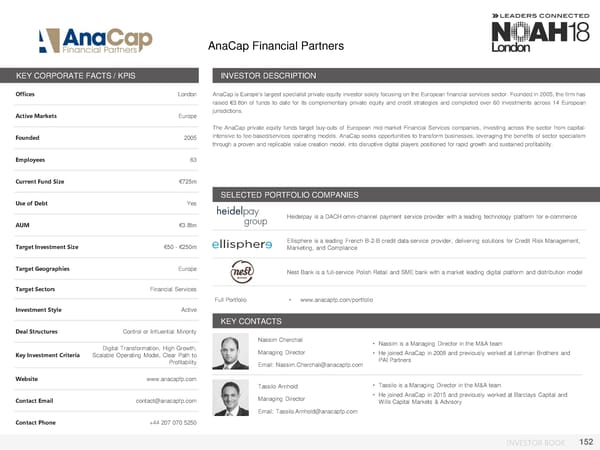

AnaCapFinancial Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London AnaCapis Europe’s largest specialist private equity investor solely focusing on the European financial services sector. Founded in 2005, the firm has raised €3.8bn of funds to date for its complementary private equity and credit strategies and completed over 60 investments across 14 European Active Markets Europe jurisdictions. The AnaCap private equity funds target buy-outs of European mid-market Financial Services companies, investing across the sector from capital- Founded 2005 intensive to fee-based/services operating models. AnaCap seeks opportunities to transform businesses, leveraging the benefits of sector specialism through a proven and replicable value creation model, into disruptive digital players positioned for rapid growth and sustained profitability. Employees 63 Current Fund Size €725m SELECTED PORTFOLIO COMPANIES Use of Debt Yes Heidelpay is a DACH omni-channel payment service provider with a leading technology platform for e-commerce AUM €3.8bn Target Investment Size €50 - €250m Ellisphere is a leading French B-2-B credit data-service provider, delivering solutions for Credit Risk Management, Marketing, and Compliance Target Geographies Europe Nest Bank is a full-service Polish Retail and SME bank with a market leading digital platform and distribution model Target Sectors Financial Services Full Portfolio • www.anacapfp.com/portfolio Investment Style Active KEY CONTACTS Deal Structures Control or Influential Minority Nassim Cherchali • Nassim is a Managing Director in the M&A team Digital Transformation, High Growth, Managing Director • He joined AnaCap in 2008 and previously worked at Lehman Brothers and Key Investment Criteria Scalable Operating Model, Clear Path to PAI Partners Profitability Email: Nassim.Cherchali@anacapfp.com Website www.anacapfp.com Tassilo Arnhold • Tassilo is a Managing Director in the M&A team Contact Email contact@anacapfp.com Managing Director • He joined AnaCap in 2015 and previously worked at Barclays Capital and Wills Capital Markets & Advisory Email: Tassilo.Arnhold@anacapfp.com Contact Phone +44 207 070 5250 INVESTOR BOOK 152

NOAH18 London Investor Book Page 151 Page 153

NOAH18 London Investor Book Page 151 Page 153