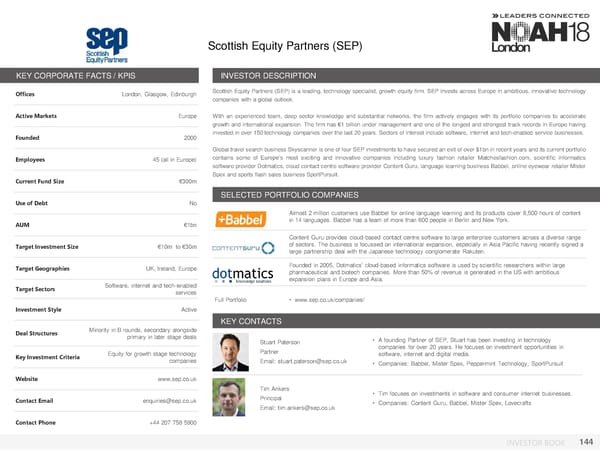

Scottish Equity Partners (SEP) KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, Glasgow, Edinburgh Scottish Equity Partners (SEP) is a leading, technology specialist, growth equity firm. SEP invests across Europe in ambitious, innovative technology companies with a global outlook. Active Markets Europe With an experienced team, deep sector knowledge and substantial networks, the firm actively engages with its portfolio companies to accelerate growth and international expansion. The firm has €1 billion under management and one of the longest and strongest track records in Europe having Founded 2000 invested in over 150 technology companies over the last 20 years. Sectors of interest include software, internet and tech-enabled service businesses. Global travel search business Skyscanner is one of four SEP investments tohave secured an exit of over $1bn in recent years and its current portfolio Employees 45 (all in Europe) contains some of Europe’s most exciting and innovative companies including luxury fashion retailer Matchesfashion.com, scientific informatics software provider Dotmatics, cloud contact centre software provider Content Guru, language learning business Babbel, online eyewear retailer Mister Current Fund Size €300m Spex and sports flash sales business SportPursuit. SELECTED PORTFOLIO COMPANIES Use of Debt No Almost 2 million customers use Babbel for online language learning and its products cover 8,500 hours of content AUM €1bn in 14 languages. Babbel has a team of more than 600 people in Berlin and New York. Content Guru provides cloud-based contact centre software to large enterprise customers across a diverse range Target Investment Size €10m to €30m of sectors. The business is focussed on international expansion, especially in Asia Pacific having recently signed a large partnership deal with the Japanese technology conglomerate Rakuten. Target Geographies UK, Ireland, Europe Founded in 2005, Dotmatics’ cloud-based informatics software is used by scientific researchers within large pharmaceutical and biotech companies. More than 50% of revenue is generated in the US with ambitious expansion plans in Europe and Asia. Target Sectors Software, internet and tech-enabled services Full Portfolio • www.sep.co.uk/companies/ Investment Style Active KEY CONTACTS Deal Structures Minority in B rounds, secondary alongside primary in later stage deals Stuart Paterson • Afounding Partner of SEP, Stuart has been investing in technology Partner companies for over 20 years. He focuses on investment opportunities in Key Investment Criteria Equity for growth stage technology software, internet and digital media. companies Email: stuart.paterson@sep.co.uk • Companies: Babbel, Mister Spex, Peppermint Technology, SportPursuit Website www.sep.co.uk Tim Ankers • Tim focuses on investments in software and consumer internet businesses. Contact Email enquiries@sep.co.uk Principal • Companies: Content Guru, Babbel, Mister Spex, Lovecrafts Email: tim.ankers@sep.co.uk Contact Phone +44 207 758 5900 INVESTOR BOOK 144

NOAH18 London Investor Book Page 143 Page 145

NOAH18 London Investor Book Page 143 Page 145