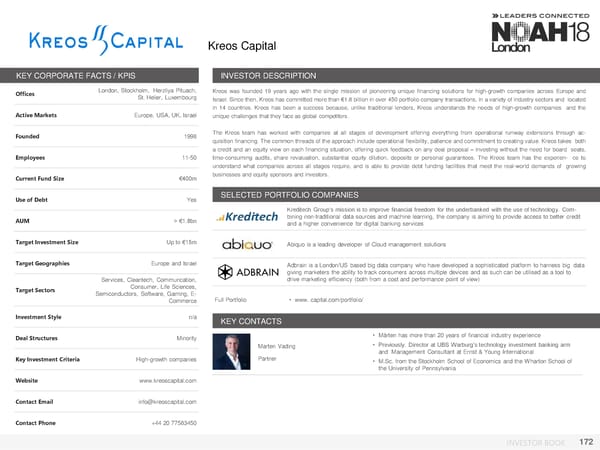

Kreos Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, Stockholm, Herzliya Pituach, Kreos was founded 19 years ago with the single mission of pioneering unique financing solutions for high-growth companies across Europe and St. Helier, Luxembourg Israel. Since then, Kreos has committed more than €1.8 billion in over 450 portfolio company transactions, in a variety of industry sectors and located in 14 countries. Kreos has been a success because, unlike traditional lenders, Kreos understands the needs of high-growth companies and the Active Markets Europe, USA, UK, Israel unique challenges that they face as global competitors. Founded 1998 The Kreos team has worked with companies at all stages of development offering everything from operational runway extensions through ac- quisition financing. The common threads of the approach include operational flexibility, patience and commitment to creating value. Kreos takes both a credit and an equity view on each financing situation, offering quick feedback on any deal proposal – investing without the need for board seats, Employees 11-50 time-consuming audits, share revaluation, substantial equity dilution, deposits or personal guarantees. The Kreos team has the experien- ce to understand what companies across all stages require, and is able to provide debt funding facilities that meet the real-world demands of growing Current Fund Size €400m businesses and equity sponsors and investors. Use of Debt Yes SELECTED PORTFOLIO COMPANIES Kreditech Group’s mission is to improve financial freedom for the underbanked with the use of technology. Com- AUM > €1.8bn bining non-traditional data sources and machine learning, the company is aiming to provide access to better credit and a higher convenience for digital banking services Target Investment Size Up to €15m Abiquo is a leading developer of Cloud management solutions Target Geographies Europe and Israel Adbrain is a London/US based big data company who have developed a sophisticated platform to harness big data giving marketers the ability to track consumers across multiple devices and as such can be utilised as a tool to Services, Cleantech, Communcation, drive marketing efficiency (both from a cost and performance point of view) Target Sectors Consumer, Life Sciences, Semiconductors, Software, Gaming, E- Commerce Full Portfolio • www. capital.com/portfolio/ Investment Style n/a KEY CONTACTS Deal Structures Minority • Mårten has more than 20 years of financial industry experience Marten Vading • Previously: Director at UBS Warburg’s technology investment banking arm and Management Consultant at Ernst & Young International Key Investment Criteria High-growth companies Partner • M.Sc. from the Stockholm School of Economics and the Wharton School of the University of Pennsylvania Website www.kreoscapital.com Contact Email info@kreoscapital.com Contact Phone +44 20 77583450 INVESTOR BOOK 172

NOAH18 London Investor Book Page 171 Page 173

NOAH18 London Investor Book Page 171 Page 173