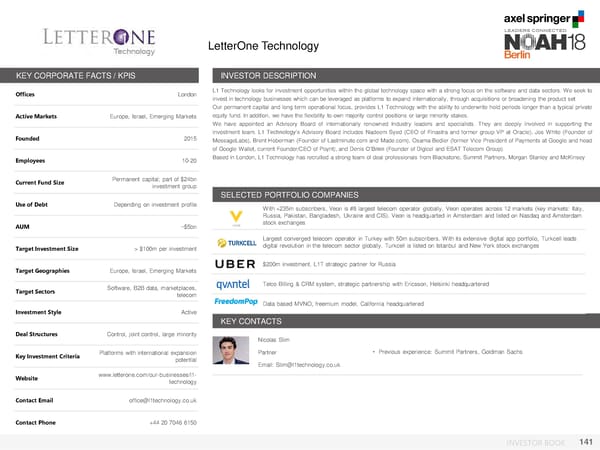

LetterOne Technology KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London L1 Technology looks for investment opportunities within the global technology space with a strong focus on the software and data sectors. We seek to invest in technology businesses which can be leveraged as platforms to expand internationally, through acquisitions or broadening the product set Our permanent capital and long term operational focus, provides L1 Technology with the ability to underwrite hold periods longer than a typical private Active Markets Europe, Israel, Emerging Markets equity fund. In addition, we have the flexibility to own majority control positions or large minority stakes. We have appointed an Advisory Board of internationally renowned Industry leaders and specialists. They are deeply involved in supporting the Founded 2015 investment team. L1 Technology’s Advisory Board includes Nadeem Syed (CEO of Finastra and former group VP at Oracle), Jos White (Founder of MessageLabs), Brent Hoberman (Founder of Lastminute.com and Made.com), Osama Bedier (former Vice President of Payments at Google and head of Google Wallet, current Founder/CEO of Poynt), and Denis O’Brien (Founder of Digicel and ESAT Telecom Group). Employees 10-20 Based in London, L1 Technology has recruited a strong team of deal professionals from Blackstone, Summit Partners, Morgan Stanley and McKinsey Current Fund Size Permanent capital; part of $24bn investment group SELECTED PORTFOLIO COMPANIES Use of Debt Depending on investment profile With+235m subscribers, Veon is #8 largest telecom operator globally. Veon operates across 12 markets (key markets: Italy, Russia, Pakistan, Bangladesh, Ukraine and CIS). Veon is headquarted in Amsterdam and listed on Nasdaq and Amsterdam AUM ~$5bn stock exchanges Largest converged telecom operator in Turkey with 50m subscribers. Withits extensive digital app portfolio, Turkcell leads Target Investment Size > $100m per investment digital revolution in the telecom sector globally. Turkcell is listed on Istanbul and New York stock exchanges Target Geographies Europe, Israel, Emerging Markets $200m investment. L1T strategic partner for Russia Software, B2B data, marketplaces, Telco Billing & CRM system, strategic partnership with Ericsson, Helsinki headquartered Target Sectors telecom Data based MVNO, freemium model, California headquartered Investment Style Active KEY CONTACTS Deal Structures Control, joint control, large minority Nicolas Slim Platforms with international expansion Photo Partner • Previous experience: Summit Partners, Goldman Sachs Key Investment Criteria potential Email: Slim@l1technology.co.uk Website www.letterone.com/our-businesses/l1- technology Contact Email office@l1technology.co.uk Contact Phone +44 20 7046 6150 INVESTOR BOOK 141

NOAH18 London Investor Book Page 140 Page 142

NOAH18 London Investor Book Page 140 Page 142