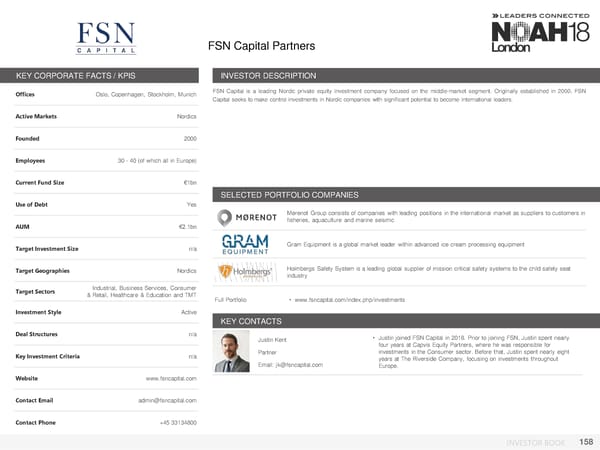

FSN Capital Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Oslo, Copenhagen, Stockholm, Munich FSN Capital is a leading Nordic private equity investment company focused on the middle-market segment. Originally established in 2000, FSN Capital seeks to make control investments in Nordic companies with significant potential to become international leaders. Active Markets Nordics Founded 2000 Employees 30 - 40 (of which all in Europe) Current Fund Size €1bn SELECTED PORTFOLIO COMPANIES Use of Debt Yes Mørenot Group consists of companies with leading positions in the international market as suppliers to customers in AUM €2.1bn fisheries, aquaculture and marine seismic Target Investment Size n/a Gram Equipment is a global market leader within advanced ice cream processing equipment Target Geographies Nordics Holmbergs Safety System is a leading global supplier of mission critical safety systems to the child safety seat industry Target Sectors Industrial, Business Services, Consumer & Retail, Healthcare & Education and TMT Full Portfolio • www.fsncapital.com/index.php/investments Investment Style Active KEY CONTACTS Deal Structures n/a Justin Kent • Justin joined FSN Capital in 2018. Prior to joining FSN, Justin spent nearly four years at Capvis Equity Partners, where he was responsible for Key Investment Criteria n/a Partner investments in the Consumer sector. Before that, Justin spent nearly eight years at The Riverside Company, focusing on investments throughout Email: jk@fsncapital.com Europe. Website www.fsncapital.com Contact Email admin@fsncapital.com Contact Phone +45 33134800 INVESTOR BOOK 158

NOAH18 London Investor Book Page 157 Page 159

NOAH18 London Investor Book Page 157 Page 159