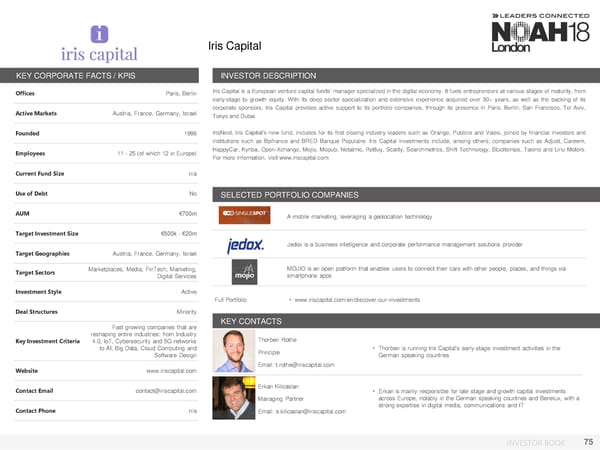

Iris Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Paris, Berlin Iris Capital is a European venture capital funds’ manager specialized in the digital economy. It fuels entrepreneurs at various stages of maturity, from early-stage to growth equity. With its deep sector specialization and extensive experience acquired over 30+ years, as well as the backing of its Active Markets Austria, France, Germany, Israel corporate sponsors, Iris Capital provides active support to its portfolio companies, through its presence in Paris, Berlin, San Francisco, Tel Aviv, Tokyoand Dubai. Founded 1986 IrisNext, Iris Capital’s new fund, includes for its first closing industry leaders such as Orange, Publicis and Valeo, joined by financial investors and institutions such as Bpifrance and BRED Banque Populaire. Iris Capital investments include, among others, companies such as Adjust, Careem, Employees 11 - 25 (of which 12 in Europe) HappyCar, Kyriba, Open-Xchange, Mojio, Mopub, Netatmo, ReBuy, Scality, Searchmetrics, Shift Technology, Studitemps, Talend and Unu Motors. For more information, visit www.iriscapital.com Current Fund Size n/a Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €700m A mobile marketing, leveraging a geolocation technology Target Investment Size €500k - €20m Jedox is a business intelligence and corporate performance management solutions provider Target Geographies Austria, France, Germany, Israel Target Sectors Marketplaces, Media, FinTech, Marketing, MOJIO is an open platform that enables users to connect their cars with other people, places, and things via Digital Services smartphone apps Investment Style Active Full Portfolio • www.iriscapital.com/en/discover-our-investments Deal Structures Minority Fast growing companies that are KEY CONTACTS reshaping entire industries: from Industry Thorben Rothe Key Investment Criteria 4.0, IoT, Cybersecurity and 5G networks to AI, Big Data, Cloud Computing and Principle • Thorben is running Iris Capital's early-stage investment activities in the Software Design German speaking countries Website www.iriscapital.com Email: t.rothe@iriscapital.com Contact Email contact@iriscapital.com Erkan Kilicaslan • Erkan is mainly responsible for late stage and growth capital investments Managing Partner across Europe, notably in the German speaking countries and Benelux, with a Contact Phone n/a strong expertise in digital media, communications and IT Email: e.kilicaslan@iriscapital.com INVESTOR BOOK 75

NOAH18 London Investor Book Page 74 Page 76

NOAH18 London Investor Book Page 74 Page 76