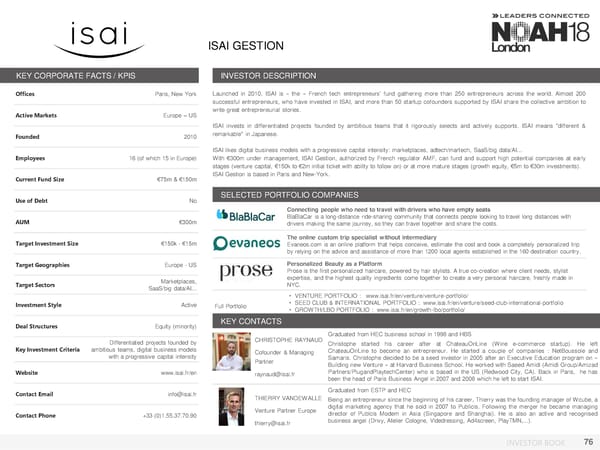

ISAI GESTION KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Paris, New York Launched in 2010, ISAI is « the » French tech entrepreneurs’ fund gathering more than 250 entrepreneurs across the world. Almost 200 successful entrepreneurs, who have invested in ISAI, and more than 50 startup cofounders supported by ISAI share the collective ambition to Active Markets Europe – US write great entrepreneurial stories. ISAI invests in differentiated projects founded by ambitious teams that it rigorously selects and actively supports. ISAI means "different & Founded 2010 remarkable" in Japanese. ISAI likes digital business models with a progressive capital intensity: marketplaces, adtech/martech, SaaS/big data/AI... Employees 16 (of which 15 in Europe) With €300m under management, ISAI Gestion, authorized by French regulator AMF, can fund and support high potential companies at early stages (venture capital, €150k to €2m initial ticket with ability to follow on) or at more mature stages (growth equity, €5m to €30m investments). Current Fund Size €75m & €150m ISAI Gestion is based in Paris and New-York. Use of Debt No SELECTED PORTFOLIO COMPANIES Connecting people who need to travel with drivers who have empty seats AUM €300m BlaBlaCar is a long-distance ride-sharing community that connects people looking to travel long distances with drivers making the same journey, so they can travel together and share the costs. Target Investment Size €150k - €15m The online custom trip specialist without intermediary Evaneos.com is an online platform that helps conceive, estimate the cost and book a completely personalized trip by relying on the advice and assistance of more than 1200 local agents established in the 160 destination country. Target Geographies Europe - US Personalized Beauty as a Platform Prose is the first personalized haircare, powered by hair stylists. A true co-creation where client needs, stylist Marketplaces, expertise, and the highest quality ingredients come together to create a very personal haircare, freshly made in Target Sectors SaaS/big data/AI... NYC. • VENTURE PORTFOLIO : www.isai.fr/en/venture/venture-portfolio/ Investment Style Active Full Portfolio • SEED CLUB & INTERNATIONAL PORTFOLIO : www.isai.fr/en/venture/seed-club-international-portfolio • GROWTH/LBO PORTFOLIO : www.isai.fr/en/growth-lbo/portfolio/ Deal Structures Equity (minority) KEY CONTACTS CHRISTOPHE RAYNAUD Graduated from HEC business school in 1998 and HBS Differentiated projects founded by Christophe started his career after at ChateauOnLine (Wine e-commerce startup). He left Key Investment Criteria ambitious teams, digital business models Cofounder & Managing ChateauOnLine to become an entrepreneur. He started a couple of companies : NetBoussole and with a progressive capital intensity Partner Samaris. Christophe decided to be a seed investor in 2005 after an Executive Education program on « Building new Venture » at Harvard Business School. He worked with Saeed Amidi (Amidi Group/Amizad Website www.isai.fr/en raynaud@isai.fr Partners/PlugandPlaytechCenter) who is based in the US (Redwood City, CA). Back in Paris, he has been the head of Paris Business Angel in 2007 and 2008 which he left to start ISAI. Contact Email info@isai.fr Graduated from ESTP and HEC THIERRY VANDEWALLE Beinganentrepreneur sincethebeginning of his career, Thierry was the founding manager of Wcube, a Venture Partner Europe digital marketing agency that he sold in 2007 to Publicis. Following the merger he became managing Contact Phone +33 (0)1.55.37.70.90 director of Publcis Modem in Asia (Singapore and Shanghai). He is also an active and recognised thierry@isai.fr business angel (Drivy, Atelier Cologne, Videdressing, Ad4screen, PlayTMN,...). INVESTOR BOOK 76

NOAH18 London Investor Book Page 75 Page 77

NOAH18 London Investor Book Page 75 Page 77