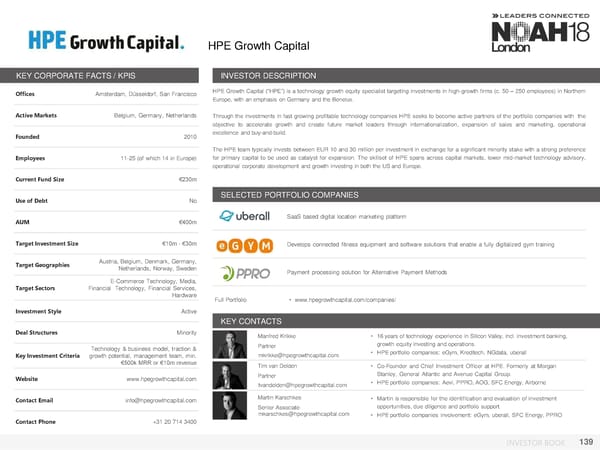

HPE Growth Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Amsterdam, Düsseldorf, San Francisco HPEGrowth Capital (“HPE”) is a technology growth equity specialist targeting investments in high-growth firms (c. 50 – 250 employees) in Northern Europe, with an emphasis on Germany and the Benelux. Active Markets Belgium, Germany, Netherlands Through the investments in fast growing profitable technology companies HPE seeks to become active partners of the portfolio companies with the objective to accelerate growth and create future market leaders through internationalization, expansion of sales and marketing, operational Founded 2010 excellence and buy-and-build. The HPE team typically invests between EUR 10 and 30 million per investment in exchange for a significant minority stake with a strong preference Employees 11-25 (of which 14 in Europe) for primary capital to be used as catalyst for expansion. The skillset of HPE spans across capital markets, lower mid-market technology advisory, operational corporate development and growth investing in both the US and Europe. Current Fund Size €230m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM €400m SaaS based digital location marketing platform Target Investment Size €10m - €30m Develops connected fitness equipment and software solutions that enable a fully digitalized gym training Target Geographies Austria, Belgium, Denmark, Germany, Netherlands, Norway, Sweden Payment processing solution for Alternative Payment Methods E-Commerce Technology, Media, Target Sectors Financial Technology, Financial Services, Hardware Full Portfolio • www.hpegrowthcapital.com/companies/ Investment Style Active KEY CONTACTS Deal Structures Minority Manfred Krikke • 16yearsof technology experience in Silicon Valley, incl. investment banking, Technology & business model, traction & Partner growth equity investing and operations. Key Investment Criteria growth potential, management team, min. mkrikke@hpegrowthcapital.com • HPE portfolio companies: eGym, Kreditech, NGdata, uberall €500k MRR or €10m revenue Tim van Delden • Co-Founder and Chief Investment Officer at HPE. Formerly at Morgan Website www.hpegrowthcapital.com Partner Stanley, General Atlantic and Avenue Capital Group. tvandelden@hpegrowthcapital.com • HPE portfolio companies: Aevi, PPRO, AOG, SFC Energy, Airborne Contact Email info@hpegrowthcapital.com Martin Karschkes • Martin is responsible for the identification and evaluation of investment Senior Associate opportunities, due diligence and portfolio support. mkarschkes@hpegrowthcapital.com • HPE portfolio companies involvement: eGym, uberall, SFC Energy, PPRO Contact Phone +31 20 714 3400 INVESTOR BOOK 139

NOAH18 London Investor Book Page 138 Page 140

NOAH18 London Investor Book Page 138 Page 140