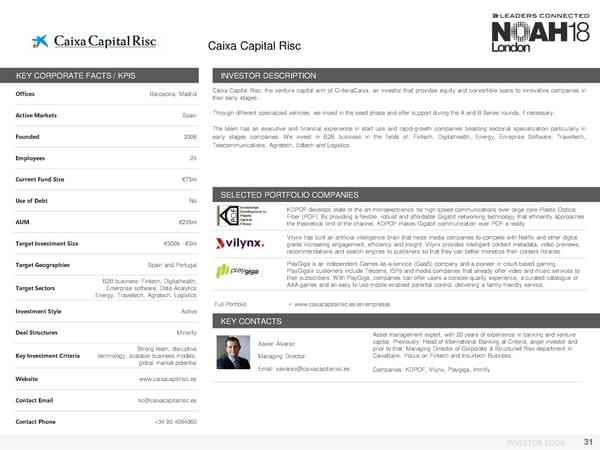

Caixa Capital Risc KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Barcelona, Madrid Caixa Capital Risc, the venture capital arm of CriteriaCaixa, an investor that provides equity and convertible loans to innovative companies in their early stages. Active Markets Spain Through different specialized vehicles, we invest in the seed phase and offer support during the A and B Series rounds, if necessary. The team has an executive and financial experience in start ups and rapid-growth companies boasting sectorial specialization particularly in Founded 2006 early stages companies. We invest in B2B business in the fields of: Fintech, Digitalhealth, Energy, Enreprise Software, Traveltech, Telecommunications, Agrotech, Edtech and Logistics. Employees 24 Current Fund Size €75m Use of Debt No SELECTED PORTFOLIO COMPANIES KDPOF develops state of the art microelectronics for high speed communications over large core Plastic Optical AUM €235m Fiber (POF). By providing a flexible, robust and affordable Gigabit networking technology that efficiently approaches the theoretical limit of the channel, KDPOF makes Gigabit communication over POF a reality Target Investment Size €300k - €3m Vilynx has built an artificial intelligence brain that helps media companies to compete with Netflix and other digital Logo giants increasing engagement, efficiency and insight. Vilynx provides intelligent content metadata, video previews, recommendations and search engines to publishers so that they can better monetize their content libraries. Target Geographies Spain and Portugal PlayGiga is an independent Games-as-a-service (GaaS) company and a pioneer in cloud-based gaming. Logo PlayGiga's customers include Telcoms, ISPs and media companies that already offer video and music services to B2B business: Fintech, Digitalhealth, their subscribers. With PlayGiga, companies can offer users a console-quality experience, a curated catalogue of Target Sectors Enterprise software, Data Analytics AAA games and an easy to use mobile-enabled parental control, delivering a family-friendly service. Energy, Traveltech, Agrotech, Logistics Investment Style Active Full Portfolio • www.caixacapitalrisc.es/en/empresas KEY CONTACTS Deal Structures Minority Asset management expert, with 20 years of experience in banking and venture Xavier Álvarez capital. Previously: Head of International Banking at Criteria, angel investor and Strong team, disruptive prior to that, Managing Director of Corporate & Structured Risk department in Key Investment Criteria technology, scalable business models, Managing Director CaixaBank. Focus on Fintech and Insurtech Business. global market potential Email: xalvarez@caixacapitalrisc.es Companies: KDPOF, Vilynx, Playgiga, Immfly Website www.caixacapitlrisc.es Contact Email tic@caixacapitalrisc.es Contact Phone +34 93 4094060 INVESTOR BOOK 31

NOAH18 London Investor Book Page 30 Page 32

NOAH18 London Investor Book Page 30 Page 32