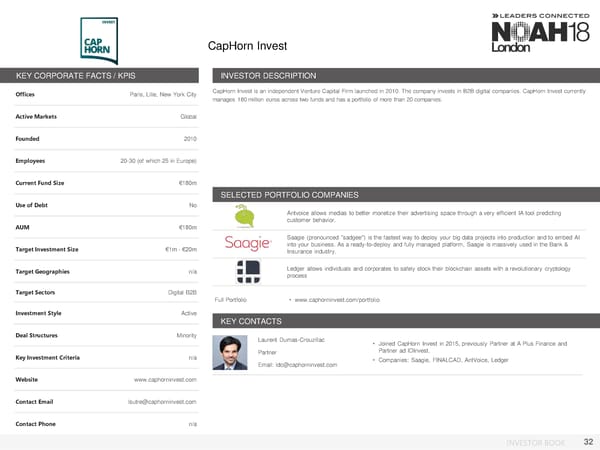

CapHorn Invest KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Paris, Lille, New York City CapHorn Invest is an independent Venture Capital Firm launched in 2010. The company invests in B2B digital companies. CapHorn Invest currently manages 180million euros across two funds and has a portfolio of more than 20 companies. Active Markets Global Founded 2010 Employees 20-30 (of which 25 in Europe) Current Fund Size €180m SELECTED PORTFOLIO COMPANIES Use of Debt No Antvoice allows medias to better monetize their advertising space through a very efficient IA tool predicting AUM €180m customer behavior. Saagie (pronounced "sadgee") is the fastest way to deploy your big data projects into production and to embed AI Target Investment Size €1m - €20m into your business. As a ready-to-deploy and fully managed platform, Saagie is massively used in the Bank & Insurance industry. Target Geographies n/a Ledger allows individuals and corporates to safely stock their blockchain assets with a revolutionary cryptology process Target Sectors Digital B2B Full Portfolio • www.caphorninvest.com/portfolio Investment Style Active KEY CONTACTS Deal Structures Minority Laurent Dumas-Crouzillac • Joined CapHorn Invest in 2015, previously Partner at A Plus Finance and Key Investment Criteria n/a Partner Partner ad IDInvest. Email: ldc@caphorninvest.com • Companies: Saagie, FINALCAD, AntVoice, Ledger Website www.caphorninvest.com Contact Email lsutre@caphorninvest.com Contact Phone n/a INVESTOR BOOK 32

NOAH18 London Investor Book Page 31 Page 33

NOAH18 London Investor Book Page 31 Page 33