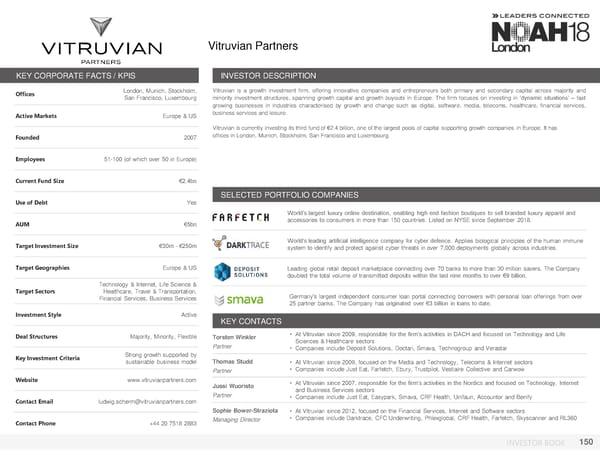

Vitruvian Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, Munich, Stockholm, Vitruvian is a growth investment firm, offering innovative companies and entrepreneurs both primary and secondary capital across majority and San Francisco, Luxembourg minority investment structures, spanning growth capital and growth buyouts in Europe. The firm focuses on investing in ‘dynamic situations’ – fast growing businesses in industries characterised by growth and change such as digital, software, media, telecoms, healthcare, financial services, Active Markets Europe & US business services and leisure. Vitruvian is currently investing its third fund of €2.4 billion, one of the largest pools of capital supporting growth companies in Europe. It has Founded 2007 offices in London, Munich, Stockholm, San Francisco and Luxembourg. Employees 51-100 (of which over 50 in Europe) Current Fund Size €2.4bn Use of Debt Yes SELECTED PORTFOLIO COMPANIES World’s largest luxury online destination, enabling high end fashion boutiques to sell branded luxury apparel and AUM €5bn accessories to consumers in more than 150 countries. Listed on NYSE since September 2018. Target Investment Size €30m - €250m World’s leading artificial intelligence company for cyber defence. Applies biological principles of the human immune system to identify and protect against cyber threats in over 7,000 deployments globally across industries. Target Geographies Europe & US Leading global retail deposit marketplace connecting over 70 banks to more than 30 million savers. The Company doubled the total volume of transmitted deposits within the last nine months to over €9 billion. Technology & Internet, Life Science & Target Sectors Healthcare, Travel & Transportation, Germany's largest independent consumer loan portal connecting borrowers with personal loan offerings from over Financial Services, Business Services 25 partner banks. The Company has originated over €3 billion in loans to date. Investment Style Active KEY CONTACTS Deal Structures Majority, Minority, Flexible Torsten Winkler • At Vitruvian since 2009, responsible for the firm’s activities in DACH and focused on Technology and Life Partner Sciences & Healthcare sectors • Companies include Deposit Solutions, Doctari, Smava, Technogroup and Verastar Key Investment Criteria Strong growth supported by sustainable business model Thomas Studd • At Vitruvian since 2009, focused on the Media and Technology, Telecoms & Internet sectors Partner • Companies include Just Eat, Farfetch, Ebury, Trustpilot, Vestiaire Collective and Carwow Website www.vitruvianpartners.com Jussi Wuoristo • At Vitruvian since 2007, responsible for the firm’s activities in the Nordics and focused on Technology, Internet Partner and Business Services sectors Contact Email ludwig.scherm@vitruvianpartners.com • Companies include Just Eat, Easypark, Smava, CRF Health, Unifaun, Accountor and Benify Sophie Bower-Straziota • At Vitruvian since 2012, focused on the Financial Services, Internet and Software sectors Contact Phone +44 20 7518 2883 Managing Director • Companies include Darktrace, CFC Underwriting, Phlexglobal, CRF Health, Farfetch, Skyscanner and RL360 INVESTOR BOOK 150

NOAH18 London Investor Book Page 149 Page 151

NOAH18 London Investor Book Page 149 Page 151