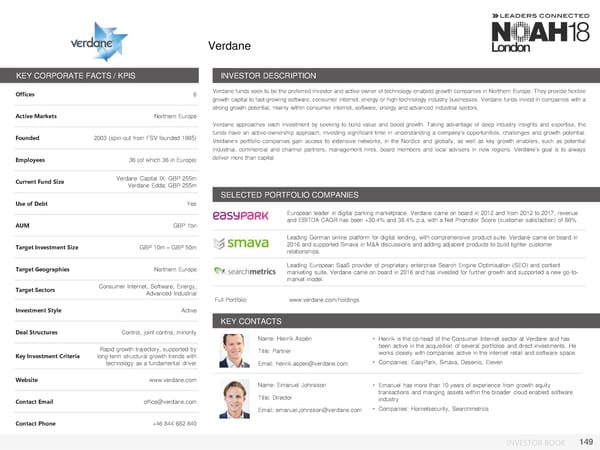

Verdane KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices 6 Verdane funds seek to be the preferred investor and active owner of technology-enabled growth companies in Northern Europe. They provide flexible growth capital to fast-growing software, consumer internet, energy or high-technology industry businesses. Verdane funds invest in companies with a strong growth potential, mainly within consumer internet, software, energy and advanced industrial sectors. Active Markets Northern Europe Verdane approaches each investment by seeking to build value and boost growth. Taking advantage of deep industry insights and expertise, the Founded 2003 (spin-out from FSV founded 1985) funds have an active-ownership approach, investing significant time in understanding a company’s opportunities, challenges and growth potential. Verdane’s portfolio companies gain access to extensive networks, in the Nordics and globally, as well as key growth enablers, such as potential industrial, commercial and channel partners, management hires, board members and local advisers in new regions. Verdane’s goal is to always Employees 36 (of which 36 in Europe) deliver more than capital. Current Fund Size Verdane Capital IX: GBP 255m Verdane Edda: GBP 255m SELECTED PORTFOLIO COMPANIES Use of Debt Yes European leader in digital parking marketplace. Verdane came on board in 2012 and from 2012 to 2017, revenue AUM GBP 1bn and EBITDA CAGR has been +30.4% and 38.4% p.a. with a Net Promotor Score (customer satisfaction) of 86% Leading German online platform for digital lending, with comprehensive product suite. Verdane came on board in Target Investment Size GBP 10m –GBP 50m 2016 and supported Smava in M&A discussions and adding adjacent products to build tighter customer relationships. Target Geographies Northern Europe Leading European SaaS provider of proprietary enterprise Search Engine Optimisation (SEO) and content marketing suite. Verdane came on board in 2016 and has invested for further growth and supported a new go-to- market model. Target Sectors Consumer Internet, Software, Energy, Advanced Industrial Full Portfolio www.verdane.com/holdings Investment Style Active KEY CONTACTS Deal Structures Control, joint control, minority Name: Henrik Aspén • Henrik is the co-head of the Consumer Internet sector at Verdane and has Rapid growth trajectory, supported by Photo Title: Partner been active in the acquisition of several portfolios and direct investments. He Key Investment Criteria long-term structural growth trends with works closely with companies active in the internet retail and software space. technology as a fundamental driver Email: henrik.aspen@verdane.com • Companies: EasyPark, Smava, Desenio, Eleven Website www.verdane.com Name: Emanuel Johnsson • Emanuel has more than 10 years of experience from growth equity Title: Director transactions and manging assets within the broader cloud enabled software Contact Email office@verdane.com industry Email: emanuel.johnsson@verdane.com • Companies: Hornetsecurity, Searchmetrics Contact Phone +46 844 682 840 INVESTOR BOOK 149

NOAH18 London Investor Book Page 148 Page 150

NOAH18 London Investor Book Page 148 Page 150