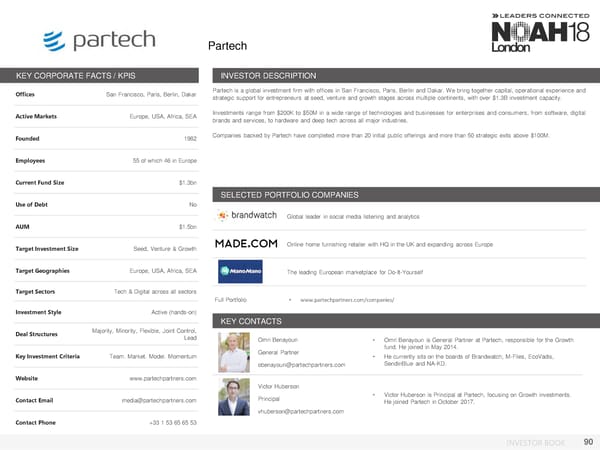

Partech KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices San Francisco, Paris, Berlin, Dakar Partech is a global investment firm with offices in San Francisco, Paris, Berlin and Dakar. Webring together capital, operational experience and strategic support for entrepreneurs at seed, venture and growth stages across multiple continents, with over $1.3B investment capacity. Active Markets Europe, USA, Africa, SEA Investments range from $200K to $50M in a wide range of technologies and businesses for enterprises and consumers, from software, digital brands and services, to hardware and deep tech across all major industries. Founded 1982 Companies backed by Partech have completed more than 20 initial public offerings and more than 50 strategic exits above $100M. Employees 55 of which 46 in Europe Current Fund Size $1.3bn SELECTED PORTFOLIO COMPANIES Use of Debt No Global leader in social media listening and analytics AUM $1.5bn Target Investment Size Seed, Venture & Growth Online home furnishing retailer with HQ in the UK and expanding across Europe Target Geographies Europe, USA, Africa, SEA The leading European marketplace for Do-It-Yourself Target Sectors Tech & Digital across all sectors Full Portfolio • www.partechpartners.com/companies/ Investment Style Active (hands-on) KEY CONTACTS Deal Structures Majority, Minority, Flexible, Joint Control, Lead Omri Benayoun • Omri Benayoun is General Partner at Partech, responsible for the Growth General Partner fund. He joined in May 2014. Key Investment Criteria Team. Market. Model. Momentum • He currently sits on the boards of Brandwatch, M-Files, EcoVadis, obenayoun@partechpartners.com SendinBlue and NA-KD. Website www.partechpartners.com Victor Huberson Contact Email media@partechpartners.com Principal • Victor Huberson is Principal at Partech, focusing on Growth investments. He joined Partech in October 2017. vhuberson@partechpartners.com Contact Phone +33 1 53 65 65 53 INVESTOR BOOK 90

NOAH18 London Investor Book Page 89 Page 91

NOAH18 London Investor Book Page 89 Page 91