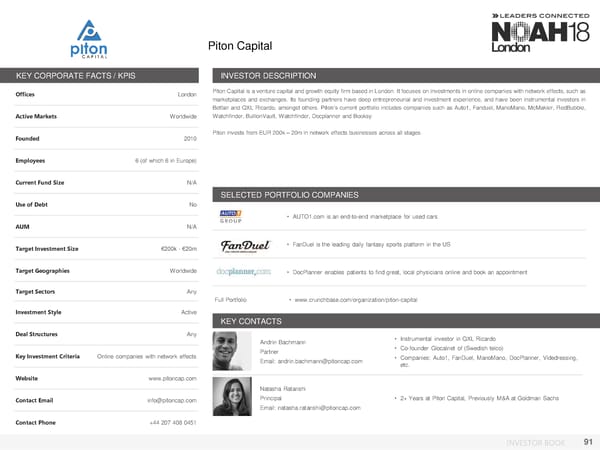

Piton Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London Piton Capital is a venture capital and growth equity firm based in London. It focuses on investments in online companies with network effects, such as marketplaces and exchanges. Its founding partners have deep entrepreneurial and investment experience, and have been instrumental investors in Betfair and QXL Ricardo, amongst others. Piton’s current portfolio includes companies such as Auto1, Fanduel, ManoMano, McMakler, RedBubble, Active Markets Worldwide Watchfinder, BullionVault, Watchfinder, Docplanner and Booksy. Founded 2010 Piton invests from EUR 200k – 20m in network effects businesses across all stages. Employees 6 (of which 6 in Europe) Current Fund Size N/A SELECTED PORTFOLIO COMPANIES Use of Debt No • AUTO1.com is an end-to-end marketplace for used cars AUM N/A Target Investment Size €200k - €20m • FanDuel is the leading daily fantasy sports platform in the US Target Geographies Worldwide • DocPlanner enables patients to find great, local physicians online and book an appointment Target Sectors Any Full Portfolio • www.crunchbase.com/organization/piton-capital Investment Style Active KEY CONTACTS Deal Structures Any • Instrumental investor in QXL Ricardo Photo Andrin Bachmann Partner • Co-founder Glocalnet of (Swedish telco) Key Investment Criteria Online companies with network effects Email: andrin.bachmann@pitoncap.com • Companies: Auto1, FanDuel, ManoMano, DocPlanner, Videdressing, etc. Website www.pitoncap.com Photo Natasha Ratanshi Contact Email info@pitoncap.com Principal • 2+ Years at Piton Capital, Previously M&A at Goldman Sachs Email: natasha.ratanshi@pitoncap.com Contact Phone +44 207 408 0451 INVESTOR BOOK 91

NOAH18 London Investor Book Page 90 Page 92

NOAH18 London Investor Book Page 90 Page 92