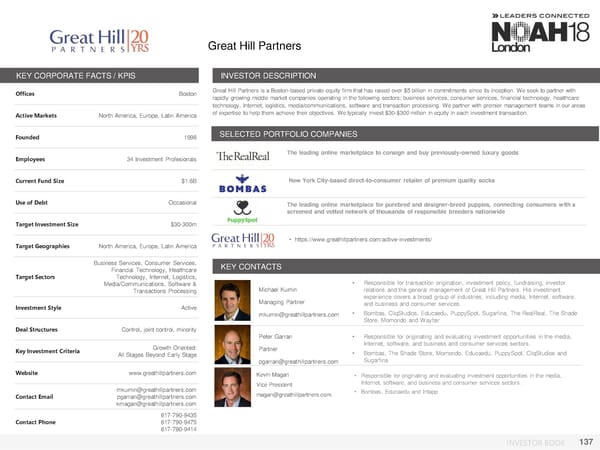

Great Hill Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Boston Great Hill Partners is a Boston-based private equity firm that has raised over $5 billion in commitments since its inception. We seek to partner with rapidly growing middle market companies operating in the following sectors; business services, consumer services, financial technology, healthcare technology, Internet, logistics, media/communications, software and transaction processing. We partner with premier management teams in our areas Active Markets North America, Europe, Latin America of expertise to help them achieve their objectives. We typically invest $30-$300 million in equity in each investment transaction. Founded 1998 SELECTED PORTFOLIO COMPANIES Employees 34 Investment Profesionals The leading online marketplace to consign and buy previously-owned luxury goods Current Fund Size $1.6B New York City-based direct-to-consumer retailer of premium quality socks Use of Debt Occasional The leading online marketplace for purebred and designer-breed puppies, connecting consumers with a screened and vetted network of thousands of responsible breeders nationwide Target Investment Size $30-300m Target Geographies North America, Europe, Latin America • https://www.greathillpartners.com/active-investments/ Business Services, Consumer Services, KEY CONTACTS Financial Technology, Healthcare Target Sectors Technology, Internet, Logistics, • Responsible for transaction origination, investment policy, fundraising, investor Media/Communications, Software & Michael Kumin relations and the general management of Great Hill Partners. His investment Transactions Processing Photo experience covers a broad group of industries, including media, Internet, software, Investment Style Active Managing Partner and business and consumer services. mkumin@greathillpartners.com • Bombas, CliqStudios, Educaedu, PuppySpot, Sugarfina, The RealReal, The Shade Store, Momondo and Wayfair Deal Structures Control, joint control, minority Peter Garran • Responsible for originating and evaluating investment opportunities in the media, Growth Oriented: Photo Partner Internet, software, and business and consumer services sectors. Key Investment Criteria All Stages Beyond Early Stage • Bombas, The Shade Store, Momondo, Educaedu, PuppySpot, CliqStudios and pgarran@greathillpartners.com Sugarfina Website www.greathillpartners.com Kevin Magan • Responsible for originating and evaluating investment opportunities in the media, Vice President Internet, software, and business and consumer services sectors. mkumin@greathillpartners.com magan@greathillpartners.com • Bombas, Educaedu and Intapp Contact Email pgarran@greathillpartners.com kmagan@greathillpartners.com 617-790-9435 Contact Phone 617-790-9475 617-790-9414 INVESTOR BOOK 137

NOAH18 London Investor Book Page 136 Page 138

NOAH18 London Investor Book Page 136 Page 138