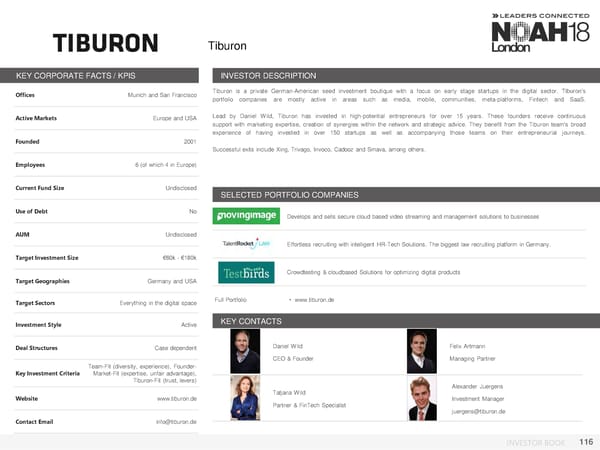

Tiburon KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Munich and San Francisco Tiburon is a private German-American seed investment boutique with a focus on early stage startups in the digital sector. Tiburon’s portfolio companies are mostly active in areas such as media, mobile, communities, meta-platforms, Fintech and SaaS. Active Markets Europe and USA Lead by Daniel Wild, Tiburon has invested in high-potential entrepreneurs for over 15 years. These founders receive continuous support with marketing expertise, creation of synergies within the network and strategic advice. They benefit from the Tiburon team's broad experience of having invested in over 150 startups as well as accompanying those teams on their entrepreneurial journeys. Founded 2001 Successful exits include Xing, Trivago, Invoco, Cadooz and Smava, among others. Employees 6 (of which 4 in Europe) Current Fund Size Undisclosed SELECTED PORTFOLIO COMPANIES Use of Debt No Develops and sells secure cloud based video streaming and management solutions to businesses AUM Undisclosed Effortless recruiting with intelligent HR-Tech Solutions. The biggest law recruiting platform in Germany. Target Investment Size €60k - €180k Crowdtesting & cloudbased Solutions for optimizing digital products Target Geographies Germany and USA Target Sectors Everything in the digital space Full Portfolio • www.tiburon.de Investment Style Active KEY CONTACTS Deal Structures Case dependent Daniel Wild Felix Artmann CEO & Founder Managing Partner Team-Fit (diversity, experience), Founder- Key Investment Criteria Market-Fit (expertise, unfair advantage), Tiburon-Fit (trust, levers) Alexander Juergens Website www.tiburon.de Tatjana Wild Investment Manager Partner & FinTech Specialist juergens@tiburon.de Contact Email info@tiburon.de INVESTOR BOOK 116

NOAH18 London Investor Book Page 115 Page 117

NOAH18 London Investor Book Page 115 Page 117