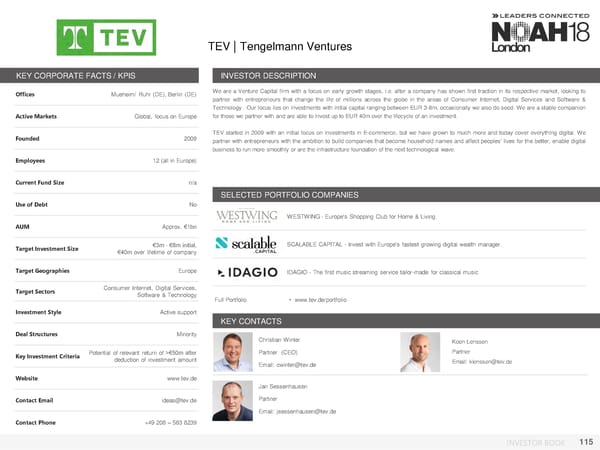

TEV | Tengelmann Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Mueheim/ Ruhr (DE), Berlin (DE) Weare a Venture Capital firm with a focus on early growth stages, i.e. after a company has shown first traction in its respective market, looking to partner with entrepreneurs that change the life of millions across the globe in the areas of Consumer Internet, Digital Services and Software & Technology . Our focus lies on investments with initial capital ranging between EUR 3-8m, occasionally we also do seed. Weare a stable companion Active Markets Global, focus on Europe for those we partner with and are able to invest up to EUR 40m over the lifecycle of an investment. Founded 2009 TEV started in 2009 with an initial focus on investments in E-commerce, but we have grown to much more and today cover everything digital. We partner with entrepreneurs with the ambition to build companies that become household names and affect peoples’ lives for the better, enable digital business to run more smoothly or are the infrastructure foundation of the next technological wave. Employees 12 (all in Europe) Current Fund Size n/a SELECTED PORTFOLIO COMPANIES Use of Debt No WESTWING -Europe's Shopping Club for Home & Living. AUM Approx. €1bn Target Investment Size €3m - €8m initial, SCALABLE CAPITAL - Invest with Europe's fastest growing digital wealth manager. €40m over lifetime of company Target Geographies Europe IDAGIO - The first music streaming service tailor-made for classical music Target Sectors Consumer Internet, Digital Services, Software & Technology Full Portfolio • www.tev.de/portfolio Investment Style Active support KEY CONTACTS Deal Structures Minority Christian Winter Koen Lenssen Key Investment Criteria Potential of relevant return of >€50m after Partner (CEO) Partner deduction of investment amount Email: cwinter@tev.de Email: klenssen@tev.de Website www.tev.de Jan Sessenhausen Contact Email ideas@tev.de Partner Email: jsessenhausen@tev.de Contact Phone +49 208 – 583 8239 INVESTOR BOOK 115

NOAH18 London Investor Book Page 114 Page 116

NOAH18 London Investor Book Page 114 Page 116