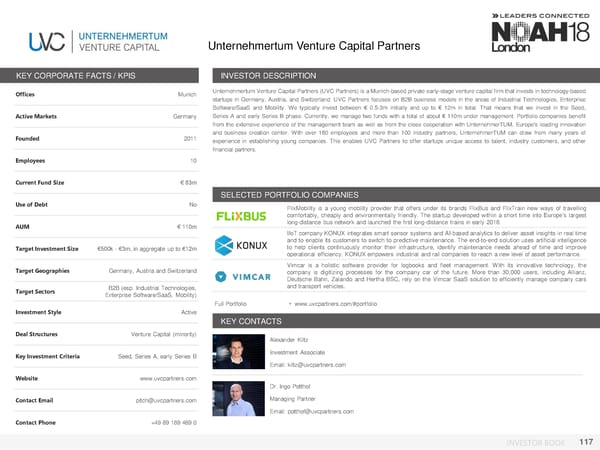

Unternehmertum Venture Capital Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Munich UnternehmertumVenture Capital Partners (UVC Partners) is a Munich-based private early-stage venture capital firm that invests in technology-based startups in Germany, Austria, and Switzerland. UVC Partners focuses on B2B business models in the areas of Industrial Technologies, Enterprise Software/SaaS and Mobility. We typically invest between € 0.5-3m initially and up to € 12m in total. That means that we invest in the Seed, Active Markets Germany Series A and early Series B phase. Currently, we manage two funds with a total of about € 110m under management. Portfolio companies benefit from the extensive experience of the management team as well as from the close cooperation with UnternehmerTUM, Europe's leading innovation Founded 2011 and business creation center. With over 180 employees and more than 100 industry partners, UnternehmerTUM can draw from many years of experience in establishing young companies. This enables UVC Partners to offer startups unique access to talent, industry customers, and other financial partners. Employees 10 Current Fund Size € 83m SELECTED PORTFOLIO COMPANIES Use of Debt No FlixMobility is a young mobility provider that offers under its brands FlixBus and FlixTrain new ways of travelling comfortably, cheaply and environmentally friendly. The startup developed within a short time into Europe’s largest AUM € 110m long-distance bus network and launched the first long-distance trains in early 2018. IIoT company KONUX integrates smart sensor systems and AI-based analytics todeliver asset insights in real time and to enable its customers to switch to predictive maintenance. The end-to-end solution uses artificial intelligence Target Investment Size €500k - €3m, in aggregate up to €12m to help clients continuously monitor their infrastructure, identify maintenance needs ahead of time and improve operational efficiency. KONUX empowers industrial and rail companies to reach a new level of asset performance. Target Geographies Germany, Austria and Switzerland Vimcar is a holistic software provider for logbooks and fleet management. With its innovative technology, the company is digitizing processes for the company car of the future. More than 30,000 users, including Allianz, Deutsche Bahn, Zalando and Hertha BSC, rely on the Vimcar SaaS solution to efficiently manage company cars Target Sectors B2B (esp. Industrial Technologies, and transport vehicles. Enterprise Software/SaaS, Mobility) Full Portfolio • www.uvcpartners.com/#portfolio Investment Style Active KEY CONTACTS Deal Structures Venture Capital (minority) Alexander Kiltz Photo Investment Associate Key Investment Criteria Seed, Series A, early Series B Email: kiltz@uvcpartners.com Website www.uvcpartners.com Dr. Ingo Potthof Contact Email pitch@uvcpartners.com Photo Managing Partner Email: potthof@uvcpartners.com Contact Phone +49 89 189 469 0 INVESTOR BOOK 117

NOAH18 London Investor Book Page 116 Page 118

NOAH18 London Investor Book Page 116 Page 118