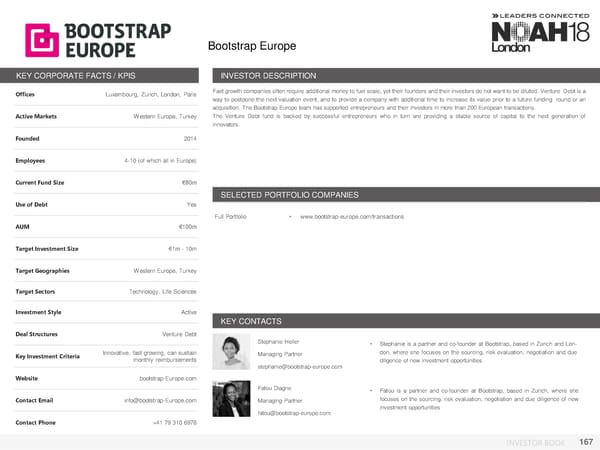

Bootstrap Europe KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Luxembourg, Zurich, London, Paris Fast growth companies often require additional money to fuel scale, yet their founders and their investors do not want to be diluted. Venture Debt is a way to postpone the next valuation event, and to provide a company with additional time to increase its value prior to a future funding round or an acquisition. The Bootstrap Europe team has supported entrepreneurs and their investors in more than 200 European transactions. Active Markets Western Europe, Turkey The Venture Debt fund is backed by successful entrepreneurs who in turn are providing a stable source of capital to the next generation of innovators. Founded 2014 Employees 4-10 (of which all in Europe) Current Fund Size €80m SELECTED PORTFOLIO COMPANIES Use of Debt Yes Full Portfolio • www.bootstrap-europe.com/transactions AUM €100m Target Investment Size €1m - 10m Target Geographies Western Europe, Turkey Target Sectors Technology, Life Sciences Investment Style Active KEY CONTACTS Deal Structures Venture Debt Stephanie Heller • Stephanie is a partner and co-founder at Bootstrap, based in Zurich and Lon- Key Investment Criteria Innovative, fast growing, can sustain Managing Partner don, where she focuses on the sourcing, risk evaluation, negotiation and due monthly reimbursements diligence of new investment opportunities stephanie@bootstrap-europe.com Website bootstrap-Europe.com Fatou Diagne • Fatou is a partner and co-founder at Bootstrap, based in Zurich, where she Contact Email info@bootstrap-Europe.com Managing Partner focuses on the sourcing, risk evaluation, negotiation and due diligence of new fatou@bootstrap-europe.com investment opportunities Contact Phone +41 79 310 6978 INVESTOR BOOK 167

NOAH18 London Investor Book Page 166 Page 168

NOAH18 London Investor Book Page 166 Page 168