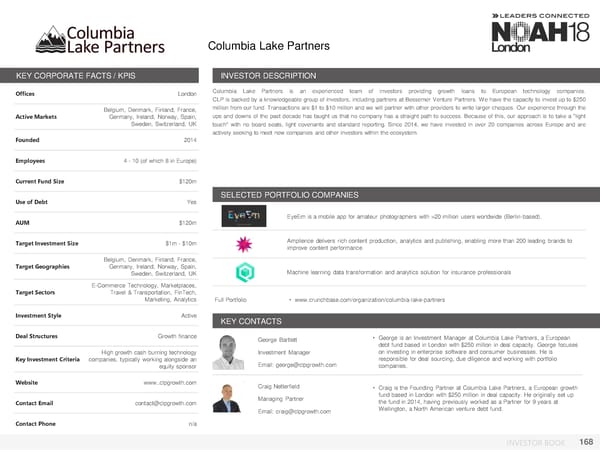

Columbia Lake Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London Columbia Lake Partners is an experienced team of investors providing growth loans to European technology companies. CLP is backed by a knowledgeable group of investors, including partners at Bessemer Venture Partners. We have the capacity to invest up to $250 Belgium, Denmark, Finland, France, million from our fund. Transactions are $1 to $10 million and we will partner with other providers to write larger cheques. Our experience through the Active Markets Germany, Ireland, Norway, Spain, ups and downs of the past decade has taught us that no company has a straight path to success. Because of this, our approach is to take a "light Sweden, Switzerland, UK touch" with no board seats, light covenants and standard reporting. Since 2014, we have invested in over 20 companies across Europe and are actively seeking to meet new companies and other investors within the ecosystem. Founded 2014 Employees 4 - 10 (of which 8 in Europe) Current Fund Size $120m Use of Debt Yes SELECTED PORTFOLIO COMPANIES AUM $120m EyeEm is a mobile app for amateur photographers with >20 million users worldwide (Berlin-based). Target Investment Size $1m - $10m Amplience delivers rich content production, analytics and publishing, enabling more than 200 leading brands to improve content performance Belgium, Denmark, Finland, France, Target Geographies Germany, Ireland, Norway, Spain, Machine learning data transformation and analytics solution for insurance professionals Sweden, Switzerland, UK E-Commerce Technology, Marketplaces, Target Sectors Travel & Transportation, FinTech, Marketing, Analytics Full Portfolio • www.crunchbase.com/organization/columbia-lake-partners Investment Style Active KEY CONTACTS Deal Structures Growth finance George Bartlett • George is an Investment Manager at Columbia Lake Partners, a European debt fund based in London with $250 million in deal capacity. George focuses High growth cash burning technology Investment Manager on investing in enterprise software and consumer businesses. He is Key Investment Criteria companies, typically working alongside an responsible for deal sourcing, due diligence and working with portfolio equity sponsor Email: george@clpgrowth.com companies. Website www..clpgrowth.com Craig Netterfield • Craig is the Founding Partner at Columbia Lake Partners, a European growth Managing Partner fund based in London with $250 million in deal capacity. He originally set up Contact Email contact@clpgrowth.com the fund in 2014, having previously worked as a Partner for 9 years at Email: craig@clpgrowth.com Wellington, a North American venture debt fund. Contact Phone n/a INVESTOR BOOK 168

NOAH18 London Investor Book Page 167 Page 169

NOAH18 London Investor Book Page 167 Page 169