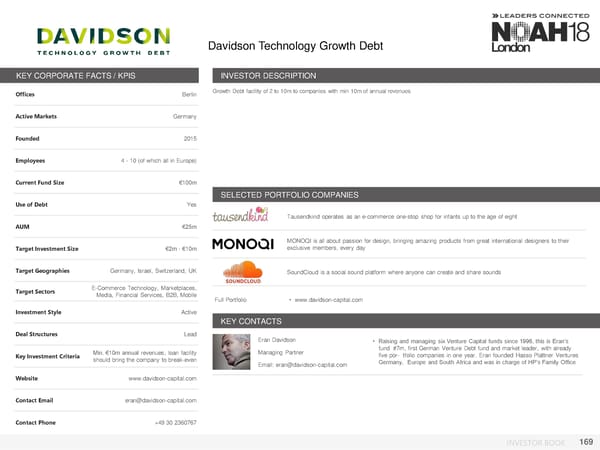

Davidson Technology Growth Debt KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Berlin Growth Debt facility of 2 to 10m to companies with min 10m of annual revenues Active Markets Germany Founded 2015 Employees 4 - 10 (of which all in Europe) Current Fund Size €100m SELECTED PORTFOLIO COMPANIES Use of Debt Yes Tausendkind operates as an e-commerce one-stop shop for infants up to the age of eight AUM €25m MONOQI is all about passion for design, bringing amazing products from great international designers to their Target Investment Size €2m - €10m exclusive members, every day Target Geographies Germany, Israel, Switzerland, UK SoundCloud is a social sound platform where anyone can create and share sounds Target Sectors E-Commerce Technology, Marketplaces, Media, Financial Services, B2B, Mobile Full Portfolio • www.davidson-capital.com Investment Style Active KEY CONTACTS Deal Structures Lead Eran Davidson • Raising and managing six Venture Capital funds since 1996, this is Eran’s Min. €10m annual revenues, loan facility Managing Partner fund #7m, first German Venture Debt fund and market leader, with already Key Investment Criteria should bring the company to break-even five por- tfolio companies in one year. Eran founded Hasso Plattner Ventures Email: eran@davidson-capital.com Germany, Europe and South Africa and was in charge of HP’s Family Office Website www.davidson-capital.com Contact Email eran@davidson-capital.com Contact Phone +49 30 2360767 INVESTOR BOOK 169

NOAH18 London Investor Book Page 168 Page 170

NOAH18 London Investor Book Page 168 Page 170