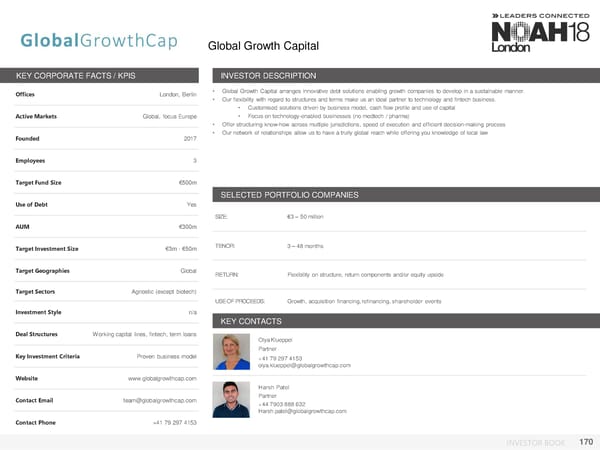

Global Growth Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, Berlin • Global Growth Capital arranges innovative debt solutions enabling growth companies to develop in a sustainable manner. • Our flexibility with regard to structures and terms make us an ideal partner to technology and fintech business. • Customised solutions driven by business model, cash flow profile and use of capital Active Markets Global, focus Europe • Focus on technology-enabled businesses (no medtech / pharma) • Offer structuring know-how across multiple jurisdictions, speed of execution and efficient decision-making process Founded 2017 • Our network of relationships allow us to have a trully global reach while offering you knowledge of local law Employees 3 Target Fund Size €500m SELECTED PORTFOLIO COMPANIES Use of Debt Yes SIZE: €3– 50million AUM €300m Target Investment Size €3m - €50m TENOR: 3–48months Target Geographies Global RETURN: Flexibility on structure, return components and/or equity upside Target Sectors Agnostic (except biotech) USE OFPROCEEDS: Growth, acquisition financing, refinancing, shareholder events Investment Style n/a KEY CONTACTS Deal Structures Working capital lines, fintech, term loans OlyaKlueppel Partner Key Investment Criteria Proven business model +41792974153 olya.klueppel@globalgrowthcap.com Website www.globalgrowthcap.com Harsh Patel Contact Email team@globalgrowthcap.com Partner +447903888632 Harsh.patel@globalgrowthcap.com Contact Phone +41 79 297 4153 INVESTOR BOOK 170

NOAH18 London Investor Book Page 169 Page 171

NOAH18 London Investor Book Page 169 Page 171