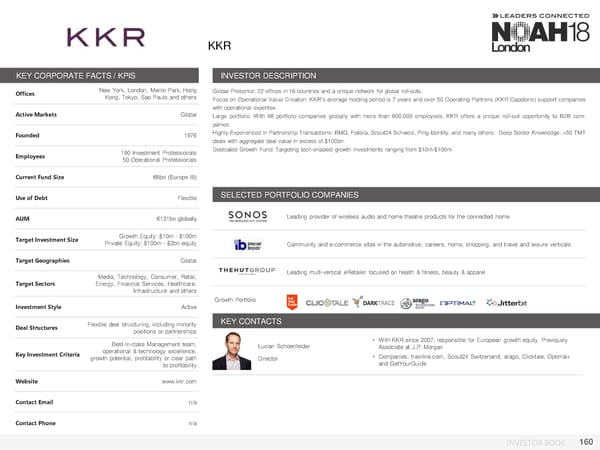

KKR KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices New York, London, Menlo Park, Hong Global Presence: 22 offices in 16 countries and a unique network for global roll-outs. Kong, Tokyo, Sao Paulo and others Focus on Operational Value Creation: KKR’s average holding period is 7 years and over 50 Operating Partners (KKR Capstone) support companies Active Markets Global with operational expertise. Large portfolio: With 98 portfolio companies globally with more than 800,000 employees, KKR offers a unique roll-out opportunity to B2B com- panies. Founded 1976 Highly Experienced in Partnership Transactions: BMG, Fotolia, Scout24 Schweiz, Ping Identity, and many others. Deep Sector Knowledge: >50 TMT deals with aggregate deal value in excess of $100bn. Employees 190 Investment Professionals Dedicated Growth Fund: Targeting tech-enabled growth investments ranging from $10m-$100m. 50 Operational Professionals Current Fund Size €6bn (Europe III) Use of Debt Flexible SELECTED PORTFOLIO COMPANIES AUM €131bn globally Leading provider of wireless audio and home theatre products for the connected home Target Investment Size Growth Equity: $10m - $100m Private Equity: $100m - $2bn equity Community and e-commerce sites in the automotive, careers, home, shopping, and travel and leisure verticals Target Geographies Global Media, Technology, Consumer, Retail, Leading multi-vertical eRetailer focused on health & fitness, beauty & apparel Target Sectors Energy, Financial Services, Healthcare, Infrastructure and others Investment Style Active Growth Portfolio Deal Structures Flexible deal structuring, including minority KEY CONTACTS positions or partnerships Best-in-class Management team, • With KKR since 2007, responsible for European growth equity. Previously operational & technology excellence, Lucian Schoenfelder Associate at J.P. Morgan Key Investment Criteria growth potential, profitability or clear path Director • Companies: trainline.com, Scout24 Switzerland, arago, Clicktale, Optimal+ to profitability and GetYourGuide Website www.kkr.com Contact Email n/a Contact Phone n/a INVESTOR BOOK 160

NOAH18 London Investor Book Page 159 Page 161

NOAH18 London Investor Book Page 159 Page 161