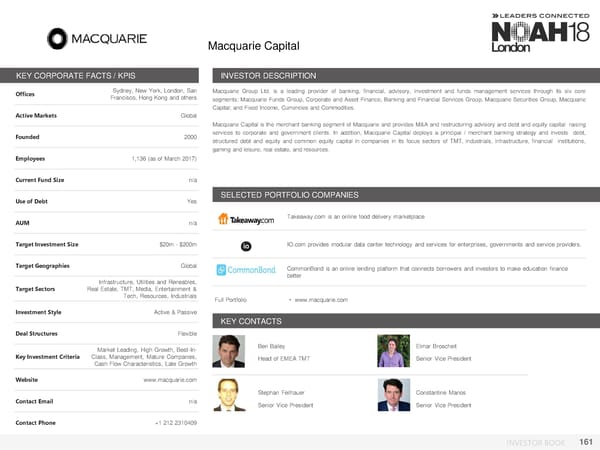

Macquarie Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Sydney, New York, London, San Macquarie Group Ltd. is a leading provider of banking, financial, advisory, investment and funds management services through its six core Francisco, Hong Kong and others segments: Macquarie Funds Group, Corporate and Asset Finance, Banking and Financial Services Group, Macquarie Securities Group, Macquarie Capital; and Fixed Income, Currencies and Commodities. Active Markets Global Macquarie Capital is the merchant banking segment of Macquarie and provides M&A and restructuring advisory and debt and equity capital raising Founded 2000 services to corporate and government clients. In addition, Macquarie Capital deploys a principal / merchant banking strategy and invests debt, structured debt and equity and common equity capital in companies in its focus sectors of TMT, industrials, infrastructure, financial institutions, gaming and leisure, real estate, and resources. Employees 1,136 (as of March 2017) Current Fund Size n/a Use of Debt Yes SELECTED PORTFOLIO COMPANIES AUM n/a Takeaway.com is an online food delivery marketplace Target Investment Size $20m - $200m IO.com provides modular data center technology and services for enterprises, governments and service providers. Target Geographies Global CommonBond is an online lending platform that connects borrowers and investors to make education finance better Infrastructure, Utilities and Reneables, Target Sectors Real Estate, TMT, Media, Entertainment & Tech, Resources, Industrials Full Portfolio • www.macquarie.com Investment Style Active & Passive KEY CONTACTS Deal Structures Flexible Market Leading, High Growth, Best-In- Ben Bailey Elmar Broscheit Key Investment Criteria Class, Management, Mature Companies, Head of EMEA TMT Senior Vice President Cash Flow Characteristics, Late Growth Website www.macquarie.com Stephan Feilhauer Constantine Manos Contact Email n/a Senior Vice President Senior Vice President Contact Phone +1 212 2310409 INVESTOR BOOK 161

NOAH18 London Investor Book Page 160 Page 162

NOAH18 London Investor Book Page 160 Page 162