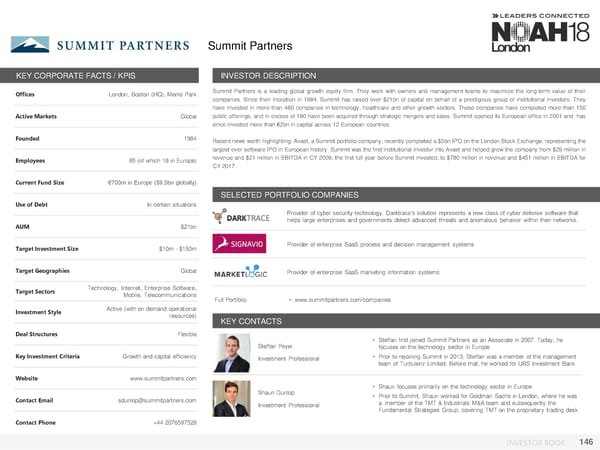

Summit Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, Boston (HQ), Menlo Park Summit Partners is a leading global growth equity firm. They work with owners and management teams to maximize the long-term value of their companies. Since their inception in 1984, Summit has raised over $21bn of capital on behalf of a prestigious group of institutional investors. They have invested in more than 460 companies in technology, healthcare and other growth sectors. These companies have completed more than 150 Active Markets Global public offerings, and in excess of 180 have been acquired through strategic mergers and sales. Summit opened its European office in 2001 and has since invested more than €2bn in capital across 12 European countries. Founded 1984 Recentnews worth highlighting: Avast, a Summit portfolio company, recently completed a $5bn IPO on the London Stock Exchange, representing the largest ever software IPO in European history. Summit was the first institutional investor into Avast and helped grow the company from $29 million in Employees 85 (of which 18 in Europe) revenue and $21 million in EBITDA in CY2009, the first full year before Summit invested, to $780 million in revenue and $451 million in EBITDA for CY2017. Current Fund Size €700m in Europe ($9.5bn globally) SELECTED PORTFOLIO COMPANIES Use of Debt In certain situations Provider of cyber security technology. Darktrace’s solution represents a new class of cyber defense software that AUM $21bn helps large enterprises and governments detect advanced threats and anomalous behavior within their networks. Target Investment Size $10m - $150m Provider of enterprise SaaS process and decision management systems Target Geographies Global Provider of enterprise SaaS marketing information systems Target Sectors Technology, Internet, Enterprise Software, Mobile, Telecommunications Full Portfolio • www.summitpartners.com/companies Investment Style Active (with on demand operational resources) KEY CONTACTS Deal Structures Flexible • Steffan first joined Summit Partners as an Associate in 2007. Today, he Steffan Peyer focuses on the technology sector in Europe Key Investment Criteria Growth and capital efficiency Investment Professional • Prior to rejoining Summit in 2013, Steffan was a member of the management team of Turbulenz Limited. Before that, he worked for UBS Investment Bank Website www.summitpartners.com • Shaun focuses primarily on the technology sector in Europe Shaun Dunlop • Prior to Summit, Shaun worked for Goldman Sachs in London, where he was Contact Email sdunlop@summitpartners.com Investment Professional a member of the TMT & Industrials M&A team and subsequently the Fundamental Strategies Group, covering TMT on the proprietary trading desk Contact Phone +44 2076597528 INVESTOR BOOK 146

NOAH18 London Investor Book Page 145 Page 147

NOAH18 London Investor Book Page 145 Page 147