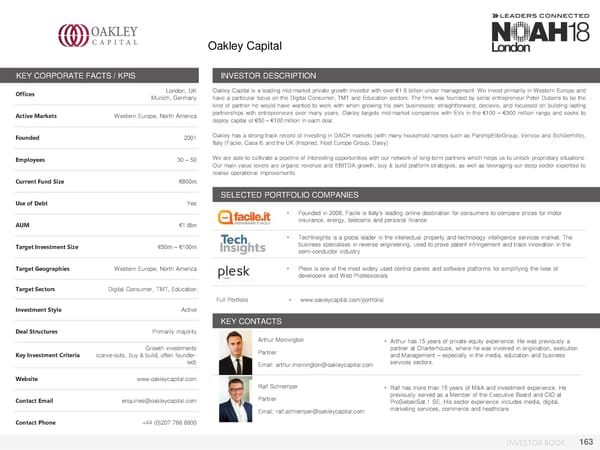

Oakley Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, UK Oakley Capital is a leading mid-market private growth investor with over €1.6 billion under management. We invest primarily in Western Europe and Munich, Germany have a particular focus on the Digital Consumer, TMT and Education sectors. The firm was founded by serial entrepreneur Peter Dubens to be the kind of partner he would have wanted to work with when growing his own businesses: straightforward, decisive, and focussed on building lasting Active Markets Western Europe, North America partnerships with entrepreneurs over many years. Oakley targets mid-market companies with EVs in the €100 – €300 million range and seeks to deploy capital of €50 – €100 million in each deal. Founded 2001 Oakley has a strong track record of investing in DACH markets (with many household names such as ParshipEliteGroup, Verivox and Schülerhilfe), Italy (Facile, Casa.it) and the UK (Inspired, Host Europe Group, Daisy) Employees 30 – 50 Weare able to cultivate a pipeline of interesting opportunities with our network of long-term partners which helps us to unlock proprietary situations. Our main value levers are organic revenue and EBITDA growth, buy & build platform strategies, as well as leveraging our deep sector expertise to realise operational improvements. Current Fund Size €800m SELECTED PORTFOLIO COMPANIES Use of Debt Yes Logo • Founded in 2008, Facile is Italy’s leading online destination for consumers to compare prices for motor AUM €1.6bn insurance, energy, telecoms and personal finance • TechInsights is a global leader in the intellectual property and technology intelligence services market. The Target Investment Size €50m –€100m business specialises in reverse engineering, used to prove patent infringement and track innovation in the semi-conductor industry Target Geographies Western Europe, North America Logo • Plesk is one of the most widely used control panels and software platforms for simplifying the lives of developers and Web Professionals Target Sectors Digital Consumer, TMT, Education Full Portfolio • www.oakleycapital.com/portfolio/ Investment Style Active KEY CONTACTS Deal Structures Primarily majority Arthur Mornington • Arthur has 15 years of private equity experience. He was previously a Growth investments Photo Partner partner at Charterhouse, where he was involved in origiination, execution Key Investment Criteria (carve-outs, buy & build, often founder- and Management – especially in the media, education and business led) Email: arthur.mornington@oakleycapital.com services sectors. Website www.oakleycapital.com Ralf Schremper • Ralf has more than 15 years of M&A and investment experience. He Contact Email enquiries@oakleycapital.com Photo Partner previously served as a Member of the Executive Board and CIO at ProSiebenSat.1 SE. His sector experience includes media, digital, Email: ralf.schremper@oakleycapital.com marketing services, commerce and healthcare. Contact Phone +44 (0)207 766 6900 INVESTOR BOOK 163

NOAH18 London Investor Book Page 162 Page 164

NOAH18 London Investor Book Page 162 Page 164