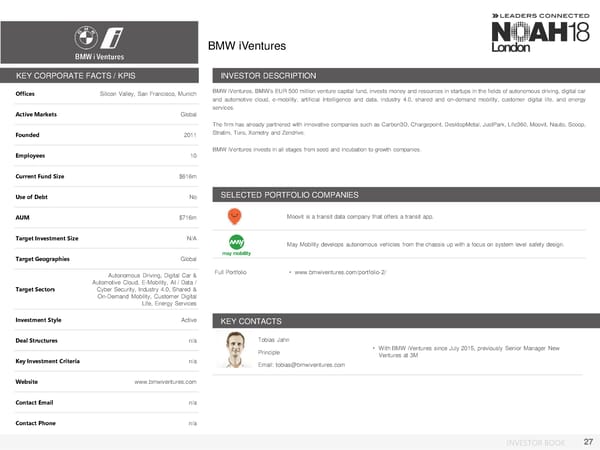

BMW iVentures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Silicon Valley, San Francisco, Munich BMWiVentures, BMW’sEUR500million venture capital fund, invests money and resources in startups in the fields of autonomous driving, digital car and automotive cloud, e-mobility, artificial Intelligence and data, industry 4.0, shared and on-demand mobility, customer digital life, and energy Active Markets Global services. Thefirm has already partnered with innovative companies such as Carbon3D, Chargepoint, DesktopMetal, JustPark, Life360, Moovit, Nauto, Scoop, Founded 2011 Stratim, Turo, Xometry and Zendrive. Employees 10 BMWiVentures invests in all stages from seed and incubation to growth companies. Current Fund Size $616m Use of Debt No SELECTED PORTFOLIO COMPANIES AUM $716m Moovit is a transit data company that offers a transit app. Target Investment Size N/A May Mobility develops autonomous vehicles from the chassis up with a focus on system level safety design. Target Geographies Global Autonomous Driving, Digital Car & Full Portfolio • www.bmwiventures.com/portfolio-2/ Automotive Cloud, E-Mobility, AI / Data / Target Sectors Cyber Security, Industry 4.0, Shared & On-Demand Mobility, Customer Digital Life, Energy Services Investment Style Active KEY CONTACTS Deal Structures n/a Tobias Jahn Principle • With BMW iVentures since July 2015, previously Senior Manager New Key Investment Criteria n/a Ventures at 3M Email: tobias@bmwiventures.com Website www.bmwiventures.com Contact Email n/a Contact Phone n/a INVESTOR BOOK 27

NOAH18 London Investor Book Page 26 Page 28

NOAH18 London Investor Book Page 26 Page 28