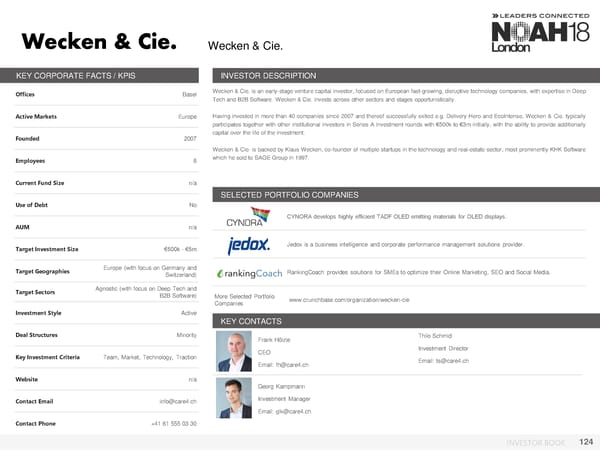

Wecken& Cie. KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Basel Wecken&Cie.is an early-stage venture capital investor, focused on European fast-growing, disruptive technology companies, with expertise in Deep Techand B2BSoftware. Wecken&Cie. invests across other sectors and stages opportunistically. Active Markets Europe Having invested in more than 40 companies since 2007 and thereof successfully exited e.g. Delivery Hero and EcoIntense, Wecken & Cie. typically participates together with other institutional investors in Series A investment rounds with €500k to €3m initially, with the ability to provide additionally Founded 2007 capital over the life of the investment. Wecken&Cie. is backed by Klaus Wecken, co-founder of multiple startups in the technology and real-estate sector, most prominently KHK Software Employees 8 which he sold to SAGE Group in 1997. Current Fund Size n/a SELECTED PORTFOLIO COMPANIES Use of Debt No CYNORA develops highly efficient TADF OLED emitting materials for OLED displays. AUM n/a Target Investment Size €500k - €5m Jedox is a business intelligence and corporate performance management solutions provider. Target Geographies Europe (with focus on Germany and RankingCoach provides solutions for SMEs to optimize their Online Marketing, SEO and Social Media. Switzerland) Target Sectors Agnostic (with focus on Deep Tech and B2B Software) More Selected Portfolio www.crunchbase.com/organization/wecken-cie Companies Investment Style Active KEY CONTACTS Deal Structures Minority Frank Hölzle Thilo Schmid Photo CEO Investment Director Key Investment Criteria Team, Market, Technology, Traction Email: ts@care4.ch Email: fh@care4.ch Website n/a Georg Kampmann Contact Email info@care4.ch Photo Investment Manager Email: glk@care4.ch Contact Phone +41 61 555 03 30 INVESTOR BOOK 124

NOAH18 London Investor Book Page 123 Page 125

NOAH18 London Investor Book Page 123 Page 125