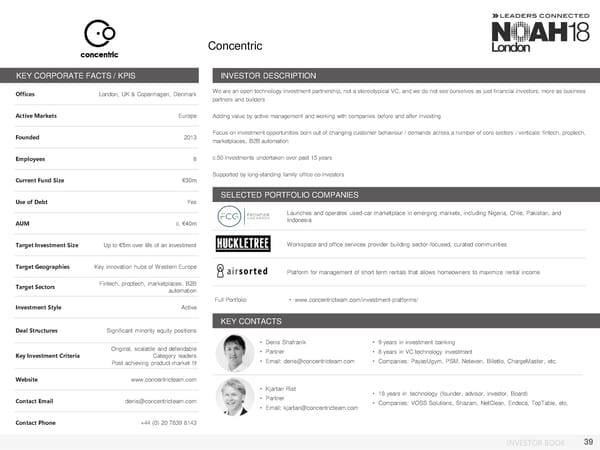

Concentric KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, UK & Copenhagen, Denmark Weareanopentechnology investment partnership, not astereotypical VC, and we do not see ourselves as just financial investors, more as business partners and builders ActiveMarkets Europe Adding value by active management and working with companies before and after investing Founded 2013 Focus on investment opportunities born out of changing customer behaviour / demands across a number of core sectors / verticals: fintech, proptech, marketplaces, B2Bautomation Employees 6 c.50 investments undertaken over past 15 years Current Fund Size €30m Supported by long-standing family office co-investors Use of Debt Yes SELECTED PORTFOLIO COMPANIES Launches and operates used-car marketplace in emerging markets, including Nigeria, Chile, Pakistan, and AUM c. €40m Indonesia Target Investment Size Up to €5m over life of an investment Workspace and office services provider building sector-focused, curated communities Target Geographies Key innovation hubs of Western Europe Platform for management of short term rentals that allows homeowners to maximize rental income Target Sectors Fintech, proptech, marketplaces, B2B automation Full Portfolio • www.concentricteam.com/investment-platforms/ Investment Style Active KEY CONTACTS Deal Structures Significant minority equity positions • Denis Shafranik • 9 years in investment banking Original, scalable and defendable • Partner • 8 years in VC technology investment Key Investment Criteria Category leaders • Email: denis@concentricteam.com • Companies: PayasUgym, PSM, Neteven, Billetto, ChargeMaster, etc. Post achieving product-market fit Website www.concentricteam.com • Kjartan Rist • 18 years in technology (founder, advisor, investor, Board) Contact Email denis@concentricteam.com • Partner • Companies: VOSS Solutions, Shazam, NetClean, Endeca, TopTable, etc. • Email: kjartan@concentricteam.com Contact Phone +44 (0) 20 7839 8143 INVESTOR BOOK 39

NOAH18 London Investor Book Page 38 Page 40

NOAH18 London Investor Book Page 38 Page 40