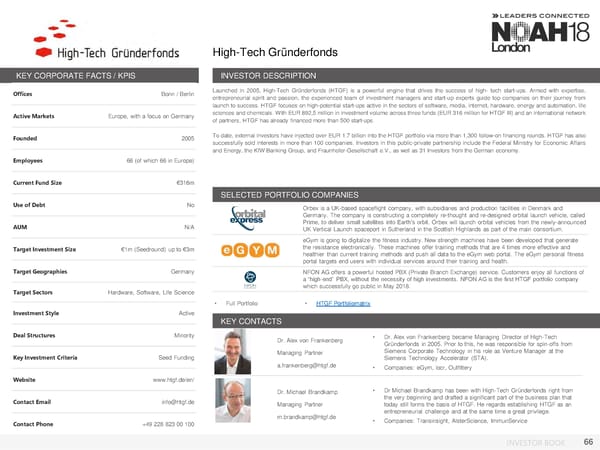

High-Tech Gründerfonds KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Bonn / Berlin Launched in 2005, High-Tech Gründerfonds (HTGF) is a powerful engine that drives the success of high- tech start-ups. Armed with expertise, entrepreneurial spirit and passion, the experienced team of investment managers and start-up experts guide top companies on their journey from launch to success. HTGF focuses on high-potential start-ups active in the sectors of software, media, internet, hardware, energy and automation, life Active Markets Europe, with a focus on Germany sciences andchemicals. With EUR 892,5 million in investment volume across three funds (EUR 316 million for HTGF III) and an international network of partners, HTGF has already financed more than 500 start-ups. Founded 2005 Todate, external investors have injected over EUR 1.7 billion into the HTGF portfolio via more than 1,300 follow-on financing rounds. HTGF has also successfully sold interests in more than 100 companies. Investors in this public-private partnership include the Federal Ministry for Economic Affairs and Energy, the KfWBanking Group, and Fraunhofer-Gesellschaft e.V., as well as 31 Investors from the German economy. Employees 66 (of which 66 in Europe) Current Fund Size €316m SELECTED PORTFOLIO COMPANIES Use of Debt No Orbex is a UK-based spaceflight company, with subsidiaries and production facilities in Denmark and Germany. The company is constructing a completely re-thought and re-designed orbital launch vehicle, called AUM N/A Prime, to deliver small satellites into Earth’s orbit. Orbex will launch orbital vehicles from the newly-announced UK Vertical Launch spaceport in Sutherland in the Scottish Highlands as part of the main consortium. eGym is going to digitalize the fitness industry. New strength machines have been developed that generate Target Investment Size €1m (Seedround) up to €3m the resistance electronically. These machines offer training methods that are 4 times more effective and healthier than current training methods and push all data to the eGym web portal. The eGym personal fitness portal targets end users with individual services around their training and health. Target Geographies Germany NFON AG offers a powerful hosted PBX (Private Branch Exchange) service. Customers enjoy all functions of a “high-end” PBX, without the necessity of high investments. NFON AG is the first HTGF portfolio company Target Sectors Hardware, Software, Life Science which successfully go public in May 2018. • Full Portfolio • HTGF Portfoliomatrix Investment Style Active KEY CONTACTS Deal Structures Minority Dr. Alex von Frankenberg • Dr. Alex von Frankenberg became Managing Director of High-Tech Gründerfonds in 2005. Prior to this, he was responsible for spin-offs from Key Investment Criteria Seed Funding Managing Partner Siemens Corporate Technology in his role as Venture Manager at the Siemens Technology Accelerator (STA). a.frankenberg@htgf.de • Companies: eGym, locr, Outfittery Website www.htgf.de/en/ Dr. Michael Brandkamp • Dr Michael Brandkamp has been with High-Tech Gründerfonds right from Contact Email info@htgf.de the very beginning and drafted a significant part of the business plan that Managing Partner today still forms the basis of HTGF. He regards establishing HTGF as an m.brandkamp@htgf.de entrepreneurial challenge and at the same time a great privilege. Contact Phone +49 228 823 00 100 • Companies: Transinsight, AlsterScience, ImmunService INVESTOR BOOK 66

NOAH18 London Investor Book Page 65 Page 67

NOAH18 London Investor Book Page 65 Page 67