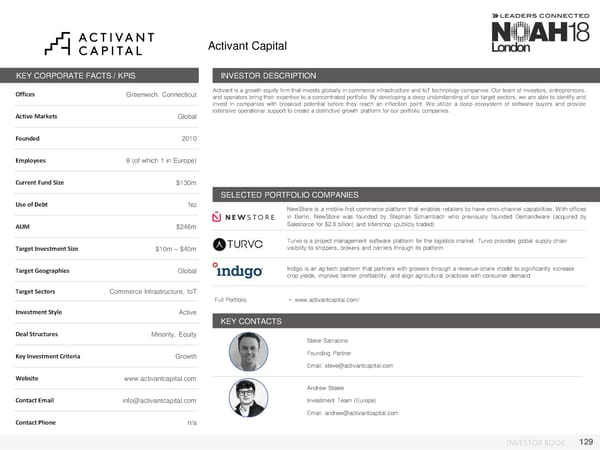

Activant Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Greenwich, Connecticut Activant is a growth equity firm that invests globally in commerce infrastructure and IoT technology companies. Our team of investors, entrepreneurs, and operators bring their expertise to a concentrated portfolio. By developing a deep understanding of our target sectors, we are able to identify and invest in companies with breakout potential before they reach an inflection point. We utilize a deep ecosystem of software buyers and provide Active Markets Global extensive operational support to create a distinctive growth platform for our portfolio companies. Founded 2010 Employees 8 (of which 1 in Europe) Current Fund Size $130m SELECTED PORTFOLIO COMPANIES Use of Debt No NewStore is a mobile-first commerce platform that enables retailers to have omni-channel capabilities. With offices in Berlin, NewStore was founded by Stephan Schambach who previously founded Demandware (acquired by AUM $246m Salesforce for $2.8 billion) and Intershop (publicly traded) Turvo is a project management software platform for the logistics market. Turvo provides global supply chain Target Investment Size $10m – $40m visibility to shippers, brokers and carriers through its platform Target Geographies Global Indigo is an ag-tech platform that partners with growers through a revenue-share model to significantly increase crop yields, improve farmer profitability, and align agricultural practices with consumer demand Target Sectors CommerceInfrastructure, IoT Full Portfolio • www.activantcapital.com/ Investment Style Active KEY CONTACTS Deal Structures Minority, Equity Steve Sarracino Key Investment Criteria Growth Founding Partner Email: steve@activantcapital.com Website www.activantcapital.com Andrew Steele Contact Email info@activantcapital.com Investment Team (Europe) Email: andrew@activantcapital.com Contact Phone n/a INVESTOR BOOK 129

NOAH18 London Investor Book Page 128 Page 130

NOAH18 London Investor Book Page 128 Page 130