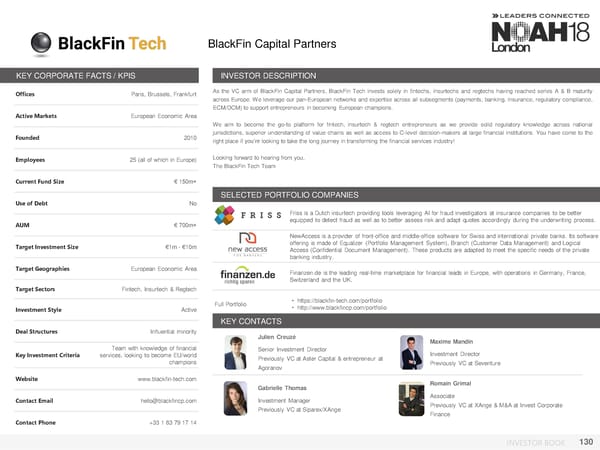

BlackFin Capital Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Paris, Brussels, Frankfurt As the VC arm of BlackFin Capital Partners, BlackFin Tech invests solely in fintechs, insurtechs and regtechs having reached series A & B maturity across Europe. Weleverage our pan-European networks and expertise across all subsegments (payments, banking, insurance, regulatory compliance, ECM/DCM)to support entrepreneurs in becoming European champions. Active Markets European Economic Area We aim to become the go-to platform for fintech, insurtech & regtech entrepreneurs as we provide solid regulatory knowledge across national Founded 2010 jurisdictions, superior understanding of value chains as well as access to C-level decision-makers at large financial institutions. You have come to the right place if you’re looking to take the long journey in transforming the financial services industry! Employees 25 (all of which in Europe) Looking forward to hearing from you, TheBlackFin Tech Team Current Fund Size € 150m+ SELECTED PORTFOLIO COMPANIES Use of Debt No Friss is a Dutch insurtech providing tools leveraging AI for fraud investigators at insurance companies to be better AUM € 700m+ equipped to detect fraud as well as to better assess risk and adapt quotes accordingly during the underwriting process. NewAccess is a provider of front-office and middle-office software for Swiss and international private banks. Its software Target Investment Size €1m - €10m offering is made of Equalizer (Portfolio Management System), Branch (Customer Data Management) and Logical Access (Confidential Document Management). These products are adapted to meet the specific needs of the private banking industry. Target Geographies European Economic Area Finanzen.de is the leading real-time marketplace for financial leads in Europe, with operations in Germany, France, Switzerland and the UK. Target Sectors Fintech, Insurtech & Regtech Full Portfolio • https://blackfin-tech.com/portfolio Investment Style Active • http://www.blackfincp.com/portfolio KEY CONTACTS Deal Structures Influential minority Julien Creuzé Photo Maxime Mandin Team with knowledge of financial Senior Investment Director Investment Director Key Investment Criteria services, looking to become EU/world Previously VC at Aster Capital & entrepreneur at champions Agoranov Previously VC at Seventure Website www.blackfin-tech.com Romain Grimal Photo Gabrielle Thomas Contact Email hello@blackfincp.com Investment Manager Associate Previously VC at Siparex/XAnge Previously VC at XAnge & M&A at Invest Corporate Finance Contact Phone +33 1 83 79 17 14 INVESTOR BOOK 130

NOAH18 London Investor Book Page 129 Page 131

NOAH18 London Investor Book Page 129 Page 131