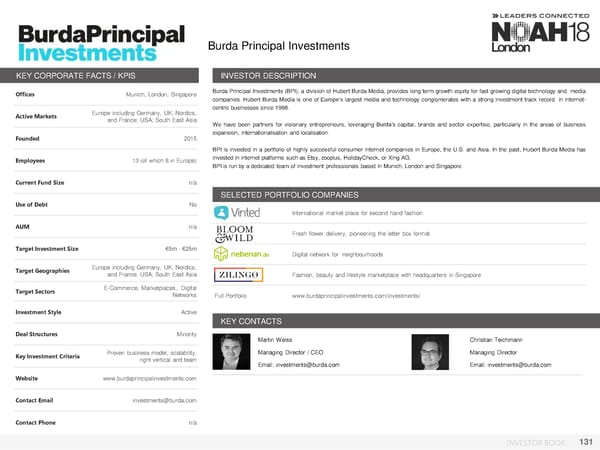

Burda Principal Investments KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Munich, London, Singapore Burda Principal Investments (BPI), a division of Hubert Burda Media, provides long term growth equity for fast growing digital technology and media companies. Hubert Burda Media is one of Europe’s largest media and technology conglomerates with a strong investment track record in internet- Europe including Germany, UK, Nordics, centric businesses since 1998. Active Markets and France; USA; South East Asia Wehave been partners for visionary entrepreneurs, leveraging Burda’s capital, brands and sector expertise, particularly in the areas of business Founded 2015 expansion, internationalisation and localisation. BPI is invested in a portfolio of highly successful consumer internet companies in Europe, the U.S. and Asia. In the past, Hubert Burda Media has Employees 13 (of which 8 in Europe) invested in internet platforms such as Etsy, zooplus, HolidayCheck, or Xing AG. BPIis run by a dedicated team of investment professionals based in Munich, London and Singapore. Current Fund Size n/a SELECTED PORTFOLIO COMPANIES Use of Debt No International market place for second hand fashion AUM n/a Fresh flower delivery, pioneering the letter box format Target Investment Size €5m - €25m Digital network for neighbourhoods Target Geographies Europe including Germany, UK, Nordics, and France; USA; South East Asia Fashion, beauty and lifestyle marketplace with headquarters in Singapore Target Sectors E-Commerce, Marketplaces, Digital Networks Full Portfolio www.burdaprincipalinvestments.com/investments/ Investment Style Active KEY CONTACTS Deal Structures Minority Martin Weiss Christian Teichmann Proven business model, scalability, Photo Managing Director / CEO Managing Director Key Investment Criteria right vertical and team Email: investments@burda.com Email: investments@burda.com Website www.burdaprincipalinvestments.com Contact Email investments@burda.com Contact Phone n/a INVESTOR BOOK 131

NOAH18 London Investor Book Page 130 Page 132

NOAH18 London Investor Book Page 130 Page 132