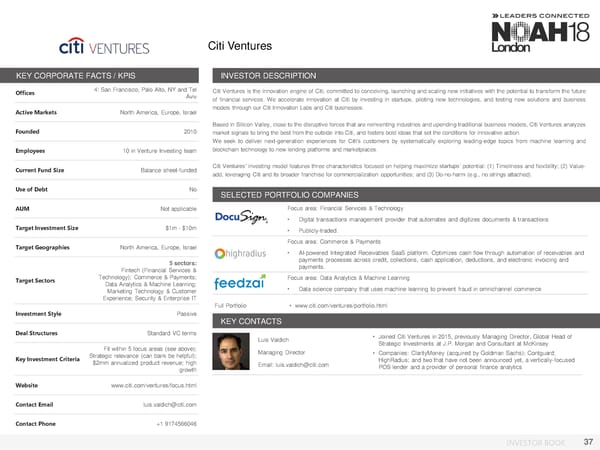

Citi Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices 4: San Francisco, Palo Alto, NY and Tel Citi Ventures is the innovation engine of Citi, committed to conceiving, launching and scaling new initiatives with the potential to transform the future Aviv of financial services. We accelerate innovation at Citi by investing in startups, piloting new technologies, and testing new solutions and business Active Markets North America, Europe, Israel models through our Citi Innovation Labs and Citi businesses. Founded 2010 Basedin Silicon Valley, close to the disruptive forces that are reinventing industries and upending traditional business models, Citi Ventures analyzes market signals to bring the best from the outside into Citi, and fosters bold ideas that set the conditions for innovative action. Weseek to deliver next-generation experiences for Citi’s customers by systematically exploring leading-edge topics from machine learning and Employees 10 in Venture Investing team blockchain technology to new lending platforms and marketplaces. Current Fund Size Balance sheet-funded Citi Ventures’ investing model features three characteristics focused on helping maximize startups’ potential: (1) Timeliness and flexibility; (2) Value- add, leveraging Citi and its broader franchise for commercialization opportunities; and (3) Do-no-harm (e.g., no strings attached). Use of Debt No SELECTED PORTFOLIO COMPANIES AUM Not applicable Focus area: Financial Services & Technology • Digital transactions management provider that automates and digitizes documents & transactions Target Investment Size $1m - $10m • Publicly-traded. Target Geographies North America, Europe, Israel Focus area: Commerce & Payments • AI-powered Integrated Receivables SaaS platform. Optimizes cash flow through automation of receivables and 5 sectors: payments processes across credit, collections, cash application, deductions, and electronic invoicing and Fintech (Financial Services & payments. Target Sectors Technology); Commerce & Payments; Focus area: Data Analytics & Machine Learning Data Analytics & Machine Learning; • Data science company that uses machine learning to prevent fraud in omnichannel commerce Marketing Technology & Customer Experience; Security & Enterprise IT Full Portfolio • www.citi.com/ventures/portfolio.html Investment Style Passive KEY CONTACTS Deal Structures Standard VC terms • Joined Citi Ventures in 2015, previously Managing Director, Global Head of Luis Valdich Strategic Investments at J.P. Morgan and Consultant at McKinsey Fit within 5 focus areas (see above); Managing Director • Companies: ClarityMoney (acquired by Goldman Sachs); Contguard; Key Investment Criteria Strategic relevance (can bank be helpful); HighRadius; and two that have not been announced yet, a vertically-focused $2mm annualized product revenue; high Email: luis.valdich@citi.com POS lender and a provider of personal finance analytics growth Website www.citi.com/ventures/focus.html Contact Email luis.valdich@citi.com Contact Phone +1 9174566046 INVESTOR BOOK 37

NOAH18 London Investor Book Page 36 Page 38

NOAH18 London Investor Book Page 36 Page 38