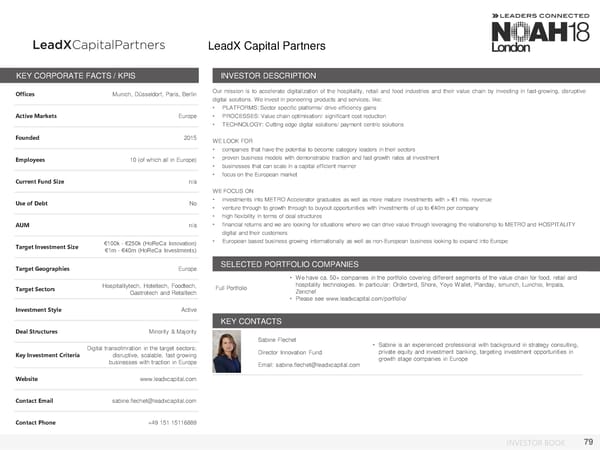

LeadXCapital Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Munich, Düsseldorf, Paris, Berlin Our mission is to accelerate digitalization of the hospitality, retail and food industries and their value chain by investing in fast-growing, disruptive digital solutions. Weinvest in pioneering products and services, like: • PLATFORMS:Sector specific platforms/ drive efficiency gains Active Markets Europe • PROCESSES:Valuechainoptimisation/ significant cost reduction • TECHNOLOGY: Cutting edge digital solutions/ payment centric solutions Founded 2015 WELOOKFOR • companies that have the potential to become category leaders in their sectors Employees 10 (of which all in Europe) • proven business models with demonstrable traction and fast growth rates at investment • businesses that can scale in a capital efficient manner Current Fund Size n/a • focus on the European market WEFOCUSON Use of Debt No • investments into METRO Accelerator graduates as well as more mature investments with > €1 mio. revenue • venture through to growth through to buyout opportunities with investments of up to €40m per company • high flexibility in terms of deal structures AUM n/a • financial returns and we are looking for situations where we can drive value through leveraging the relationship to METRO and HOSPITALITY digital and their customers Target Investment Size €100k - €250k (HoReCa Innovation) • European based business growing internationally as well as non-European business looking to expand into Europe €1m - €40m (HoReCa Investments) Target Geographies Europe SELECTED PORTFOLIO COMPANIES • We have ca. 50+ companies in the portfolio covering different segments of the value chain for food, retail and Target Sectors Hospitalitytech, Hoteltech, Foodtech, Full Portfolio hospitality technologies. In particular: Orderbird, Shore, Yoyo Wallet, Planday, smunch, Lunchio, Impala, Gastrotech and Retailtech Zenchef • Please see www.leadxcapital.com/portfolio/ Investment Style Active KEY CONTACTS Deal Structures Minority & Majority Sabine Flechet • Sabine is an experienced professional with background in strategy consulting, Digital transofmration in the target sectors; Director Innovation Fund private equity and investment banking, targeting investment opportunities in Key Investment Criteria disruptive, scalable, fast growing growth stage companies in Europe businesses with traction in Europe Email: sabine.flechet@leadxcapital.com Website www.leadxcapital.com Contact Email sabine.flechet@leadxcapital.com Contact Phone +49 151 15116889 INVESTOR BOOK 79

NOAH18 London Investor Book Page 78 Page 80

NOAH18 London Investor Book Page 78 Page 80