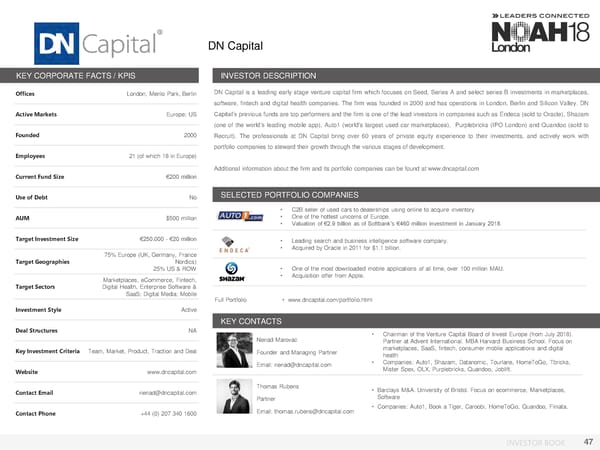

DNCapital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London, Menlo Park, Berlin DNCapital is a leading early stage venture capital firm which focuses on Seed, Series A and select series B investments in marketplaces, software, fintech and digital health companies. The firm was founded in 2000 and has operations in London, Berlin and Silicon Valley. DN Active Markets Europe; US Capital’s previous funds are top performers and the firm is one of the lead investors in companies such as Endeca (sold to Oracle), Shazam (one of the world’s leading mobile app), Auto1 (world's largest used car marketplaces), Purplebricks (IPO London) and Quandoo (sold to Founded 2000 Recruit). The professionals at DN Capital bring over 60 years of private equity experience to their investments, and actively work with portfolio companies to steward their growth through the various stages of development. Employees 21 (of which 18 in Europe) Additional information about the firm and its portfolio companies can be found at www.dncapital.com Current Fund Size €200 million Use of Debt No SELECTED PORTFOLIO COMPANIES • C2B seller of used cars to dealerships using online to acquire inventory. AUM $500 million • One of the hottest unicorns of Europe. • Valuation of €2.9 billion as of Softbank’s €460 million investment in January 2018. Target Investment Size €250,000 - €20 million • Leading search and business intelligence software company. • Acquired by Oracle in 2011 for $1.1 billion. 75% Europe (UK, Germany, France Target Geographies Nordics) 25% US & ROW • One of the most downloaded mobile applications of all time, over 100 million MAU. Marketplaces, eCommerce, Fintech, • Acquisition offer from Apple. Target Sectors Digital Health, Enterprise Software & SaaS; Digital Media; Mobile Full Portfolio • www.dncapital.com/portfolio.html Investment Style Active KEY CONTACTS Deal Structures NA • Chairman of the Venture Capital Board of Invest Europe (from July 2018). Nenad Marovac Partner at Advent International. MBA Harvard Business School. Focus on Key Investment Criteria Team, Market, Product, Traction and Deal Photo Founder and Managing Partner marketplaces, SaaS, fintech, consumer mobile applications and digital health Email: nenad@dncapital.com • Companies: Auto1, Shazam, Datanomic, Tourlane, HomeToGo, Tbricks, Website www.dncapital.com Mister Spex, OLX, Purplebricks, Quandoo, Joblift. Contact Email nenad@dncapital.com Thomas Rubens • Barclays M&A. University of Bristol. Focus on ecommerce, Marketplaces, Photo Partner Software Contact Phone +44 (0) 207 340 1600 Email: thomas.rubens@dncapital.com • Companies: Auto1, Book a Tiger, Caroobi, HomeToGo, Quandoo, Finiata. INVESTOR BOOK 47

NOAH18 London Investor Book Page 46 Page 48

NOAH18 London Investor Book Page 46 Page 48