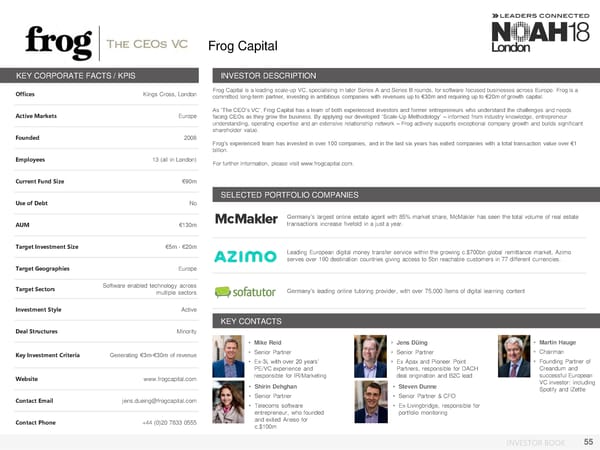

Frog Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Kings Cross, London Frog Capital is a leading scale-up VC, specialising in later Series A and Series B rounds, for software focused businesses across Europe. Frog is a committed long-term partner, investing in ambitious companies with revenues up to €30m and requiring up to €20m of growth capital. Active Markets Europe As ‘The CEO’s VC’, Frog Capital has a team of both experienced investors and former entrepreneurs who understand the challenges and needs facing CEOs as they grow the business. By applying our developed ‘Scale-Up Methodology’ – informed from industry knowledge, entrepreneur understanding, operating expertise and an extensive relationship network – Frog actively supports exceptional company growth and builds significant shareholder value. Founded 2008 Frog’s experienced team has invested in over 100 companies, and in the last six years has exited companies with a total transaction value over €1 billion. Employees 13 (all in London) For further information, please visit www.frogcapital.com. Current Fund Size €90m SELECTED PORTFOLIO COMPANIES Use of Debt No Germany’s largest online estate agent with 85% market share, McMakler has seen the total volume of real estate AUM €130m transactions increase fivefold in a just a year. Target Investment Size €5m - €20m Leading European digital money transfer service within the growing c.$700bn global remittance market, Azimo serves over 190 destination countries giving access to 5bn reachable customers in 77 different currencies. Target Geographies Europe Target Sectors Software enabled technology across Germany’s leading online tutoring provider, with over 75,000 ítems of digital learning content multiple sectors Investment Style Active KEY CONTACTS Deal Structures Minority • Mike Reid • Jens Düing • Martin Hauge Key Investment Criteria Generating €3m-€30m of revenue • Senior Partner • Senior Partner • Chairman • Ex-3i, with over 20 years’ • Ex Apax and Pioneer Point • Founding Partner of PE/VC experience and Partners, responsible for DACH Creandum and Website www.frogcapital.com responsible for IR/Marketing deal origination and B2C lead successful European • Shirin Dehghan • Steven Dunne VC investor: including Spotify and iZettle Contact Email jens.dueing@frogcapital.com • Senior Partner • Senior Partner & CFO • Telecoms software • Ex-Livingbridge, responsible for entrepreneur, who founded portfolio monitoring Contact Phone +44 (0)20 7833 0555 and exited Arieso for c.$100m INVESTOR BOOK 55

NOAH18 London Investor Book Page 54 Page 56

NOAH18 London Investor Book Page 54 Page 56