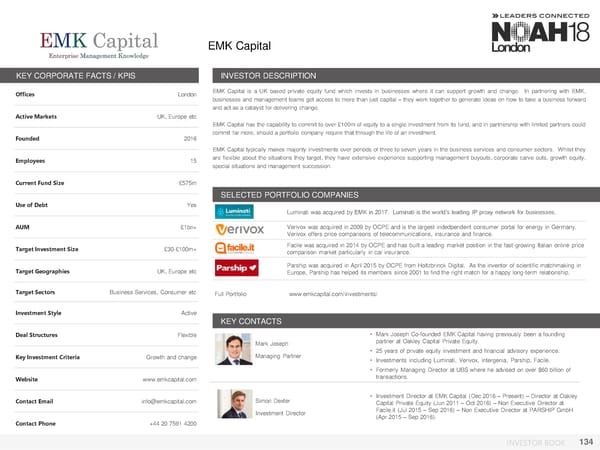

EMK Capital KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices London EMK Capital is a UK based private equity fund which invests in businesses where it can support growth and change. In partnering with EMK, businesses and management teams get access to more than just capital – they work together to generate ideas on how to take a business forward and act as a catalyst for delivering change. Active Markets UK, Europe etc EMKCapital has the capability to commit to over £100m of equity to a single investment from its fund, and in partnership with limited partners could Founded 2016 commit far more, should a portfolio company require that through the life of an investment. EMKCapital typically makes majority investments over periods of three to seven years in the business services and consumer sectors. Whilst they Employees 15 are flexible about the situations they target, they have extensive experience supporting management buyouts, corporate carve outs, growth equity, special situations and management succession. Current Fund Size £575m SELECTED PORTFOLIO COMPANIES Use of Debt Yes Luminati was acquired by EMK in 2017. Luminati is the world’s leading IP proxy network for businesses. AUM £1bn+ Verivox was acquired in 2009 by OCPE and is the largest indedpendent consumer portal for energy in Germany. Verivox offers price comparisons of telecommunications, insurance and finance. Target Investment Size £30-£100m+ Facile was acquired in 2014 by OCPE and has built a leading market position in the fast-growing Italian online price comparison market particularly in car insurance. Target Geographies UK, Europe etc Parship was acquired in April 2015 by OCPE from Holtzbrinck Digital. As the inventor of scientific matchmaking in Europe, Parship has helped its members since 2001 to find the right match for a happy long-term relationship. Target Sectors Business Services, Consumer etc Full Portfolio www.emkcapital.com/investments/ Investment Style Active KEY CONTACTS Deal Structures Flexible • Mark Joseph Co-founded EMK Capital having previously been a founding Mark Joseph partner at Oakley Capital Private Equity. Key Investment Criteria Growth and change Managing Partner • 25 years of private equity investment and financial advisory experience. • Investments including Luminati, Verivox, intergenia, Parship, Facile. • Formerly Managing Director at UBS where he advised on over $60 billion of Website www.emkcapital.com transactions. Contact Email info@emkcapital.com Simon Dexter • Investment Director at EMK Capital (Dec 2016 – Present) – Director at Oakley Capital Private Equity (Jun 2011 – Oct 2016) – Non Executive Director at Investment Director Facile.it (Jul 2015 – Sep 2016) – Non Executive Director at PARSHIP GmbH Contact Phone +44 20 7591 4200 (Apr 2015 – Sep 2016). INVESTOR BOOK 134

NOAH18 London Investor Book Page 133 Page 135

NOAH18 London Investor Book Page 133 Page 135