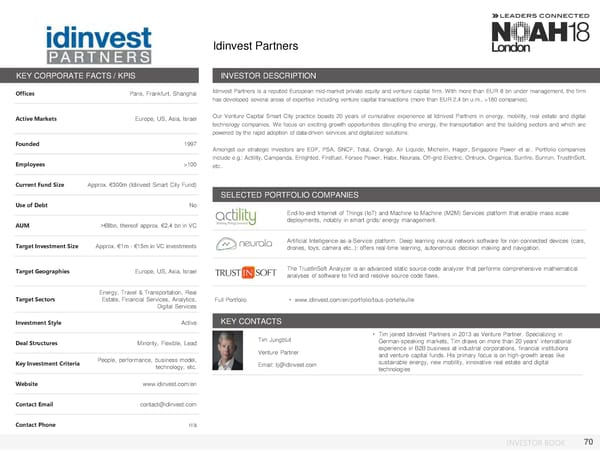

Idinvest Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Paris, Frankfurt, Shanghai Idinvest Partners is a reputed European mid-market private equity and venture capital firm. With more than EUR 8 bn under management, the firm has developed several areas of expertise including venture capital transactions (more than EUR 2,4 bn u.m., >180 companies). Active Markets Europe, US, Asia, Israel Our Venture Capital Smart City practice boasts 20 years of cumulative experience at Idinvest Partners in energy, mobility, real estate and digital technology companies. We focus on exciting growth opportunities disrupting the energy, the transportation and the building sectors and which are powered by the rapid adoption of data-driven services and digitalized solutions. Founded 1997 Amongst our strategic investors are EDF, PSA, SNCF, Total, Orange, Air Liquide, Michelin, Hager, Singapore Power et al.. Portfolio companies Employees >100 include e.g.: Actility, Campanda, Enlighted, Firstfuel, Forsee Power, Habx, Neurala, Off-grid Electric, Ontruck, Organica, Sunfire, Sunrun, TrustInSoft, etc.. Current Fund Size Approx. €300m (Idinvest Smart City Fund) SELECTED PORTFOLIO COMPANIES Use of Debt No End-to-end Internet of Things (IoT) and Machine to Machine (M2M) Services platform that enable mass scale AUM >€8bn, thereof approx. €2,4 bn in VC deployments, notably in smart grids/ energy management. Target Investment Size Approx. €1m - €15m in VC investments Artificial Intelligence-as-a-Service platform. Deep learning neural network software for non-connected devices (cars, drones, toys, camera etc..): offers real-time learning, autonomous decision making and navigation. Target Geographies Europe, US, Asia, Israel The TrustInSoft Analyzer is an advanced static source code analyzer that performs comprehensive mathematical analyses of software to find and resolve source code flaws. Energy, Travel & Transportation, Real Target Sectors Estate, Financial Services, Analytics, Full Portfolio • www.idinvest.com/en/portfolio/tous-portefeuille Digital Services Investment Style Active KEY CONTACTS Tim Jungblut • Tim joined Idinvest Partners in 2013 as Venture Partner. Specializing in Deal Structures Minority, Flexible, Lead German-speaking markets, Tim draws on more than 20 years' international Venture Partner experience in B2B business at industrial corporations, financial institutions People, performance, business model, and venture capital funds. His primary focus is on high-growth areas like Key Investment Criteria technology, etc. Email: tj@idinvest.com sustainable energy, new mobility, innovative real estate and digital technologies Website www.idinvest.com/en Contact Email contact@idinvest.com Contact Phone n/a INVESTOR BOOK 70

NOAH18 London Investor Book Page 69 Page 71

NOAH18 London Investor Book Page 69 Page 71