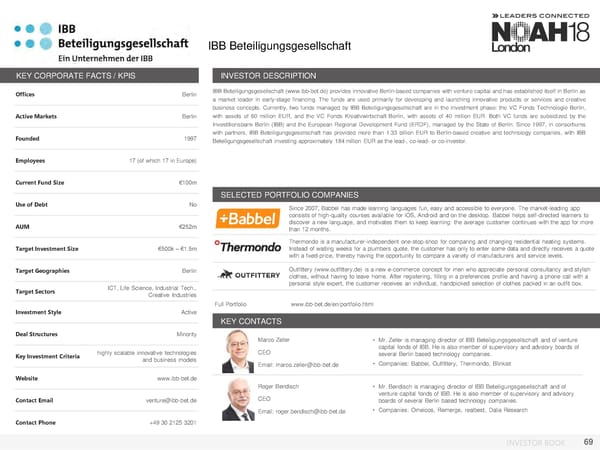

IBB Beteiligungsgesellschaft KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Berlin IBB Beteiligungsgesellschaft (www.ibb-bet.de) provides innovative Berlin-based companies with venture capital and has established itself in Berlin as a market leader in early-stage financing. The funds are used primarily for developing and launching innovative products or services and creative business concepts. Currently, two funds managed by IBB Beteiligungsgesellschaft are in the investment phase: the VC Fonds Technologie Berlin, Active Markets Berlin with assets of 60 million EUR, and the VC Fonds Kreativwirtschaft Berlin, with assets of 40 million EUR. Both VC funds are subsidized by the Investitionsbank Berlin (IBB) and the European Regional Development Fund (ERDF), managed by the State of Berlin. Since 1997, in consortiums Founded 1997 with partners, IBB Beteiligungsgesellschaft has provided more than 1.33 billion EUR to Berlin-based creative and technology companies, with IBB Beteiligungsgesellschaft investing approximately 184 million EUR as the lead-, co-lead- or co-investor. Employees 17 (of which 17 in Europe) Current Fund Size €100m SELECTED PORTFOLIO COMPANIES Use of Debt No Since 2007, Babbel has made learning languages fun, easy and accessible to everyone. The market-leading app Logo consists of high-quality courses available for iOS, Android and on the desktop. Babbel helps self-directed learners to AUM €252m discover a new language, and motivates them to keep learning: the average customer continues with the app for more than 12 months. Thermondo is a manufacturer-independent one-stop-shop for comparing and changing residential heating systems. Target Investment Size €500k – €1.5m Logo Instead of waiting weeks for a plumbers quote, the customer has only to enter some data and directly receives a quote with a fixed-price, thereby having the opportunity to compare a variety of manufacturers and service levels. Target Geographies Berlin Outfittery (www.outfittery.de) is a new e-commerce concept for men who appreciate personal consultancy and stylish Logo clothes, without having to leave home. After registering, filling in a preferences profile and having a phone call with a ICT, Life Science, Industrial Tech., personal style expert, the customer receives an individual, handpicked selection of clothes packed in an outfit box. Target Sectors Creative Industries Full Portfolio www.ibb-bet.de/en/portfolio.html Investment Style Active KEY CONTACTS Deal Structures Minority Marco Zeller • Mr. Zeller is managing director of IBB Beteiligungsgesellschaft and of venture highly scalable innovative technologies Photo CEO capital fonds of IBB. He is also member of supervisory and advisory boards of Key Investment Criteria and business models several Berlin based technology companies. Email: marco.zeller@ibb-bet.de • Companies: Babbel, Outfittery, Thermondo, Blinkist Website www.ibb-bet.de Roger Bendisch • Mr. Bendisch is managing director of IBB Beteiligungsgesellschaft and of Contact Email venture@ibb-bet.de Photo CEO venture capital fonds of IBB. He is also member of supervisory and advisory boards of several Berlin based technology companies. Email: roger.bendisch@ibb-bet.de • Companies: Omeicos, Remerge, realbest, Dalia Research Contact Phone +49 30 2125 3201 INVESTOR BOOK 69

NOAH18 London Investor Book Page 68 Page 70

NOAH18 London Investor Book Page 68 Page 70