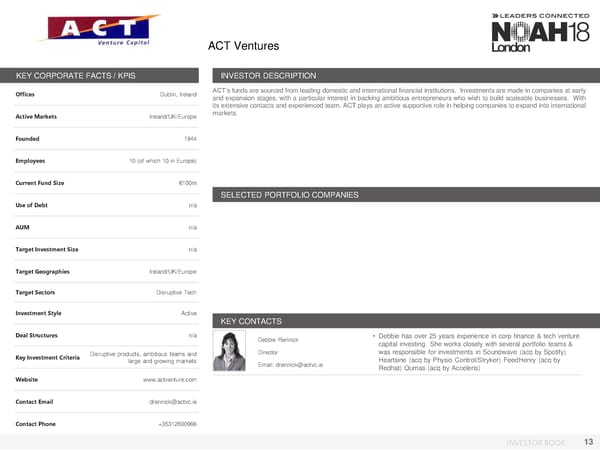

ACT Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Dublin, Ireland ACT’sfunds are sourced from leading domestic and international financial institutions. Investments are made in companies at early and expansion stages, with a particular interest in backing ambitious entrepreneurs who wish to build scaleable businesses. With its extensive contacts and experienced team, ACT plays an active supportive role in helping companies to expand into international Active Markets Ireland/UK/Europe markets. Founded 1944 Employees 10 (of which 10 in Europe) Current Fund Size €100m SELECTED PORTFOLIO COMPANIES Use of Debt n/a AUM n/a Target Investment Size n/a Target Geographies Ireland/UK/Europe Target Sectors Disruptive Tech Investment Style Active KEY CONTACTS Deal Structures n/a Debbie Rennick • Debbie has over 25 years experience in corp finance & tech venture capital investing. She works closely with several portfolio teams & Key Investment Criteria Disruptive products, ambitious teams and Director was responsible for investments in Soundwave (acq by Spotify) large and growing markets Email: drennick@actvc.ie Heartsine (acq by Physio Control/Stryker) FeedHenry (acq by Redhat) Qumas (acq by Acceleris) Website www.actventure.com Contact Email drennick@actvc.ie Contact Phone +35312600966 INVESTOR BOOK 13

NOAH18 London Investor Book Page 12 Page 14

NOAH18 London Investor Book Page 12 Page 14