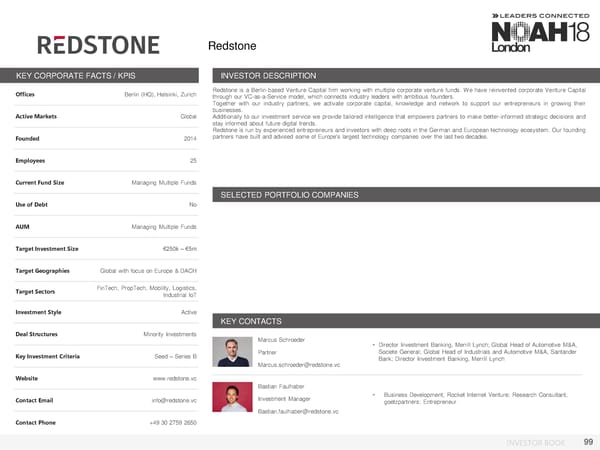

Redstone KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Berlin (HQ), Helsinki, Zurich Redstone is a Berlin-based Venture Capital firm working with multiple corporate venture funds. We have reinvented corporate Venture Capital through our VC-as-a-Service model, which connects industry leaders with ambitious founders. Together with our industry partners, we activate corporate capital, knowledge and network to support our entrepreneurs in growing their Active Markets Global businesses. Additionally to our investment service we provide tailored intelligence that empowers partners to make better-informed strategic decisions and stay informed about future digital trends. Redstone is run by experienced entrepreneurs and investors with deep roots in the German and European technology ecosystem. Our founding Founded 2014 partners have built and advised some of Europe's largest technology companies over the last two decades. Employees 25 Current Fund Size Managing Multiple Funds SELECTED PORTFOLIO COMPANIES Use of Debt No AUM Managing Multiple Funds Target Investment Size €250k – €5m Target Geographies Global with focus on Europe & DACH Target Sectors FinTech, PropTech, Mobility, Logistics, Industrial IoT Investment Style Active KEY CONTACTS Deal Structures Minority Investments Marcus Schroeder • Director Investment Banking, Merrill Lynch; Global Head of Automotive M&A, Key Investment Criteria Seed – Series B Partner Societe General; Global Head of Industrials and Automotive M&A, Santander Bank; Director Investment Banking, Merrill Lynch Marcus.schroeder@redstone.vc Website www.redstone.vc Bastian Faulhaber Contact Email info@redstone.vc Investment Manager • Business Development, Rocket Internet Venture; Research Consultant, goetzpartners; Entrepreneur Bastian.faulhaber@redstone.vc Contact Phone +49 30 2759 2650 INVESTOR BOOK 99

NOAH18 London Investor Book Page 98 Page 100

NOAH18 London Investor Book Page 98 Page 100