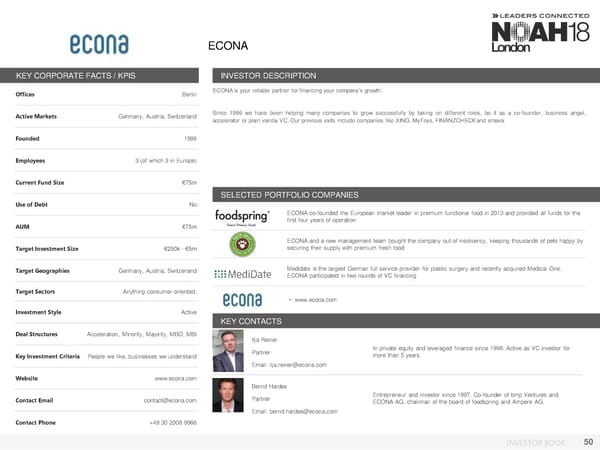

ECONA KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Berlin ECONAisyourreliable partner for financing your company’s growth. Active Markets Germany, Austria, Switzerland Since 1999 we have been helping many companies to grow successfully by taking on different roles, be it as a co-founder, business angel, accelerator or plain vanilla VC. Our previous exits include companies like XING, MyToys, FINANZCHECKand smava. Founded 1999 Employees 3 (of which 3 in Europe) Current Fund Size €75m SELECTED PORTFOLIO COMPANIES Use of Debt No ECONA co-founded the European market leader in premium functional food in 2013 and provided all funds for the AUM €75m first four years of operation ECONA and a new management team bought the company out of insolvency, keeping thousands of pets happy by Target Investment Size €250k - €5m securing their supply with premium fresh food Target Geographies Germany, Austria, Switzerland Medidate is the largest German full service provider for plastic surgery and recently acquired Medical One. ECONA participated in two rounds of VC financing Target Sectors Anything consumer-oriented. • www.econa.com Investment Style Active KEY CONTACTS Deal Structures Acceleration, Minority, Majority, MBO, MBI Ilja Reiner Photo Partner In private equity and leveraged finance since 1998. Active as VC investor for Key Investment Criteria People we like, businesses we understand more than 5 years. Email: ilja,reiner@econa.com Website www.econa.com Bernd Hardes Contact Email contact@econa.com Photo Partner Entrepreneur and investor since 1997. Co-founder of bmp Ventures and ECONA AG, chairman of the board of foodspring and Ampere AG. Email: bernd.hardes@econa.com Contact Phone +49 30 2008 9966 INVESTOR BOOK 50

NOAH18 London Investor Book Page 49 Page 51

NOAH18 London Investor Book Page 49 Page 51