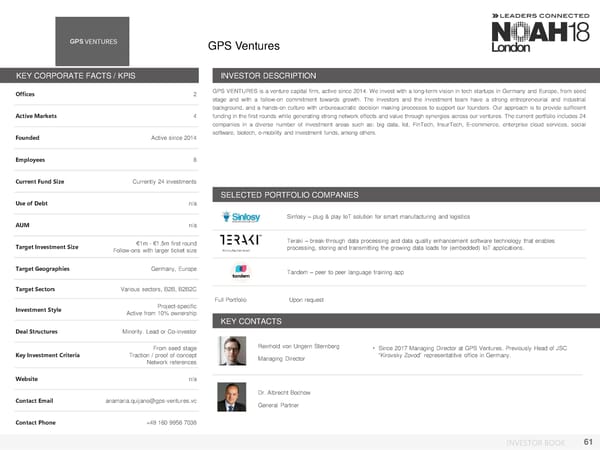

GPS Ventures KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices 2 GPSVENTURESisaventurecapital firm, active since 2014. Weinvest with a long-term vision in tech startups in Germany and Europe, from seed stage and with a follow-on commitment towards growth. The investors and the investment team have a strong entrepreneurial and industrial background, and a hands-on culture with unbureaucratic decision making processes to support our founders. Our approach is to provide sufficient Active Markets 4 funding in the first rounds while generating strong network effects and value through synergies across our ventures. The current portfolio includes 24 companies in a diverse number of investment areas such as: big data, Iot, FinTech, InsurTech, E-commerce, enterprise cloud services, social Founded Active since 2014 software, biotech, e-mobility and investment funds, among others. Employees 8 Current Fund Size Currently 24 investments SELECTED PORTFOLIO COMPANIES Use of Debt n/a Sinfosy – plug & play IoT solution for smart manufacturing and logistics AUM n/a Target Investment Size €1m - €1.5m first round Teraki – break-through data processing and data quality enhancement software technology that enables Follow-ons with larger ticket size processing, storing and transmitting the growing data loads for (embedded) IoT applications. Target Geographies Germany, Europe Tandem – peer to peer language training app Target Sectors Various sectors, B2B, B2B2C Full Portfolio Upon request Investment Style Project-specific Active from 10% ownership KEY CONTACTS Deal Structures Minority. Lead or Co-investor From seed stage Reinhold von Ungern Sternberg • Since 2017 Managing Director at GPS Ventures. Previously Head of JSC Key Investment Criteria Traction / proof of concept Managing Director “Kirovsky Zovod” representatitve office in Germany. Network references Website n/a Dr. Albrecht Bochow Contact Email anamaria.quijano@gps-ventures.vc General Partner Contact Phone +49 160 9956 7038 INVESTOR BOOK 61

NOAH18 London Investor Book Page 60 Page 62

NOAH18 London Investor Book Page 60 Page 62