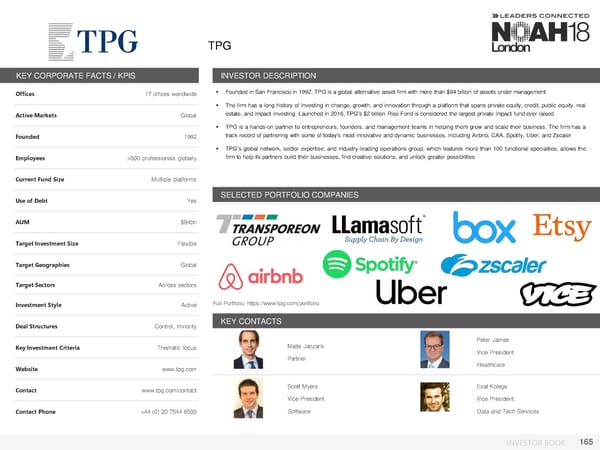

TPG KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices 17 offices worldwide ▪ Founded in San Francisco in 1992, TPG is a global alternative asset firm with more than $94 billion of assets under management ▪ Thefirm has a long history of investing in change, growth, and innovation through a platform that spans private equity, credit, public equity, real Active Markets Global estate, and impact investing. Launched in 2016,TPG’s $2 billion Rise Fund is considered the largest private impact fund ever raised ▪ TPGis a hands-on partner to entrepreneurs, founders, and management teams in helping them grow and scale their business. The firm has a Founded 1992 track record of partnering with some of today’s most innovative and dynamic businesses, including Airbnb, CAA, Spotify, Uber, and Zscaler ▪ TPG’s global network, sector expertise, and industry-leading operations group, which features more than 100 functional specialties, allows the Employees >500 professionals globally firm to help its partners build their businesses, find creative solutions, and unlock greater possibilities Current Fund Size Multiple platforms Use of Debt Yes SELECTED PORTFOLIO COMPANIES AUM $94bn Target Investment Size Flexible Target Geographies Global Target Sectors Across sectors Investment Style Active Full Portfolio: https://www.tpg.com/portfolio Deal Structures Control, minority KEY CONTACTS Peter James Key Investment Criteria Thematic focus Malte Janzarik Vice President Partner Website www.tpg.com Healthcare Contact www.tpg.com/contact Scott Myers Esat Kolege Vice President Vice President, Contact Phone +44 (0) 20 7544 6500 Software Data and Tech Services INVESTOR BOOK 165

NOAH18 London Investor Book Page 164 Page 166

NOAH18 London Investor Book Page 164 Page 166