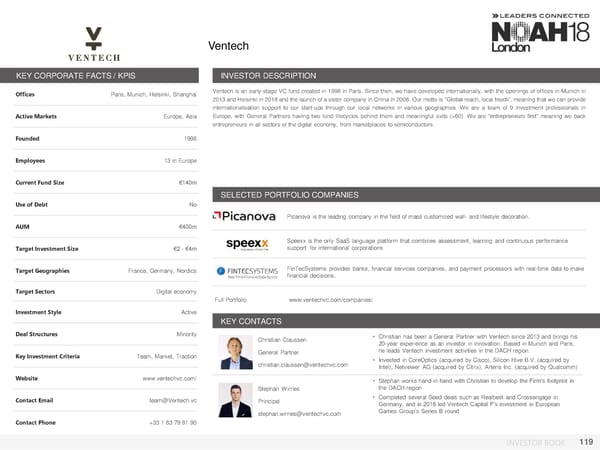

Ventech KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Paris, Munich, Helsinki, Shanghai Ventech is an early-stage VC fund created in 1998 in Paris. Since then, we have developed internationally, with the openings of offices in Munich in 2013andHelsinki in 2018 and the launch of a sister company in China in 2008. Our motto is “Global reach, local touch”, meaning that we can provide internationalisation support to our start-ups through our local networks in various geographies. We are a team of 9 investment professionals in Active Markets Europe, Asia Europe, with General Partners having two fund lifecycles behind them and meaningful exits (>60). We are “entrepreneurs first” meaning we back entrepreneurs in all sectors of the digital economy, from marketplaces to semiconductors. Founded 1998 Employees 13 in Europe Current Fund Size €140m SELECTED PORTFOLIO COMPANIES Use of Debt No Picanova is the leading company in the field of mass customized wall- and lifestyle decoration. AUM €400m Speexx is the only SaaS language platform that combines assessment, learning and continuous performance Target Investment Size €2 - €4m support for international corporations Target Geographies France, Germany, Nordics FinTecSystems provides banks, financial services companies, and payment processors with real-time data to make financial decisions. Target Sectors Digital economy Full Portfolio www.ventechvc.com/companies/ Investment Style Active KEY CONTACTS Deal Structures Minority Christian Claussen • Christian has been a General Partner with Ventech since 2013 and brings his Photo 20-year experience as an investor in innovation. Based in Munich and Paris, Key Investment Criteria Team, Market, Traction General Partner he leads Ventech investment activities in the DACH region. christian.claussen@ventechvc.com • Invested in CoreOptics (acquired by Cisco), Silicon Hive B.V. (acquired by Intel), Netviewer AG (acquired by Citrix), Arteris Inc. (acquired by Qualcomm) Website www.ventechvc.com/ • Stephan works hand-in-hand with Christian to develop the Firm’s footprint in Stephan Wirries the DACH region Contact Email team@Ventech.vc Photo Principal • Completed several Seed deals such as Realbest and Crossengage in Germany, and in 2016 led Ventech Capital F’s investment in European stephan.wirries@ventechvc.com Games Group’s Series B round Contact Phone +33 1 83 79 81 90 INVESTOR BOOK 119

NOAH18 London Investor Book Page 118 Page 120

NOAH18 London Investor Book Page 118 Page 120