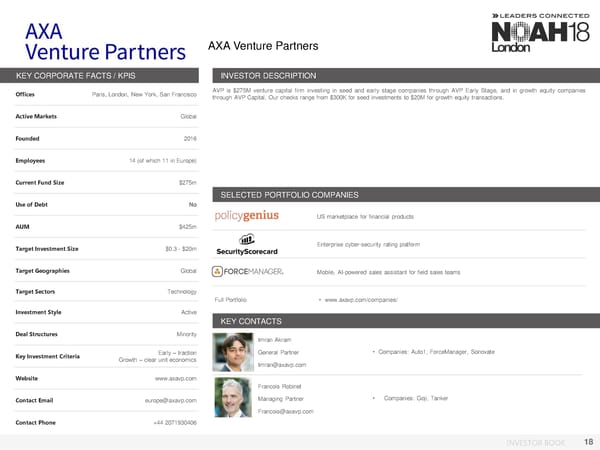

AXA Venture Partners KEY CORPORATE FACTS / KPIS INVESTOR DESCRIPTION Offices Paris, London, New York, San Francisco AVP is $275M venture capital firm investing in seed and early stage companies through AVP Early Stage, and in growth equity companies through AVP Capital. Our checks range from $300K for seed investments to $20M for growth equity transactions. Active Markets Global Founded 2016 Employees 14 (of which 11 in Europe) Current Fund Size $275m SELECTED PORTFOLIO COMPANIES Use of Debt No US marketplace for financial products AUM $425m Target Investment Size $0.3 - $20m Enterprise cyber-security rating platform Target Geographies Global Mobile, AI-powered sales assistant for field sales teams Target Sectors Technology Full Portfolio • www.axavp.com/companies/ Investment Style Active KEY CONTACTS Deal Structures Minority Imran Akram Early – traction Photo General Partner • Companies: Auto1, ForceManager, Sonovate Key Investment Criteria Growth – clear unit economics Imran@axavp.com Website www.axavp.com Francois Robinet Contact Email europe@axavp.com Photo Managing Partner • Companies: Goji, Tanker Francois@axavp.com Contact Phone +44 2071930406 INVESTOR BOOK 18

NOAH18 London Investor Book Page 17 Page 19

NOAH18 London Investor Book Page 17 Page 19