NOAH15 London Fund Book

The industry reference covering all stages of the investment spectrum - specifically internet companies seeking investment.

FUND BOOK VENTURE CAPITAL VENTURE CAPITAL

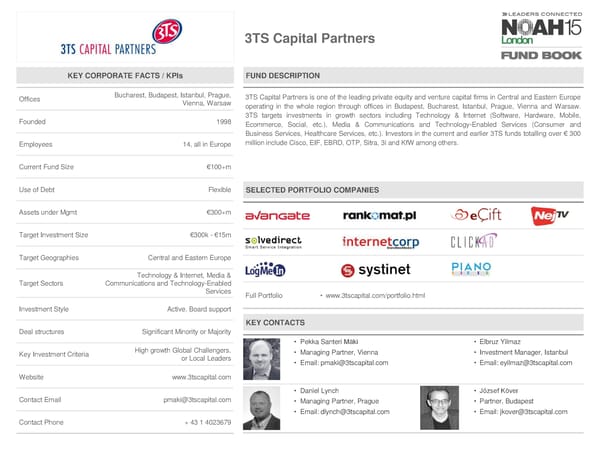

3TS Capital Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Bucharest, Budapest, Istanbul, Prague, 3TSCapital Partners is one of the leading private equity and venture capital firms in Central and Eastern Europe Vienna, Warsaw operating in the whole region through offices in Budapest, Bucharest, Istanbul, Prague, Vienna and Warsaw. Founded 1998 3TS targets investments in growth sectors including Technology & Internet (Software, Hardware, Mobile, Ecommerce, Social, etc.), Media & Communications and Technology-Enabled Services (Consumer and Business Services, Healthcare Services, etc.). Investors in the current and earlier 3TS funds totalling over € 300 Employees 14, all in Europe million include Cisco, EIF, EBRD, OTP, Sitra, 3i and KfW among others. Current Fund Size €100+m Use of Debt Flexible SELECTED PORTFOLIO COMPANIES Assets under Mgmt €300+m Target Investment Size €300k - €15m Target Geographies Central and Eastern Europe Technology & Internet, Media & Target Sectors Communications and Technology-Enabled Services Full Portfolio • www.3tscapital.com/portfolio.html Investment Style Active, Board support KEY CONTACTS Deal structures Significant Minority or Majority • Pekka Santeri Mäki • Elbruz Yilmaz Key Investment Criteria High growth Global Challengers, • Managing Partner, Vienna • Investment Manager, Istanbul or Local Leaders • Email: pmaki@3tscapital.com • Email: eyilmaz@3tscapital.com Website www.3tscapital.com • Daniel Lynch • József Köver Contact Email pmaki@3tscapital.com • Managing Partner, Prague • Partner, Budapest • Email: dlynch@3tscapital.com • Email: jkover@3tscapital.com Contact Phone + 43 1 4023679

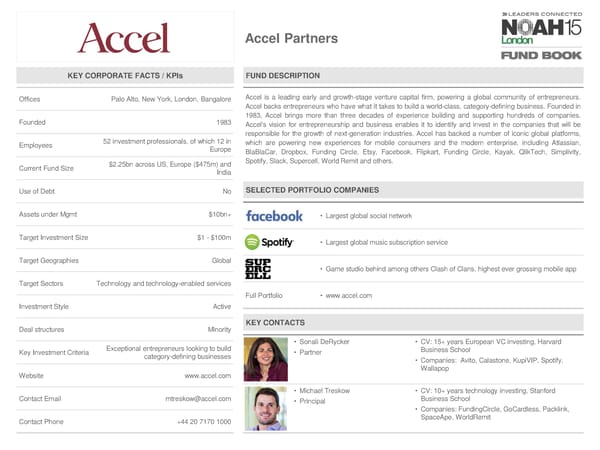

Accel Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Palo Alto, New York, London, Bangalore Accel is a leading early and growth-stage venture capital firm, powering a global community of entrepreneurs. Accel backs entrepreneurs who have what it takes to build a world-class, category-defining business. Founded in Founded 1983 1983, Accel brings more than three decades of experience building and supporting hundreds of companies. Accel's vision for entrepreneurship and business enables it to identify and invest in the companies that will be responsible for the growth of next-generation industries. Accel has backed a number of iconic global platforms, Employees 52 investment professionals, of which 12 in which are powering new experiences for mobile consumers and the modern enterprise, including Atlassian, Europe BlaBlaCar, Dropbox, Funding Circle, Etsy, Facebook, Flipkart, Funding Circle, Kayak, QlikTech, Simplivity, $2.25bn across US, Europe ($475m) and Spotify, Slack, Supercell, World Remit and others. Current Fund Size India Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $10bn+ • Largest global social network Target Investment Size $1 - $100m • Largest global music subscription service Target Geographies Global • Game studio behind among others Clash of Clans, highest ever grossing mobile app Target Sectors Technology and technology-enabled services Full Portfolio • www.accel.com Investment Style Active Deal structures Minority KEY CONTACTS Exceptional entrepreneurs looking to build • Sonali DeRycker • CV: 15+ years European VC investing, Harvard Key Investment Criteria category-defining businesses • Partner Business School • Companies: Avito, Calastone, KupiVIP, Spotify, Wallapop Website www.accel.com • Michael Treskow • CV: 10+ years technology investing, Stanford Contact Email mtreskow@accel.com • Principal Business School • Companies: FundingCircle, GoCardless, Packlink, Contact Phone +44 20 7170 1000 SpaceApe, WorldRemit

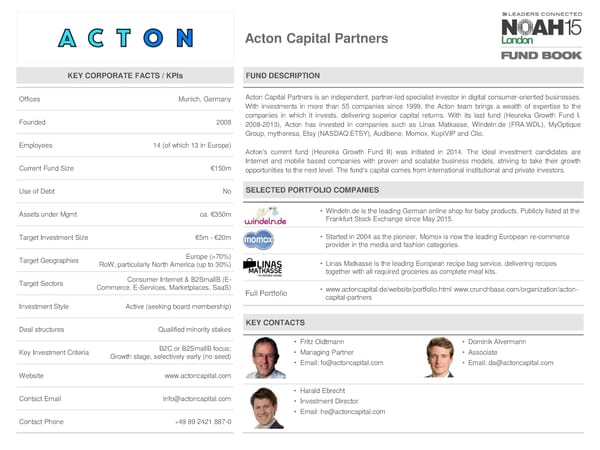

Acton Capital Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Munich, Germany Acton Capital Partners is an independent, partner-led specialist investor in digital consumer-oriented businesses. With investments in more than 55 companies since 1999, the Acton team brings a wealth of expertise to the Founded 2008 companies in which it invests, delivering superior capital returns. With its last fund (Heureka Growth Fund I, 2008-2013), Acton has invested in companies such as Linas Matkasse, Windeln.de (FRA:WDL), MyOptique Group, mytheresa, Etsy (NASDAQ:ETSY),Audibene, Momox, KupiVIP and Clio. Employees 14 (of which 13 in Europe) Acton’s current fund (Heureka Growth Fund II) was initiated in 2014. The ideal investment candidates are Internet and mobile based companies with proven and scalable business models, striving to take their growth Current Fund Size €150m opportunities to the next level. The fund’s capital comes from international institutional and private investors. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt ca. €350m • Windeln.de is the leading German online shop for baby products. Publicly listed at the Frankfurt Stock Exchange since May 2015. Target Investment Size €5m-€20m • Started in 2004 as the pioneer, Momox is now the leading European re-commerce provider in the media and fashion categories. Target Geographies Europe (>70%) RoW, particularly North America (up to 30%) • Linas Matkasse is the leading European recipe bag service, delivering recipes together with all required groceries as complete meal kits. Target Sectors Consumer Internet & B2SmallB (E- Commerce,E-Services, Marketplaces, SaaS) Full Portfolio • www.actoncapital.de/website/portfolio.html www.crunchbase.com/organization/acton- capital-partners Investment Style Active (seeking board membership) Deal structures Qualified minority stakes KEY CONTACTS B2C or B2SmallB focus; • Fritz Oidtmann • Dominik Alvermann Key Investment Criteria Growth stage, selectively early (no seed) • Managing Partner • Associate • Email: fo@actoncapital.com • Email: da@actoncapital.com Website www.actoncapital.com • Harald Ebrecht Contact Email info@actoncapital.com • Investment Director • Email: he@actoncapital.com Contact Phone +49 89 2421 887-0

Acxit Capital Management KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Frankfurt a. M., Munich, Founded in 1999, Acxit Capital Management’s principal investment arm invests in international Zurich, Hong Kong technology companies operating in the TMT, software, service, mobile and/or healthcare space. We also provide strategic and operational advice/experience and access to our international network of Founded 1999 high profile industry advisors. We act as a cooperative investor contributing to the decision making processes with resources and experience to improve a company’s market position. Acxit does not Employees 30 (of which 27 in Europe) interfere with day-to-day business. We support our portfolio companies in capital structuring, interim management and capital market transactions. In addition, we structure and lead club deals with affiliated investors. Current Fund Size NA Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt NA • Leading European eFinance enabler providing seamless e-identity verification and authentication solutions across Europe for eFinance, eGovernment, Online Gambling and eCommercemarketers Target Investment Size €250k - €10m • Leading international system- and service provider for digital/hybrid post and mail Target Geographies Europe management Target Sectors TMT,Mobile, Software, Service Provider, • Founder and lead investor of Europe's leading ASP and Wireless Local Loop (WLL) Healthcare operator. Largest tech startup in Europe ever with total financing of more than €800m. Exited amongst others to GE Capital and Bechtel Group/Incepta in 2001 Investment Style Active KEY CONTACTS Deal structures Minority • Johannes H. Lucas • Founder and MD of ACM in 1999 Key Investment Criteria MVP, USP, Management, • Founding Partner • Previously SBC Warburg (UBS), Lehman Brothers, Scalability, Market Potential • Email: lucas@acxit.com KPMG, Deutsche Bank • Initiator of German Equity Forum Website www.acxit.com • Former Board Member EASD/EASDAQ • Christian Ramme • Joined ACM in 2014 Contact Email ramme@acxit.com • Head of Growth Capital • Previously SevenVentures, Ernst & Young, • Email: ramme@acxit.com PriceWaterhouseCoopers Contact Phone +49(69) 770606111

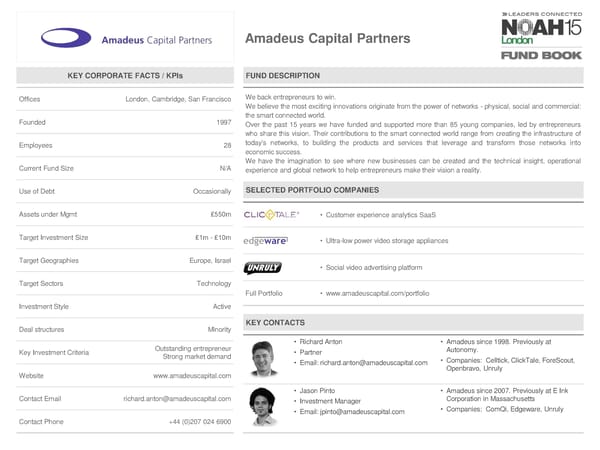

Amadeus Capital Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London, Cambridge, San Francisco Webackentrepreneurs to win. Webelieve the most exciting innovations originate from the power of networks - physical, social and commercial: Founded 1997 the smart connected world. Over the past 15 years we have funded and supported more than 85 young companies, led by entrepreneurs who share this vision. Their contributions to the smart connected world range from creating the infrastructure of Employees 28 today's networks, to building the products and services that leverage and transform those networks into economicsuccess. Wehave the imagination to see where new businesses can be created and the technical insight, operational Current Fund Size N/A experience and global network to help entrepreneurs make their vision a reality. Use of Debt Occasionally SELECTED PORTFOLIO COMPANIES Assets under Mgmt £550m • Customer experience analytics SaaS Target Investment Size £1m-£10m • Ultra-low power video storage appliances Target Geographies Europe, Israel • Social video advertising platform Target Sectors Technology Full Portfolio • www.amadeuscapital.com/portfolio Investment Style Active Deal structures Minority KEY CONTACTS Outstanding entrepreneur • Richard Anton • Amadeus since 1998. Previously at Key Investment Criteria Strong market demand • Partner Autonomy. • Email: richard.anton@amadeuscapital.com • Companies: Celltick, ClickTale, ForeScout, Openbravo, Unruly Website www.amadeuscapital.com • Jason Pinto • Amadeus since 2007. Previously at E Ink Contact Email richard.anton@amadeuscapital.com • Investment Manager Corporation in Massachusetts • Email: jpinto@amadeuscapital.com • Companies: ComQi, Edgeware, Unruly Contact Phone +44 (0)207 024 6900

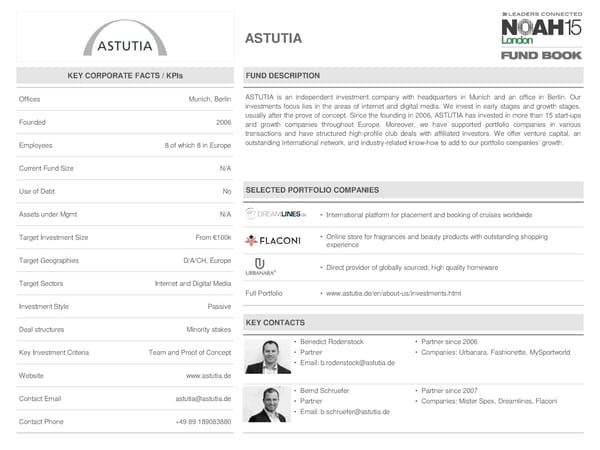

ASTUTIA KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Munich, Berlin ASTUTIA is an independent investment company with headquarters in Munich and an office in Berlin. Our investments focus lies in the areas of internet and digital media. We invest in early stages and growth stages, Founded 2006 usually after the prove of concept. Since the founding in 2006, ASTUTIA has invested in more than 15 start-ups and growth companies throughout Europe. Moreover, we have supported portfolio companies in various transactions and have structured high-profile club deals with affiliated investors. We offer venture capital, an Employees 8 of which 8 in Europe outstanding international network, and industry-related know-how to add to our portfolio companies’ growth. Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • International platform for placement and booking of cruises worldwide Target Investment Size From €100k • Online store for fragrances and beauty products with outstanding shopping experience Target Geographies D/A/CH, Europe • Direct provider of globally sourced, high quality homeware Target Sectors Internet and Digital Media Full Portfolio • www.astutia.de/en/about-us/investments.html Investment Style Passive Deal structures Minority stakes KEY CONTACTS • Benedict Rodenstock • Partner since 2006 Key Investment Criteria Team and Proof of Concept • Partner • Companies: Urbanara, Fashionette, MySportworld • Email: b.rodenstock@astutia.de Website www.astutia.de • Bernd Schruefer • Partner since 2007 Contact Email astutia@astutia.de • Partner • Companies: Mister Spex, Dreamlines, Flaconi • Email: b.schruefer@astutia.de Contact Phone +49 89 189083880

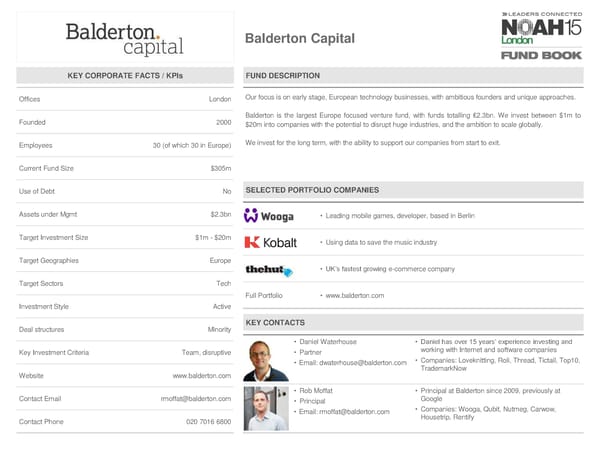

Balderton Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London Our focus is on early stage, European technology businesses, with ambitious founders and unique approaches. Founded 2000 Balderton is the largest Europe focused venture fund, with funds totalling £2.3bn. We invest between $1m to $20minto companieswith the potential to disrupt huge industries, and the ambition to scale globally. Employees 30 (of which 30 in Europe) Weinvest for the long term, with the ability to support our companies from start to exit. Current Fund Size $305m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $2.3bn • Leading mobile games, developer, based in Berlin Target Investment Size $1m-$20m • Using data to save the music industry Target Geographies Europe • UK’s fastest growing e-commerce company Target Sectors Tech Full Portfolio • www.balderton.com Investment Style Active Deal structures Minority KEY CONTACTS • Daniel Waterhouse • Daniel has over 15 years’ experience investing and Key Investment Criteria Team, disruptive • Partner working with Internet and software companies • Email: dwaterhouse@balderton.com • Companies: Loveknitting, Roli, Thread, Tictail, Top10, TrademarkNow Website www.balderton.com • Rob Moffat • Principal at Balderton since 2009, previously at Contact Email rmoffat@balderton.com • Principal Google • Email: rmoffat@balderton.com • Companies: Wooga, Qubit, Nutmeg, Carwow, Contact Phone 020 7016 6800 Housetrip, Rentify

Bauer Venture Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Hamburg, Stockholm Bauer Venture Partners focusses on Digital Media (Owned Content, Aggregators, Functional Apps, Classifieds) and Publishing Technologies (Content Creation, Distribution & Monetization), early and later stages and the Germanand Nordic Regions. Founded 2014 Weare a financial, profit-oriented investor. But if it provides value, we could offer the advantages of a strategic Employees 7 (of which 7 in Europe) investor: Access to the assets and infrastructure of one of the leading international media companies with a strong footprint in markets like Germany, UK, Poland, USA, Australia, Nordics and more. Current Fund Size €100m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt n/a • Global leading meta-search and recommendation engine for food and recipies. California-based. Target Investment Size €1m - €7m • A leading calory and fitness tracking app. Featured by Apple. Stockholm-based. Target Geographies Germany, Austria, Switzerland, Nordics • Global category leader in plus-size premium fashion for women. Aachen- and London-based. Target Sectors Digital Media & Publishing Tech Full Portfolio • N/A Investment Style Active, hands-on KEY CONTACTS Deal structures Flexible • Iskender Dirik • MD at BVP, M&A for Bauer Media Group, Founder of Key Investment Criteria Top-notch team // scaling by technology • Managing Director several Product-Startups, MD at Technology & Digital Media • Email: Consulting Boutique, Management Consulting for Clients info@bauerventurepartners.vc like Axel Springer, Deutsche Telekom, Bertelsmann, Website www.bauerventurepartners.vc Pro7Sat1, Straits Times, Porsche, Volkswagen, TUI. • Companies: Navabi, Contorion Contact Email info@bauerventurepartners.vc • Sven-Olof Reimers • MD at BVP, M&A for Bauer Media Group, COO Bauer Xcel • Managing Director Media, Publishing Director Bauer Media Group, MD Bauer • Email: Interior GmbH, Manager Bauer Digital KG, MD Bauer Living Contact Phone +49 40 3019 1078 info@bauerventurepartners.vc GmbH • Companies: Yummly, Lifesu

CapnamicVentures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Cologne (HQ), Berlin (Germany) Capnamic Ventures is an independent venture capital enterprise with offices in Cologne and Berlin that invests in business models along the digital value added chain. These include growth markets such as mobile, Founded 2012 eCommerce, gaming, payment, advertising and software-as-a-service models. The Capnamic Ventures team can rely on the expertise acquired in the course of over 100 equity interests and 30 years of investment experience. The investors chiefly are enterprises and entrepreneurial families. In addition to its own fund, Employees 8 (of which 8 in Europe) Capnamic Ventures also takes care of the entire portfolio of DuMont Venture, the holding company of the media group M. DuMont Schauberg. Further particulars are available at: www.capnamic.de Current Fund Size N/A Use of Debt N/A SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • Mobile tracking and analytics solution provider Target Investment Size €0.5m – €2.5m • Online platform for short- and adventure trips Target Geographies Germany, Europe • Online platform for luxury watches Target Sectors Digital Media Full Portfolio • www.capnamic.de/#companies Investment Style Active Deal structures Minority KEY CONTACTS • Jörg Binnenbrücker Key Investment Criteria Digital Business Model, Team, Growth • Managing Partner • Email: jb@capnamic.de Website www.capnamic.de • Christian Siegele Contact Email info@capnamic.de • Managing Partner • Email: cs@capnamic.de Contact Phone +49221 67781930

CommerzVentures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Frankfurt am Main Established in 2014, CommerzVentures is the corporate VC arm of Commerzbank investing in early and growth stage start ups in the FinTech sector. At CommerzVentures we want to work with the best entrepreneurs who Founded 2014 can articulate why they can dominate a given market segment. Our team has >25 years in venture capital. Typically we invest at series B/C stage and no less than € 2 Mio., Employees 6 (of which 6 in Europe) initially. CoV reports directly to the management board of Commerzbank AG. Martin Blessing (Commerzbank’s CEO) Current Fund Size Commerzbank Balance Sheet chairs the investment committee. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • eToro is the world's leading social investment network company based in Israel Target Investment Size €2m – €10m Target Geographies Globally Target Sectors FinTech & Insurance Investment Style lead, Co-Lead, Follower, actively involved with the Company Deal structures Standard VC terms / minorities KEY CONTACTS • Stefan Tirtey • MBA, Insead; Dipl.-Ing., RWTH Aachen Key Investment Criteria Revenue traction, B and C rounds • Managing Director Previously: Doughty Hanson, early investor • Email: stefan.tirtey@commerzventures.com in SoundCloud Website N/A • Patrick Meisberger • MBA, Eastern Illinois University; Contact Email info@commerzventures.com • Managing Director MA Business Administration, University of • Email: Cologne Contact Phone +49 69 348773496 patrick.meisberger@commerzventures.com Previously: T-Venture, Allianz Venture

Creathor Venture KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 5 Creathor Venture manages funds of more than €180m and invests in technology-oriented companies in Mobile, E-commerce, Digital Media, Cloud Technology, Internet of Things, Shared Economy, Fintech, eHealth and Life Founded 2003 Science. The management team of Creathor Venture consists of the CEO Dr. Gert Köhler, Cédric Köhler and Karlheinz Schmelig. The team has been investing successfully in the early-stage venture capital business for 30 years. Employees 16 During that time, more than 200 technology companies have been funded, more than 20 international IPOs conducted and many companies were successfullysold. Current Fund Size €180m Being a Pan-European Venture Capital company Creathor Venture holds offices in Bad Homburg, in Cologne, near Munich, in Zurich and in Stockholm while managing a portfolio of currently over 30 investments. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt €180m • World‘s smartest connected biking system Target Investment Size Upto €10m • Social shopping platform Target Geographies Germany, Switzerland, France, Austria Nordics Mobile, E-commerce, Digital Media, Cloud • Mobile shopping and payment platform Target Sectors Technology, Internet of Things, Shared Economy, Fintech, eHealth and Life Science Full Portfolio • www.creathor.de/en/portfolio/ Investment Style Active KEY CONTACTS Deal structures Control, joint control, minority, etc. • Dr. Christian Weiss Key Investment Criteria N/A • Investment Manager • Email: creathor@creathor.com Website www.creathor.com • Klaus-Christian Glueckert Contact Email creathor@creathor.com • Investment Manager • Email: creathor@creathor.com Contact Phone +49 6172 139720

DN Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London, Menlo Park, Berlin DN Capital is a global early stage and growth capital investor in software, mobile applications, digital media, marketplace and e-commerce companies. The firm has operations in London, Berlin and Menlo Park and its Founded 2000 objectives is to identify, invest in and actively support its portfolio companies to become global leaders. Portfolio companies include Shazam Entertainment, Auto1 Group, Apsmart (sold to Thomson Reuters), Book A Tiger, Datanomic (sold to Oracle), Delectable, Endeca Technologies (sold to Oracle), Happn, JacobsRimell (sold Employees N/A to Amdocs), Mister Spex, OLX (sold to Naspers), Performance Horizon Group, PurpleBricks, Quandoo (sold to Recruit Holdings), Tbricks (sold to Orc Holdings) and Windeln.de. The professionals at DN Capital bring over 60 Current Fund Size €144m years of private equity experience to their investments, and actively work with portfolio companies to steward their growth through the various stages of development. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • #1 music and media recognition on mobile devices. • Valued at $1+ bn Target Investment Size €0.25m - €20m • Leading search and business intelligence software company. 75% Europe (UK, Germany, France, Nordics) • Acquired by Oracle in 2011 for $1.1bn Target Geographies 25% US & ROW Ecommerce • Leading baby and toddler e-commerce platform in DACH Marketplaces • IPO in May 2015 Target Sectors Digital Media Enterprise software & Fin Tech Full Portfolio • www.dncapital.com/portfolio 5)Mobile Investment Style Active KEY CONTACTS Deal structures N/A • Nenad Marovac • Partner at Advent International • Managing Partner and CEO • MBA Harvard Business School Key Investment Criteria Team,Market, Product, Traction and Deal • Email: • Focus on Digital Media, Ecommerce, Marketplaces, Mobile Nenad@dncapital.com • Companies: Book a Tiger, Datanomic, Happn, Mister Spex, Website www.dncapital.com OLX, Quandoo, Shazam, Windeln • Thomas Rubens • Barclays M&A Contact Email mariam@dncapital.com • Investment Manager • University of Bristol • Email: • Focus on Ecommerce, Marketplaces, Software Contact Phone 02073401600 Thomas.rubens@dncapital. • Companies: Book a Tiger, ShipHawk, Quandoo, Videdressing com

EARLYBIRD Venture Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Berlin, Munich, Istanbul Stage agnostic Venture Fund investing in Europe Founded 1997 Employees 28 (of which 28 in Europe) Current Fund Size €700m Use of Debt N/A SELECTED PORTFOLIO COMPANIES Assets under Mgmt 34 • Cloud-based telecommunication infrastructure Target Investment Size €0.5m – €15m • Banking product for smartphones Target Geographies Europe • Enterprise-ready, open core, in memory computing software Target Sectors Consumer and enterprise internet, Fin-tech, marketplaces, Full portfolio www.earlybird.com Investment Style Active Deal structures Minority KEY CONTACTS Disruptive business models or technologies • Hendrik Brandis • Prior: Partner at McKinsey & Co in Munich and Madrid Key Investment Criteria with forward looking lock-in in large markets • Co-Founder and Partner • Companies: nfon, B2X, Videdressing, Onefootball, lead by an outstanding team • Email: brandis@earlybird.com Simscale, Enevo Website www.earlybird.com • CemSertoglu • Prior: Founder & CEO Select Minds Contact Email schmidt@earlybird.com • Partner • Focusing on technology ventures in Turkey and CEE • Email: sertoglu@earlybird.com • Companies: dcs, flipps, hazelcast, peak games, Contact Phone +4930 46724700 tapu.com, tjobs

Elaia Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Paris Elaia partners is an independent Venture capital company founded in 2002 and focused on the Digital Economy. Elaia’s team builds partnership with its portfolio companies over the long run. Investments range from €500,000 to €1 million at the seed round and can reach up to several million euros in the later rounds. Elaia also supports Founded 2002 technological innovation and invests up to €300,000 in pre-seed cutting-edge technology startups led by researchers. Elaia commonly leads the first investment round and then actively partners with companies from its portfolio, Employees 8 usually sitting at their board. Its team has over 50 years of cumulated experience in Venture Capital and Digital technology. This expertise and Elaia’s mentoring network helps creating tomorrow’s most successful startups. The company is at the heart of the French digital ecosystem and is a founding and leading member of France Current Fund Size €45m Digitale, the French startups and investors organisation. Use of Debt No SELECTED PORTFOLIO COMPANIES • Global leader in digital performance display advertising. Went public on the NASDAQ Assets under Mgmt €150m in 2013. Target Investment Size Pre-seed, Seed, Series A • First and only company in IOT networks for M2M telecomunication. Target Geographies France and Europe • Leading provider of Marketplace solutions for e-retailers and media websites. Target Sectors Digital Full Portfolio • www.elaia.com/portefeuille Investment Style Active KEY CONTACTS Deal structures Minority • Samantha Jérusalmy • Prior to joining Elaia Partners in 2008, Samantha worked in • Partner strategy consulting at Eurogroup and as an analyst at Key Investment Criteria Technology, Seed • Email: sjerusalmy@elaia.com Clipperton Finance • Companies: 1001 Menus, Agnitio, Carnet de mode, Cook Angels, Mirakl, Scoop.it, Selectionnist, Seven Academy, Website www.elaia.com Smartangels, Vodkaster, Ykone • Xavier Lazarus • After founding an educational software company and Contact Email deal@elaia.com • Principal launching a VC fund within Credit Agricole, Xavier cofounded • Email: xlazarus@elaia.com Elaia Partners in 2002. He holds a PhD in mathematics. • Companies: Adomik, Agnitio, Criteo, Cryptosense, Goom, Contact Phone +33 1 76 74 92 50 Marfeel, Mirakl, Mobirider, Sensorly, Smartangels, Tinyclues, Wyplay

Endeit Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Amsterdam(NL), Hamburg (GE) Endeit invests in pan-European "Connected Consumer" firms in digital media & marketing, e-commerce and enterprise services, supporting them to becoming leading international players in their industries. Founded 2006 With entrepreneurial roots in digital media, internationalisation and M&A, Endeit provides buy & build expertise, while leveraging its network across Europe and the USA. Endeit supports serial entrepreneurs heading high growth innovative companies with proven recurring scalable business models. Natural leaders who need Employees 7 (of which 7 in Europe) additional growth capital for branding and extending their product portfolio, or for growth Internationally. Endeit is an independent investment firm, backed by both institutional and funds from successful entrepreneurs in Internet, media and other industries. Current Fund Size €110m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt €260m • Operator of online social-gaming platforms Target Investment Size €3m-€10m • Leading global social video advertising platform Target Geographies W-EU • Leading European online (video) advertising network Target Sectors Digital Media/Marketing, EdTech, Ecommerce, Enterprise Services Full Portfolio • www.endeit.com Investment Style Active Deal structures Minority KEY CONTACTS • Martijn Hamann • 10 years in VC / Private Equity Key Investment Criteria Growth Phase, Internationalisation • Founding Partner • 12 years in M&A and Operations • Email: martijn@endeit.com • Endeit (2006), Endemol (1996-2006), Investec (1994- Website www.endeit.com 1996) • Christoph Neuhaus • 3 years in VC / Private Equity, 3 years in M&A Contact Email martijn@endeit.com,christoph@endeit.de • Managing Director DACH • Corporate Finance Partners (2010-2012), Jung von • Email: christoph@endeit.de Matt (2006-2008) Contact Phone +31-653726743 +49-1726615538

e.ventures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices SanFransisco, Sao Paolo, Berlin, Hamburg, Founded in 1998 and built on a strong, shared culture of entrepreneurship, e.ventures is a venture capital firm Moscow, Beijing, Toyko with global scale. The firm invests out of dedicated funds in five geographies, namely BV e.ventures (formerly Founded 1998 knownasBVCapital), e.ventures Europe, e.ventures Russia, Infinity e.ventures (China and Japan) and Redpoint e.ventures (Brazil and Latin America). Employees 25 (of which 9 in Europe) Thee.ventures team has been investing in Internet companies for more than 15 years and operates as one team by combining a global investment strategy and philosophy with local presence and insights. Current Fund Size €100m for Europe Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt €1bn • Farfetch.com brings together independent fashion boutiques to provide a wide selection of the most elegant brands and styles Target Investment Size Series A - €1m - €5m • E-commerce auction company for art, antiques, vintage luxury goods etc. Target Geographies US, Europe, Brazil, China • Temperature based fertility tracking Target Sectors Consumer Internet, Digital Media; We really like mobile, marketplaces, SaaS Full Portfolio • www.eventures.vc/portfolio/ Investment Style Active Deal structures Minority KEY CONTACTS Got-to-market, recurring revenue streams, • Andreas Haug • e.ventures since 2008 Key Investment Criteria clear business model, rapid growth, strong • General Partner • Companies: CityDeal (Groupon), sapato (Ozon), shutl team • Email: andreas@eventures.vc Website www.eventures.vc • Christian Leybold • e.ventures since 2003 Contact Email europe@eventures.vc • General Partner • Companies: Farfetch.com, KaufDa (Axel Springer), • Email: christian@eventures.vc auctionata Contact Phone +4940 8222555 0

Frog Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London Frog Capital is a leading growth capital investor focused on technology-led businesses in Europe. Frog’s experienced team has invested in over 100 companies, and in the last five years has exited companies with a total transaction value over €1 billion. Founded 2008 Frog is a committed long-term partner, investing in ambitious companies with revenue up to €30m and requiring up to €20m of growth capital. Employees 13 (all in London) By applying industry knowledge, a network of relationships and operating expertise, Frog actively supports exceptional company growth and builds significant shareholder value. For further information, please visit www.frogcapital.com. Current Fund Size €100+m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt €180m • Seamless content monetisation for digital publishers Target Investment Size Up to €20m • Global leader in cloud-based commerce solutions Target Geographies Europe • Disruptive leader in real-time market analytics for fashion Target Sectors IT, Digital Media & Resource Efficiency Full portfolio • www.frogcapital.com/portfolio/ Investment Style Active KEY CONTACTS Deal structures Minority or majority • Iyad Omari • Jens Düing • Mike Reid Key Investment Criteria Generating €3m-€30m of revenue • Partner • Principal • Managing Partner Website www.frogcapital.com • Joe Krancki • Stephen Lowery Contact Email Daniel.Tarver@frogcapital.com • Partner • Partner Contact Phone +44 (0)20 7833 0555

German Startups Group KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 2 German Startups Group is an investment company based in Berlin that focuses on young, fast-growing companies. The company acquires majority and minority shareholdings mainly by providing venture capital. Its Founded 2012 focus is on companies whose products or business models represent a disruptive innovation, allow for a high degree of scalability to be expected, and in which it has a great deal of trust in the entrepreneurial abilities of the founders. Since it commenced with operations in 2012, German Startups Group has in its opinion built up a Employees 10 (of which 10 in Europe) diversified portfolio of investments in young companies and become the second most active venture capital investor in Germany since 2012 (CB Insights, Germany Venture Capital Overview). According to German Startups Group, its investment portfolio reflects a cross-section of extremely promising German startups of Current Fund Size N/A various maturity stages and includes some of the most successful and best-known German startups. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A Target Investment Size €100k – €3m Target Geographies German-speaking regions E-Commerce, Online Services, Social Target Sectors Network/Sharing Economy, SaaS/BigData/AdTech, Digital Full Portfolio • www.german-startups.com/about-us/#holdings Content/Publishing/CRM, FinTech, High Tech Investment Style Active KEY CONTACTS Deal structures Minority, some control stakes • Christoph Gerlinger • Serial entrepreneur, two successful IPOs • Founderand CEO • Founder and CEO of FrogsterInteractive Pictures AG, >200 employees, IPOedin 2006 Key Investment Criteria Disruption, scalability, entrepreneurial talent • Founder and CFO of CDV Software Entertainment AG, >200 employees, IPOedin 2000 Website www.german-startups.com • Manager Finance & Administration of PsygnosisDeutschland (formerly member of Sony Group) Contact Email info@german-startups.com • Nikolas Samios • Long-standing expert in venture capital investments • COO • Founder and CEO of CooperativaGroup (a leading Berlin Family Office for Business Angel shareholdings) Contact Phone +49036098890 80 • Formerly CEO of Brandenburg Ventures GmbH (VC fund of MP3 inventor)

Grazia Equity KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 2 Grazia Equity, based in Stuttgart and Munich, is one of Europe’s top names in venture capital. Grazia specializes in start-up or early-stage financing for innovative companies with market-changing potential and opportunities for superior returns. Our successful track record and expanding global network now enable us to fund selected start- Founded 2000 ups elsewhere in Europe as well as in the US. Unlike traditional venture capital companies, Grazia works exclusively with private-sector capital, with no Employees 5 (all in Europe) institutional funding involved. That gives our portfolio companies all the advantages of speed, flexibility and a pragmatic approach. This may sound more typical of a business angel but, at Grazia, we back up agility with the solid funding and business development expertise you would normally expect of a VC firm. This combination, Current Fund Size N/A paired with our uncompromising ethical standards and commitment to sustainability, makes Grazia the ideal choice for businesses early in their life cycle. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • E-commerce enterprise specialized in the sale of glasses, sunglasses and contacts Target Investment Size > €500k • Fastest growing movie community in the world with large properties on Facebook, YouTube, and 2 of the leading movie sites: moviepilot.de and moviepilot.com Target Geographies Germany, USA, GB • The first statistics portal in the world to integrate over 60,000 diverse topics of data Internet, Digital Media, Mobile, and facts from over 10,000 sources onto a single professional platform Target Sectors Telecommunication Full Portfolio • www.grazia.com/en/portfolio.html Investment Style Board seats if possible, networking on demand Deal structures N/A KEY CONTACTS Key Investment Criteria Attractive market potential + scalability, • Jochen Klueppel significant added value • Partner Website www.grazia.com • Email: j.klueppel@grazia.com Contact Email j.klueppel@grazia.com Contact Phone +49 711 90 710 90

Hanse Ventures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Hamburg, Germany Weareanincubator for internet ventures, combining… • start-up concepts, Founded 2010 • talented people seeking to become founders who we scout and train, • skills and resources to accelerate growth (like coding, online marketing, PR and recruitment), • seed funding from our own resources and an extensive network of co-investors Employees approx. 30 …inorder to build great companies. Current Fund Size N/A Use of Debt N/A SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • Crowd-based high-end B2B translation services Target Investment Size N/A • Network of voucher code sites in fast growing e-commerce markets Target Geographies Hamburg • Market place for second hand designer fashion and accessories Target Sectors Internet & mobile Full Portfolio • www.hanseventures.com/en/portfolio/ Investment Style Founding of 2-4 start-ups p.a. Deal structures Incubator model: Straight equity, resources KEY CONTACTS and infrastructure Scalable online based concepts, talented • Jochen Maaß • Founder of artaxo AG and Hanse Key Investment Criteria people and good match with the expertise of • CEO Ventures HanseVentures • Email: jochen.maass@hanseventures.com • Degree in business informatics Website www.hanseventures.com • Alex Eulenburg • 12 years TMT investment banking in Contact Email alexander.eulenburg@hanseventures.com • CFO London and Hamburg • Email: alexander.eulenburg@hanseventures.com • PhD in applied physics Contact Phone +49 40 38 66 25 95

H-FARM Ventures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 1 H-FARM explores the frontiers of the internet in search of dynamic business models and new digital technologies, providing a unique support to start-ups, from capital resources to a full range of of services to Founded 2005 enable a rapid growth. We invest in selected ideas, providing capital support from the seed throughout the early stage and deliver bootstrap services facilities, mentorship. Employees 465 Current Fund Size 20m Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A N/A • N/A Target Investment Size 250k N/A • N/A Target Geographies EU N/A • N/A Target Sectors Digital Full Portfolio • N/A Investment Style Active Deal structures Joint control / minority, etc. KEY CONTACTS • Maurizio Rossi • Companies: H-FARM Key Investment Criteria N/A • Co-Founder • Email: mrossi@h-farmventures.com Website www.h-farmventures.com Contact Email mrossi@h-farmventures.com Contact Phone N/A

Holtzbrinck Digital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Munich, Berlin, Stuttgart Holtzbrinck Digital is the strategic digital investment holding of Holtzbrinck Publishing Group. Hometoarange of top internet brands, it is one of Germany’s leading internet investors. Holtzbrinck Digital serves as a strategic management holding company taking a hands-on approach to manage Founded N/A and develop its portfolio of leading, fast-growing digital companies, many majority owned. Employees 11 Current Fund Size Evergreen Use of Debt No SELECTED PORTFOLIO COMPANIES • The pioneer and leading global enterprise platform for search experience Assets under Mgmt Not disclosed optimization, which combines SEO, content, social media, PR & analysis • An early stage SaaS company in the education space offering educators an intuitive Target Investment Size €0.5m – €25m online learning platform as a white label solution • The leading German question-and-answer website and among the most popular 20 Target Geographies D/A/CH, Central Europe pages in Germany • The leading online matchmaking company in Germany / DACH region Target Sectors Content/Digital Publishing, eLearning Full Portfolio • www.holtzbrinck-digital.com Investment Style Active KEY CONTACTS Deal structures Control, Minority in early-stage • Markus Schunk • Joined Holtzbrinck in 2004 Market leading position (potential), • Managing Director • MD of Holtzbrinck Digital since 2011 Key Investment Criteria outstanding people and strategic fit • Email: markus.schunk@holtzbrinck.com • Vast experience in digital media M&A transactions • Michael Hock • Holtzbrinck Digital since 2011 Website www.holtzbrinck-digital.com • Senior Investment Manager • 10+ years experience in VC/M&A • Email: michael.hock@holtzbrinck.com • Actively involved in multiple M&A and IPO Contact Email susanne.ziegler@holtzbrinck.com transactions • Stefan Peters • Holtzbrinck Digital since 2012 Contact Phone +49 89 452285100 • Senior Investment Manager • 12+ years experience in M&A transactions • Email: stefan.peters@holtzbrinck.com • Expertise in digital content & community businesses

Holtzbrinck Ventures Premium Partner – Event Sponsor KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 2 “Weliketo invest at seed stage and quickly provide additional capital at the moment of initial success!” • Sixth fund generation Founded 2000 • Over $3bn of co-investment capital raised • Wereseedinvested in 5 companies that currently have >$1Bn valuation • Wereseedinvested in 10 companies that each surpass $100M in yearly sales Employees 17 • Consistent top decile performance across funds (no dependency on “one hit wonders”) • Over 110 years of combined relevant work experience Current Fund Size €285m Use of Debt N/A SELECTED PORTFOLIO COMPANIES Assets under Mgmt €635m Target Investment Size €500k - €40m Target Geographies Europe + high growth global markets Target Sectors Internet/Mobile/Digital Investment Style Active Deal structures Minority KEY CONTACTS Multi stage, early-in • Martin Weber Key Investment Criteria Teams focused on execution • General Partner • Email: martin.weber@holtzbrinck.net Website www.holtzbrinck-ventures.com • Rainer Maerkle Contact Email N/A • General Partner • Email: rainer.maerkle@holtzbrinck.net Contact Phone N/A

Idinvest Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Paris, France Idinvest Partners has one of the most active and successful Venture Capital teams in Europe. In the last 10 years, we have invested in ~100 companies in the digital space with landmark investments such as Criteo (IPO), Founded 1997 Lastminute.com (sold to Travelocity), Dailymotion (sold to Orange in 2013), Deezer, Meetic (sold to Match.com), Talend, Vestiaire Collective, Pretty Simple (the French studio behind Criminal Case) and Sigfox (which recently raised over $100m). We recently started building our presence outside of France with investments in companies Employees 60 such as Social Point, Kantox, Nosto, Clear2Pay, etc. and our ambition is to put more emphasis on that geographical expansion and be a pan-European venture firm. We focus on taking minority investments at the Series A / Series B stage (with occasional participation in seed deals and later stage transactions), both in the Current Fund Size ~€100m / per year in the digital space B2BandB2Cspaceandtakeboard seatsinorder totrytohelp building the next “Eunicorns”. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt €6bn, of which €1.3bn in VC • Ad retargeting leader - NASDAQ successful IPO in 2013 with a €2.6bn market capitalization • The French Spotify rumored to have entered the very private Unicorn group of Target Investment Size €1m - €15m in VC investments startups Target Geographies Europe • Global marketplace for the resale of luxury goods Target Sectors Internet / Software • Mobile dating app based on hyper location and real time Full Portfolio • www.idinvest.com/en/growth-capital-internet.php Investment Style Active / Board Deal structures Minority KEY CONTACTS • Guillaume Durao (attending NOAH) • Joined Idinvest in March 2015. Key Investment Criteria Team &marketpotential • Investment Director • Previously with Mangrove Capital Partners, Bryan • Email: gd@idinvest.com Garnier & Co, Credit Agricole Investment Banking and Canal+. Website http://www.idinvest.com • Matthieu Baret • Joined Idinvest in 2005. Contact Email gd@idinvest.com • Partner • 9 years in the Telecom industry with Capgemini, • Email: mb@idinvest.com Italtel, Europatweb and Bouygues Telecom. Contact Phone +33 6 73 12 38 78

Index Ventures Partner – Event Sponsor KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London, Geneva, San Francisco, Jersey Weare an international venture capital firm based in London, Geneva and San Francisco. Since 1996, we’ve teamed up with exceptional entrepreneurs who are using technology to reshape the world around us. They Founded 1996 include ASOS, Criteo, Dropbox, Etsy, Last.fm, Lovefilm, Moleskine, MySQL, Nasty Gal, Net-a-Porter, Playfish, Soundcloud, Sonos and Supercell -- among many others. Employees 58 (49 in Europe) Current Fund Size €500mGrowthFund, €350m Early Stage and €150m Life Sciences Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • Funding Circle is a P2P lending network for small businesses. Freeing up critical liquidity for SMEs, the company has created a digital marketplace which matches deposits from investors, seeking better returns, with loans to carefully screened Target Investment Size €50k - €50m businesses, who need finance fast. • Just Eat has reinvented the takeaway. From keystroke to doorstep, the London- Wherever the best entrepreneurs are looking headquartered company has built a seamless multi-platform service, with 34,000 Target Geographies to build market defining global businesses takeaways on its roster, covering 14 countries from Scandinavia to Latin America. • The brainchild of e-tail trailblazer Sophia Amoruso, NastyGal is the global hub for Target Sectors Wherever tech is reshaping the economy fasion-forward, taste-making girls. Turbo-charged by social media buzz, NastyGal has grown by over 500% each year since inception. Investment Style Active, Supportive, Handmade Full Portfolio • www.indexventures.com/portfolio Deal structures minority KEY CONTACTS + scalability + originality + missionary + • Dominique Vidal • Joined Index in 2007 Key Investment Criteria product DNA • Partner • Companies: Criteo, Outbrain, Squarespace, • Email: Adconion, be2, Best of Media Group Website www.indexventures.com dominique@indexventures.com • Jan Hammer • Joined Index in 2010 Contact Email @indexventures.com • Partner • Companies: Adyen, Just-Eat, Novus, Socialbakers, • Email: jan@indexventures.com Zendesk, Zuora Contact Phone +44 207 154 2020

Inventure Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Moscow Inventure Partners is an innovative investment firm helping inventive entrepreneurs start and grow disruptive technology businesses. We look for teams with a novel approach to solving real problems and back a wide range Founded 2012 of ventures across technology industry with an emphasis on internet, mobile, software and e-commerce segments. Although, our sweet spot is an investment of $1-5MM, we are generally flexible on the investment size and can back attractive business models both at the earliest stages of their development as well as at the Employees 8 (8 in Europe) reasonably late stages. Current Fund Size $100m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $100m • Taxi aggregator service allowing smartphone users to book a taxi Target Investment Size $1m-$5m • Online tourist agency selling packaged tourist tours via its web-site Target Geographies Russia, CIS, Europe, US • Mobile payment solution allowing users to accept payments through mobile phones Technology, Internet, Financial Technologies, Target Sectors Marketing, Digital Media, Mobile, Telecommunication Full Portfolio • www.inventurepartners.com/portfolio/ Investment Style Board and operational support on demand KEY CONTACTS Deal structures Minority • Sergey Azatyan • Inventure Partners since 2012 Key Investment Criteria Established business model and rapid growth • Managing Partner • Companies: Marshall Capital, MDM potential • Email: Sergey.Azatyan@inventurepartners.com Bank Website www.inventurepartners.com • Anton Inshutin • Inventure Partners since 2012 Contact Email Victoria.Kiseleva@ivprs.com • Managing Partner • Companies: Morgan Stanley, Deutsche • Email: Anton.Inshutin@inventurepartners.com Bank Contact Phone +7 495 641 3635

Iris Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Paris (HQ), Cologne, Dubai, Riyadh, Iris Capital is a pan-European venture capital fund manager specializing in the digital economy. Since its Montreal, San Francisco, Beijing, Tokyo inception in 1986, the Iris Capital team has invested more than € 1 billion in more than 230 companies. Iris Founded 1986 Capital targets opportunities in service or technology companies, seeking growth capital in order to realize their strategy. It provides active support to its portfolio companies on the basis of its strong sector specialization and experience, and has offices in Paris, Cologne, San Francisco, Montreal, Riyadh, Dubai, Beijing and Tokyo. In Employees 28 2012 Iris Capital has entered into a strategic partnership with Orange and Publicis to manage their joint venture capital initiative. Current Fund Size Multiple funds for different stages and geographies under management Use of Debt N/A SELECTED PORTFOLIO COMPANIES Assets under Mgmt > €1bn • Search Analytics software provider, Germany/USA Target Investment Size €1m-€20m • Online re-Commerce for entertainment products, Germany Target Geographies Europe, North-America, Asia, MENA • Big data integration software solutions, USA/France Target Sectors Early- and later- stage investments in the digital economy • Pan-European on-line video network, Germany Investment Style Proactive Deal structures Minority, special situations KEY CONTACTS High-growth potential coupled with • Erkan Kilicaslan • MBA Harvard, MSEE Bochum/Bordeaux, Key Investment Criteria exceptional management teams • Partner McKinsey & Co., Technologieholding • Email: e.kilicaslan@iriscapital.com • Companies: 1-2-3.tv, Searchmetrics, Tyntec, reBuy, Mediakraft Website www.iriscapital.com c.micoski@iriscapital.com • Curt Gunsenheimer • MBA MIT, ESSEC Paris, Cornell, Goldman Contact Email • Partner Sachs, Robertson Stephens • Email: c.gunsenheimer@iriscapital.com • Companies: Alyotech, Kyriba, Talend, dotsoft Contact Phone +33 (0) 1 45 62 73 73

Lumia Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices San Francisco, CA Lumia is an expansion-stage VC partnering with leading tech companies in under-invested emerging markets and forward-thinking US companies targeting these markets to accelerate growth. Lumia employs a hands-on strategy, working closely with management teams by pairing Silicon Valley insights and contacts with global Founded 2011 knowledge sharing and relationships to propel companies through expansion-stage challenges and opportunities. Employees 8 Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • Kabbage is a next generation financial services company utilizing propriety algorithms to extend credit to small businesses online Target Investment Size Expansion Stage: $2m - $20m • Hired is a two-sided marketplace that matches talent, particularly high-skilled tech Pre-expansion: $100k - $500k talent, with job opportunities Target Geographies US, Latin America, EMEA • OpenDNS (acquired by Cisco) is a leading cloud-based network security and DNS Mobile, Enterprise Cloud, Fintech, service company Target Sectors Marketplaces Full Portfolio • N/A Investment Style Active KEY CONTACTS Deal structures Minority • Martin Gedalin • Founder of Lumia Capital Key Investment Criteria Expansion Stage: 50%+ annual growth • Partner • Previously Focus Ventures, Oracle, NCR Pre-Expansion: 100%+ annual growth • Email: • Companies: MarkaVIP, Xtime (acquired by Cox martin@lumiacapital.com Automotive), Hired, OpenDNS (acquired by Cisco), Website www.lumiacapital.com Kabbage Contact Email info@lumiacapital.com • Chris Rogers • Joined Lumia in 2012 • Partner • Previously Co-founder, Nextel Communications, Head of • Email: chris@lumiacapital.com Corporate Development, Sprint Contact Phone N/A • Companies: Kahuna, Pitzi, Hinge, Lenddo, Telly, Betable

Mangrove Capital Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Luxembourg Founded in 2000, Mangrove Capital Partners is an investment firm dedicated to finding and helping passionate, innovative entrepreneurs start and grow global, disruptive companies. With successes such as Brands4Friends (sold to eBay),Skype (sold to eBay), Wix (IPO in October 2013), KupiVip (Russia's leading luxury e-commerce Founded 2000 company) and FreedomPop (the leading free mobile internet provider in the US), the firm has established itself as one of the pre-eminent early stage investment firms. Mangrove chases bold, transformational ideas around Employees 13 the world and invests across a variety of sectors, with an emphasis on mobile, e-commerce, media technologies and fintech. Current Fund Size $180m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $650m • Web platform to create HTML5 websites and mobile sites. IPO 2013 • Russia's leading online luxury fashion retailer. Target Investment Size $100k - $15m • Israeli provider of productivity tools for online user experience. Target Geographies Europe, Israel, Russia, India • The leading free mobile internet provider in the US. Target Sectors mobile, ecommerce, media, fintech • The largest Indian online shopping network focused on rural consumers Full Portfolio • www.mangrove.vc Investment Style Active KEY CONTACTS Deal structures Minority • Hans-Jürgen Schmitz • Mangrove Co-Founder Category defining technologies, Disruptive • Partner • 15 years of VC investing Key Investment Criteria product or service, Exceptional and ambitious • Email: hans-juergen@mangrove.vc • Portfolio: Helpling, Outfittery, Storeking founders • Mark Tluszcz • Mangrove Co-Founder Website www.mangrove.vc • Partner • 15 years of VC investing • Email: mark@mangrove.vc • Portfolio: JobToday, FreedomPop, Wix Contact Email deals@mangrove.vc • Michael Jackson • With Mangrove since 2007 • Partner • Previously Tele 2, Skype Contact Phone +352 26 25 34-1 • Email: michael@mangrove.vc • Portfolio: Churchdesk, Nimbuzz, Riddle

MCI Management Partner – Event Sponsor KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 1 MCI is one of the most dynamic private equity groups in Emerging Europe. MCI invests in digital disruption, adaptation and ecosystem through early stage, growth stage and expansion/buy-out stage investments in CEE, Founded 1999 Germany and Austria (DACH), Russia and Turkey. The value of AUM reaches above 500 M EUR. The MCI Group has so far closed over 60 investment projects and near 30 full exits. Since 1999 MCI generated net IRR at the level of 20-25%. MCI Management SA is listed on the Warsaw Stock Exchange since February 2001. Employees 25 (of which 25 in Europe) Current Fund Size Over 35 investments Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt Over €500m • Gett is a leader of the market of on-demand transport services and a major global B2B player. Target Investment Size Up to €50m • Auctionata is a global disruptor which enables its users to bid for unique works of art, antiques and luxury collectibles through online auctions broadcast in real time from Berlin and New York. Target Geographies CEE, DACH, Russia and Turkey • Azimois a London-based online money transfer service, changing the way people E-commerce,digital entertainment, mobile send money around the world. Azimo operates in over 200 countries across the Target Sectors Internet, TMT, IoT, Fintech, BigData, Cloud world. Computing Full Portfolio • www.mci.eu Investment Style Active KEY CONTACTS Deal structures Control, joint control, minority, etc. • Tomasz Czechowicz • Entrepreneur since 1985, in 1990-98 Co-founder and MCI invests in companies at the stage of • Managing Partner CEO of JTT Computer SA - leading CE computer Key Investment Criteria growth and expansion in the sectors of new • Email: czechowicz@mci.eu manufacturer with USD 100M+ revenue. Since 1999 technologies. VC/PE investor, founder of MCI. In 2000 one of the TOP- 10 most influential people in the European Internet by Website www.mci.eu Business Week. • Sylwester Janik • More than 10 years experience in strategic mgmt, new Contact Email sabak@mci.eu • Partner business development, M&A and VC/PE investments. He • Email: janik@mci.eu was a Director of Strategy & Development at ATM SA, a Vice President of mPay, strategy and mgmtconsultant for Contact Phone +48 697 888 110 PricewaterhouseCoopers, London and Lockheed Martin, Poland. Since 2008 Partner in MCI.

Mountain Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 6 Mountain Partners is a global venture builder and investor. Our business model is based on identifying, incubating and/or investing in scalable technology and internet companies and business models. We also have Founded 2005 established an international hub network in selected emerging markets where we can help our companies internationalise into these markets. Portfolio exits of last 18 months included Secusmart (sold to Blackberry), Lieferando (sold to Takeaway), MeinProspekt (sold to AxelSpringer), bab.la (sold to Oxford University Press) and Employees 20 in Europe plus international hub teams RegioHelden (sold to Ströer Media). Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • High-performance database used for business intelligence applications such as data warehousing, web analytics, data mining applications Target Investment Size €250k –€1.5m initial investment • Digital contract management solution • Product insurance online with only one click, by integrating into the checkout Target Geographies Europe and emerging markets processes of online retailers • Automatically creates and optimizes millions of tailor-made ads, helping its partners to Technology & Security, e-Commerce & make advertising more profitable Target Sectors Services, Digital Payments & Fintech • One of Europe’s leading ecommerce companies for entertainment products Investment Style Active, hands-on Full Portfolio • www.balderton.com Deal structures Minority KEY CONTACTS • Ingo Drexler • Companies: reBuy, Lieferando, Crealytics, Key Investment Criteria Team, scalability, early stage • CIO Simplesurance, Exasol, Volders, Regiohelden, • Email: id@mountain-partners.ch Lingoda, MovingImage24, Customer Alliance Website mountain.partners Contact Email contact@mountain.partners Contact Phone N/A

Nokia Growth Partners Partner – Event Sponsor KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 4 Nokia Growth Partners (NGP) is an independent fund sponsored solely by Nokia backing entrepreneurs focused on building a connected world. NGP offers industry expertise, capital and an extensive network, enabling entrepreneurs to build disruptive, industry-changing companies and take them to the global market. With offices Employees 20 of which 4 investors in Europe in the US, Europe, India and China, NGP extends the reach of companies making their products and services local everywhere. Current Fund Size $700m Nokia Growth Partners is a Sponsor of NOAH 15 London. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $700m • Offers high quality language learning on the go. With 14 languages, the Babbel app Target Investment Size $5m - $15m sees over 120.000 downloads per day. • Worldslargest local transportation app used by 28 million people across 700 cities in Target Geographies US, Europe, India, China 58 countries. Connected Enterprise, Connected Car, • Heptagon provides intelligent micro optics systems for smart devices. Has shipped Target Sectors Mobile Consumer, Data & Analytics, Local over 1.5bn units. Commerce Full Portfolio • www.nokiagrowthpartners.com/portfolio Investment Style Active KEY CONTACTS Deal structures Minority • Bo Ilsoe • Over 25 years of experience in venture capital, Key Investment Criteria Established business model, shipping • Managing Partner investment management, fundraising, product, about to expand internationally • Email: bo.Ilsoe@nokiagrowthpartners.com organizational and strategic development as well as sales and marketing. Website www.nokiagrowthpartners.com • Companies: Fyber, Heptagon, Swype, Moovit, Pelican Imaging, InVisage Contact Email ngpteam@nokiagrowthpartners.com • Vivek Goyal • Vivek has extensive operating and strategy • Senior Analyst consulting experience across Telecomm, • Email: Media, Consumer Goods, Chemicals, Private Contact Phone N/A vivek.goyal@nokiagrowthpartners.com Equity and Auto industries. • Companies: Digital Lumens, Indix, Kaltura

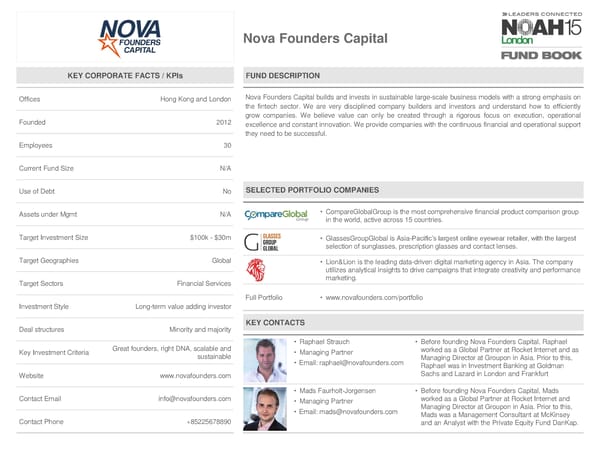

Nova Founders Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Hong Kong and London Nova Founders Capital builds and invests in sustainable large-scale business models with a strong emphasis on the fintech sector. We are very disciplined company builders and investors and understand how to efficiently Founded 2012 grow companies. We believe value can only be created through a rigorous focus on execution, operational excellence and constant innovation. We provide companies with the continuous financial and operational support they need to be successful. Employees 30 Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • CompareGlobalGroup is the most comprehensive financial product comparison group in the world, active across 15 countries. Target Investment Size $100k - $30m • GlassesGroupGlobal is Asia-Pacific’s largest online eyewear retailer, with the largest selection of sunglasses, prescription glasses and contact lenses. Target Geographies Global • Lion&Lion is the leading data-driven digital marketing agency in Asia. The company utilizes analytical insights to drive campaigns that integrate creativity and performance Target Sectors Financial Services marketing. Full Portfolio • www.novafounders.com/portfolio Investment Style Long-term value adding investor Deal structures Minority and majority KEY CONTACTS Great founders, right DNA, scalable and • Raphael Strauch • Before founding Nova Founders Capital, Raphael Key Investment Criteria sustainable • Managing Partner worked as a Global Partner at Rocket Internet and as • Email: raphael@novafounders.com Managing Director at Groupon in Asia. Prior to this, Raphael was in Investment Banking at Goldman Website www.novafounders.com Sachs and Lazard in London and Frankfurt • Mads Faurholt-Jorgensen • Before founding Nova Founders Capital, Mads Contact Email info@novafounders.com • Managing Partner worked as a Global Partner at Rocket Internet and • Email: mads@novafounders.com Managing Director at Groupon in Asia. Prior to this, Mads was a Management Consultant at McKinsey Contact Phone +85225678890 and an Analyst with the Private Equity Fund DanKap.

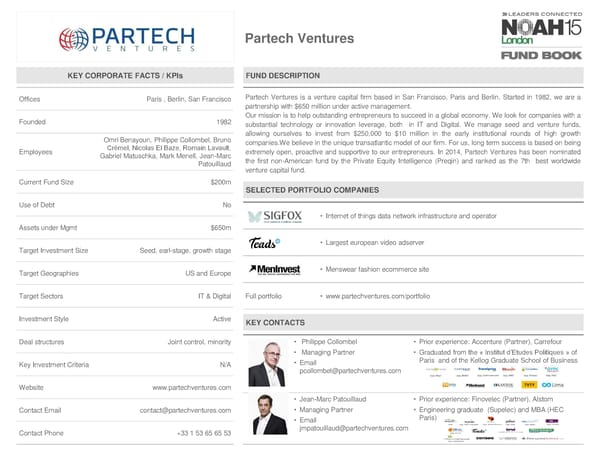

Partech Ventures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Paris , Berlin, San Francisco Partech Ventures is a venture capital firm based in San Francisco, Paris and Berlin. Started in 1982, we are a partnership with $650 million under active management. Founded 1982 Our mission is to help outstanding entrepreneurs to succeed in a global economy. We look for companies with a substantial technology or innovation leverage, both in IT and Digital. We manage seed and venture funds, Omri Benayoun, Philippe Collombel, Bruno allowing ourselves to invest from $250,000 to $10 million in the early institutional rounds of high growth companies.Webelieve in the unique transatlantic model of our firm. For us, long term success is based on being Employees Crémel, Nicolas El Baze, Romain Lavault, extremely open, proactive and supportive to our entrepreneurs. In 2014, Partech Ventures has been nominated Gabriel Matuschka, Mark Menell, Jean-Marc the first non-American fund by the Private Equity Intelligence (Preqin) and ranked as the 7th best worldwide Patouillaud venture capital fund. Current Fund Size $200m SELECTED PORTFOLIO COMPANIES Use of Debt No • Internet of things data network infrastructure and operator Assets under Mgmt $650m • Largest european video adserver Target Investment Size Seed, earl-stage, growth stage Target Geographies US and Europe • Menswear fashion ecommerce site Target Sectors IT & Digital Full portfolio • www.partechventures.com/portfolio Investment Style Active KEY CONTACTS Deal structures Joint control, minority • Philippe Collombel • Prior experience: Accenture (Partner), Carrefour • Managing Partner • Graduated from the « Institut d’Etudes Politiques » of Key Investment Criteria N/A • Email Paris and of the Kellog Graduate School of Business pcollombel@partechventures.com Website www.partechventures.com • Jean-Marc Patouillaud • Prior experience: Finovelec (Partner), Alstom Contact Email contact@partechventures.com • Managing Partner • Engineering graduate (Supelec) and MBA (HEC • Email Paris) Contact Phone +33 1 53 65 65 53 jmpatouillaud@partechventures.com

Piton Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London Piton Capital is a venture capital and growth equity firm based in London. It focuses on investments in online companies with network effects, such as marketplaces and exchanges. Its founding partners have deep Founded 2010 entrepreneurial and investment experience, and have been instrumental investors in Betfair and QXL Ricardo, amongst others. Piton’s current portfolio includes companies such as Auto1, Fanduel, DaWanda, RedBubble, Watchfinder, BullionVault, videdressing, Take Eat Easy and docplanner Employees 6 (of which 6 in Europe) Current Fund Size N/A Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • FanDuel is the leading daily fantasy sports game • AUTO1.com is an end-to-end marketplace for used cars Target Investment Size €200k - €20m • Watchfinder is the leading end-to-end marketplace for second-hand watches • Redbubble is an online marketplace where people can shop for lifestyle products Target Geographies Worldwide featuring work from independent artists and designers worldwide • DocPlanner enables patients to find great, local physicians online and book an Target Sectors Any appointment • DaWanda is the leading online marketplace for unique and handmade Investment Style Active Full portfolio • www.pitoncap.com/portfolio/ Deal structures Any KEY CONTACTS • Andrin Bachmann • Instrumental investor in QXL Ricardo Key Investment Criteria Online companies with network effects • Partner • Co-founder Glocalnet of (Swedish telco) • Email: • Companies: Auto1, FanDuel, DaWanda, DocPlanner, Website www.pitoncap.com Andrin.Bachmann@pitoncap.com Videdressing, etc. • Greg Lockwood • Ran UBSCapital’s VC business Contact Email info@pitoncap.com • Partner • Investor and former Chairman of Betfair • Email: • Companies: BullionVault, Watchfinder, Contact Phone +44 (0) 207 408 0451 Greg.Lockwood@pitoncap.com MBA&Company, RedBubble, etc.

Prime Ventures KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Amsterdam,Cambridge Prime Ventures is a leading venture capital and growth equity firm focusing on investing in European companies in the technology and related industries and leverages its capital, experience and network to actively guide them Founded 1999 into global category leaders. The firm has invested in companies in the Benelux countries, the United Kingdom, France, Germany, Spain, Finland and Sweden. From its offices in The Netherlands and the UK the independent partnership manages over 465 million euro in committed capital. Employees 9 (all in Europe) Current Fund Size €170m Use of Debt Yes SELECTED PORTFOLIO COMPANIES Assets under Mgmt €465m • Enables business change by helping companies rapidly develop, deploy and integrate business apps at a fraction of the time and cost Target Investment Size €5m-€25m • With Takeaway.com hungry consumers can order their favourite takeaway food on the company’s websites or through its mobile applications Target Geographies Europe • Through its mobile games marketing platform, AppLift helps mobile game advertisers acquire loyal, quality gaming users at scale on a CPI basis Consumer internet, digital media, enterprise • With Falcon Social customers can navigate the rapidly-expanding world of social Target Sectors software, mobile computing, communications, media easily and efficiently. infrastructure services, semiconductor Investment Style Active support (board membership) Full Portfolio • www.amadeuscapital.com/portfolio Deal structures Sizable minority stake KEY CONTACTS Fast growing European technology • Sake Bosh • Sake Bosch is a founder and Managing Partner of Prime Key Investment Criteria companies with • Managing Partner Ventures as of 1999. the first proof points of success • sake@primeventures.com • He is actively involved in Civolution, Dealerdirect, Digital Website www.primeventures.com Origin, Greetz, MarkaVIP and Takeaway.com Contact Email info@primeventures.com • Roel de Hoop • Roel is a Partner at Prime Ventures as of 1999. • Partner • Companies: Bright Computing, Falcon Social, Mendix, • roel@primeventures.com GenKeyand Applift Contact Phone +31 20 20 508 20

Redalpine Venture Partners KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 1 Redalpine provides Venture Capital to highly scalable European start-ups. Our mission is to help talented entrepreneurs turn an ambitious vision into reality by providing money, experience, coaching and door opening. Founded 2007 Redalpine was established in 2006 by a group of successful serial entrepreneurs, business angels and start-up coaches. Since the mid-eighties, they have co-founded and supported some of the most disruptive and successful European high-tech start-up companies, including Xing, SoundCloud and Plazes. The two funds Employees 7 (of which 7 in Europe) currently in operation have invested in over 20 companies active within the ICT and life science sectors. Current Fund Size CHF 50m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt CHF 50m • The first fully digitalised insurance broker Target Investment Size CHF 0.5m – CHF 2m • Art. Everywhere. Online Shop for Art, Apparel and Accessories Target Geographies Europe (with focus on CH, GE) • Europe’s most modern and entirely smartphone-based current account Target Sectors ICT, Life Sciences Full Portfolio • www.redalpine.com/portfolio/ Investment Style Active Deal structures Minority KEY CONTACTS Early stage, highly scalable • Peter Niederhauser • Serial entrepreneur since 1986, co-founder of Miracle Key Investment Criteria technology/product, convincing founders • Founder, Partner Software, Business Angel • Email: • Companies: InSphero, Poken, Number26, Trekksoft, peter.niederhauser@redalpine.com Juniqe, Knip Website www.redalpine.com • Michael Sidler • PhD in Life Sciences, Consultant at Boston Contact Email info@redalpine.com • Founder, Partner Consulting group, Business developer at Prionics, • Email: michael.sidler@redalpine.com CTI- startup coach Contact Phone +41 44 271 15 30 • Companies: Redbiotec, Biognosys, Malcisbo, Onsite- Lab (Medmira)

Redline Capital Management KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices London and Luxembourg Redline Capital is a global Venture Capital and Growth Equity fund Redline’s funds originate from Vladimir Evtushenkov, one of Russia’s most successful entrepreneurs who started as a Technology investor and entrepreneur more than 20 years ago. He is the majority shareholder and principal Founded N/A founder of London listed JSFC Sistema, one of Russia’s largest publicly traded investment groups and the controlling shareholder of NYSE listed MTS, the largest mobile phone service provider in Russia and CIS with Employees N/A over 100 million subscribers Redline’s funded structure, without the need for LP drawdowns, allows for efficient and quick decision-making and execution Current Fund Size $350m Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt $350m • ironSource is a world leading platform for software discovery, distribution and delivery across platforms and devices Target Investment Size $10m - $35m in equity • iwoca offers flexible credit to small businesses across Europe, allowing them to take advantage of opportunities previously only available to their larger peers Target Geographies Europe, North America and Israel • Touch Surgery is a surgery simulator that allows you to practice and rehearse operations before ever setting foot in the Operating Room Target Sectors Technology and Life Sciences Full portfolio • N/A Investment Style Minority, with and without board representation KEY CONTACTS Deal structures N/A • Tatiana Evtushenkova • Previously worked at MTS, a NYSE listed, leading Telco Team, IP, growth track record, • Managing Partner and BoD in Russia and CIS. De-facto deputy CEO, member of the Key Investment Criteria market potential member BoD and VP for Strategy & Development notably leading • Email: tevtushenkova@redline- all M&A and Corporate Finance activities capital.com • After MTS, advisor to the CEO of Sberbank of Russia, Website www.redline-capital.com Head of Private Equity Initiative • Started her career with Salomon Brothers’ Investment Contact Email N/A Banking division in London • Benno Jering • Previously with two boutique tech investment banks in • Associate London and Credit Suisse’s TMT Investment Banking Contact Phone N/A • Email: bjering@redline-capital.com team

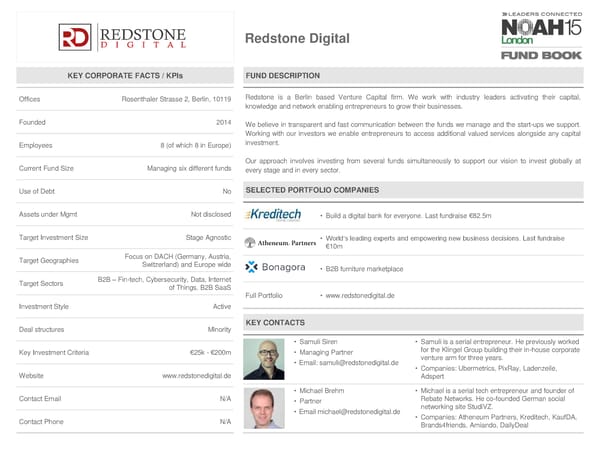

Redstone Digital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Rosenthaler Strasse 2, Berlin, 10119 Redstone is a Berlin based Venture Capital firm. We work with industry leaders activating their capital, knowledge and network enabling entrepreneurs to grow their businesses. Founded 2014 Webelieve in transparent and fast communication between the funds we manage and the start-ups we support. Working with our investors we enable entrepreneurs to access additional valued services alongside any capital Employees 8 (of which 8 in Europe) investment. Our approach involves investing from several funds simultaneously to support our vision to invest globally at Current Fund Size Managing six different funds every stage and in every sector. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt Not disclosed • Build a digital bank for everyone. Last fundraise €82.5m Target Investment Size Stage Agnostic • World‘s leading experts and empowering new business decisions. Last fundraise €10m Target Geographies Focus on DACH (Germany, Austria, Switzerland) and Europe wide • B2B furniture marketplace Target Sectors B2B – Fin-tech, Cybersecurity, Data, Internet of Things, B2B SaaS Full Portfolio • www.redstonedigital.de Investment Style Active Deal structures Minority KEY CONTACTS • Samuli Siren • Samuli is a serial entrepreneur. He previously worked Key Investment Criteria €25k - €200m • Managing Partner for the Klingel Group building their in-house corporate • Email: samuli@redstonedigital.de venture arm for three years. • Companies: Ubermetrics, PixRay, Ladenzeile, Website www.redstonedigital.de Adspert • Michael Brehm • Michael is a serial tech entrepreneur and founder of Contact Email N/A • Partner Rebate Networks. He co-founded German social • Email michael@redstonedigital.de networking site StudiVZ. Contact Phone N/A • Companies: Atheneum Partners, Kreditech, KaufDA, Brands4friends, Amiando, DailyDeal

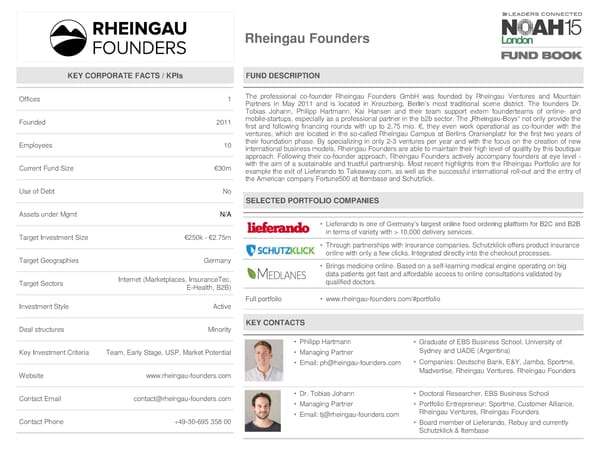

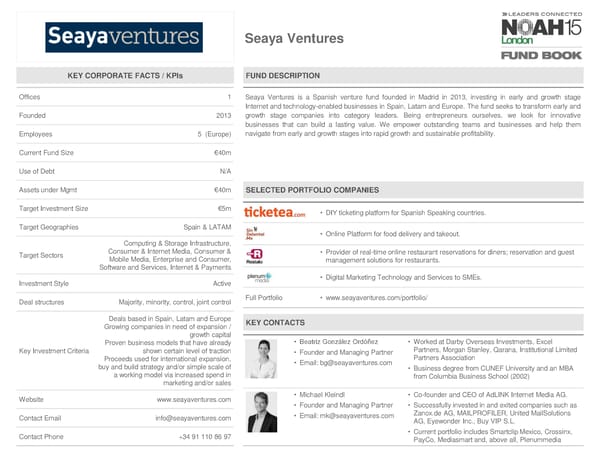

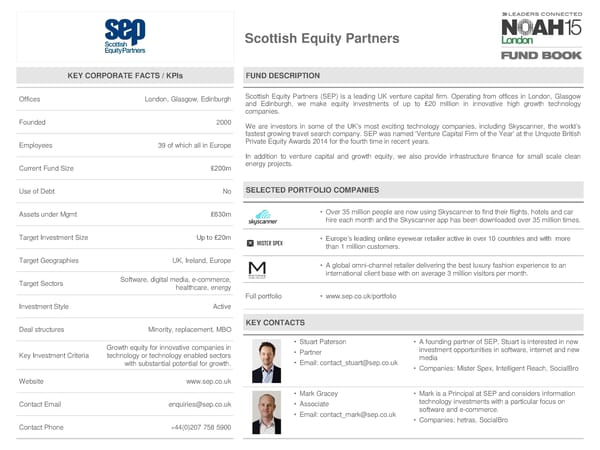

Rheingau Founders KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices 1 The professional co-founder Rheingau Founders GmbH was founded by Rheingau Ventures and Mountain Partners in May 2011 and is located in Kreuzberg, Berlin’s most traditional scene district. The founders Dr. Tobias Johann, Philipp Hartmann, Kai Hansen and their team support extern founderteams of online- and Founded 2011 mobile-startups, especially as a professional partner in the b2b sector. The „Rheingau-Boys“ not only provide the first and following financing rounds with up to 2,75 mio. €, they even work operational as co-founder with the ventures, which are located in the so-called Rheingau Campus at Berlins Oranienplatz for the first two years of Employees 10 their foundation phase. By specializing in only 2-3 ventures per year and with the focus on the creation of new international business models, Rheingau Founders are able to maintain their high level of quality by this boutique approach. Following their co-founder approach, Rheingau Founders actively accompany founders at eye level - Current Fund Size €30m with the aim of a sustainable and trustful partnership. Most recent highlights from the Rheingau Portfolio are for example the exit of Lieferando to Takeaway.com, as well as the successful international roll-out and the entry of the American company Fortune500 at Itembase and Schutzlick. Use of Debt No SELECTED PORTFOLIO COMPANIES Assets under Mgmt N/A • Lieferando is one of Germany’s largest online food ordering platform for B2C and B2B Target Investment Size €250k - €2.75m in terms of variety with > 10,000 delivery services. • Through partnerships with insurance companies, Schutzklick offers product insurance online with only a few clicks. Integrated directly into the checkout processes. Target Geographies Germany • Brings medicine online. Based on a self-learning medical engine operating on big Internet (Marketplaces, InsuranceTec, data patients get fast and affordable access to online consultations validated by Target Sectors E-Health, B2B) qualified doctors. Full portfolio • www.rheingau-founders.com/#portfolio Investment Style Active Deal structures Minority KEY CONTACTS • Philipp Hartmann • Graduate of EBS Business School, University of Key Investment Criteria Team, Early Stage, USP, Market Potential • Managing Partner Sydney and UADE (Argentina) • Email: ph@heingau-founders.com • Companies: Deutsche Bank, E&Y, Jamba, Sportme, Website www.rheingau-founders.com Madvertise, Rheingau Ventures, Rheingau Founders Contact Email contact@rheingau-founders.com • Dr. Tobias Johann • Doctoral Researcher, EBS Business School • Managing Partner • Portfolio Entrepreneur: Sportme, Customer Alliance, • Email: tj@rheingau-founders.com Rheingau Ventures, Rheingau Founders Contact Phone +49-30-695 358 00 • Board member of Lieferando, Rebuy and currently Schutzklick & Itembase