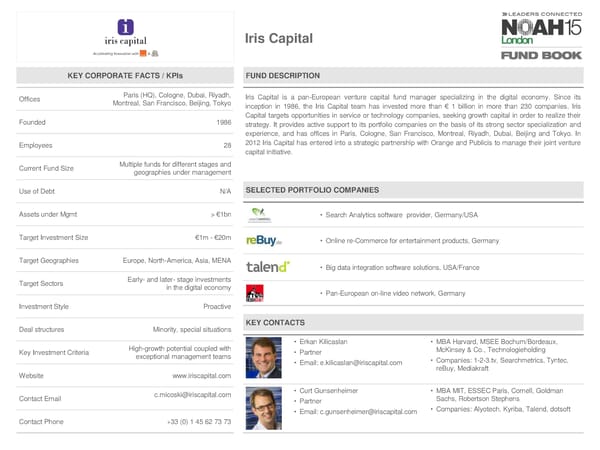

Iris Capital KEY CORPORATE FACTS / KPIs FUND DESCRIPTION Offices Paris (HQ), Cologne, Dubai, Riyadh, Iris Capital is a pan-European venture capital fund manager specializing in the digital economy. Since its Montreal, San Francisco, Beijing, Tokyo inception in 1986, the Iris Capital team has invested more than € 1 billion in more than 230 companies. Iris Founded 1986 Capital targets opportunities in service or technology companies, seeking growth capital in order to realize their strategy. It provides active support to its portfolio companies on the basis of its strong sector specialization and experience, and has offices in Paris, Cologne, San Francisco, Montreal, Riyadh, Dubai, Beijing and Tokyo. In Employees 28 2012 Iris Capital has entered into a strategic partnership with Orange and Publicis to manage their joint venture capital initiative. Current Fund Size Multiple funds for different stages and geographies under management Use of Debt N/A SELECTED PORTFOLIO COMPANIES Assets under Mgmt > €1bn • Search Analytics software provider, Germany/USA Target Investment Size €1m-€20m • Online re-Commerce for entertainment products, Germany Target Geographies Europe, North-America, Asia, MENA • Big data integration software solutions, USA/France Target Sectors Early- and later- stage investments in the digital economy • Pan-European on-line video network, Germany Investment Style Proactive Deal structures Minority, special situations KEY CONTACTS High-growth potential coupled with • Erkan Kilicaslan • MBA Harvard, MSEE Bochum/Bordeaux, Key Investment Criteria exceptional management teams • Partner McKinsey & Co., Technologieholding • Email: [email protected] • Companies: 1-2-3.tv, Searchmetrics, Tyntec, reBuy, Mediakraft Website www.iriscapital.com [email protected] • Curt Gunsenheimer • MBA MIT, ESSEC Paris, Cornell, Goldman Contact Email • Partner Sachs, Robertson Stephens • Email: [email protected] • Companies: Alyotech, Kyriba, Talend, dotsoft Contact Phone +33 (0) 1 45 62 73 73

NOAH15 London Fund Book Page 32 Page 34

NOAH15 London Fund Book Page 32 Page 34